SERENITY HOME HEALTH CARE LLC Form

What is the Serenity Home Health Care LLC?

Serenity Home Health Care LLC is a provider of home health services that aims to deliver compassionate and professional care to individuals in their homes. This organization specializes in offering a range of services, including skilled nursing, physical therapy, and personal care assistance. The focus is on enhancing the quality of life for patients while ensuring they receive the necessary support in a familiar environment. By employing qualified healthcare professionals, Serenity Home Health Care LLC ensures that each patient’s needs are met with dignity and respect.

Key elements of the Serenity Home Health Care LLC

The key elements of the Serenity Home Health Care LLC include a commitment to patient-centered care, a team of licensed and experienced healthcare providers, and adherence to regulatory standards. The organization emphasizes the importance of individualized care plans tailored to meet the unique needs of each patient. Additionally, Serenity Home Health Care LLC maintains compliance with federal and state regulations to ensure that all services provided are safe and effective. The incorporation of technology in care delivery, such as electronic health records, enhances communication and coordination among care teams.

Steps to complete the Serenity Home Health Care LLC

Completing the process with Serenity Home Health Care LLC involves several steps. First, potential clients or their families can initiate contact to discuss care needs. Next, a comprehensive assessment is conducted to evaluate the patient's condition and requirements. Following this assessment, a customized care plan is developed, which outlines the services to be provided. After the plan is agreed upon, services can commence, with regular evaluations to ensure that care remains aligned with the patient's evolving needs. Communication between caregivers and families is encouraged throughout the process to ensure transparency and satisfaction.

Legal use of the Serenity Home Health Care LLC

The legal use of Serenity Home Health Care LLC services is governed by various federal and state laws that regulate home health care. These laws ensure that the organization operates within the legal framework, providing safe and effective care. Compliance with regulations such as the Health Insurance Portability and Accountability Act (HIPAA) is crucial, as it protects patient privacy and confidentiality. Additionally, the organization must adhere to licensing requirements and quality standards set forth by state health departments and other regulatory bodies.

Examples of using the Serenity Home Health Care LLC

Examples of utilizing the services of Serenity Home Health Care LLC include post-operative care for patients recovering from surgery, management of chronic health conditions such as diabetes or heart disease, and assistance with daily living activities for elderly individuals. Each scenario highlights the flexibility and adaptability of the services offered, allowing patients to remain in their homes while receiving the necessary medical attention. The organization also provides support for families, offering respite care and educational resources to help them navigate the challenges of caregiving.

Required Documents

To initiate services with Serenity Home Health Care LLC, several documents may be required. These typically include a physician's order for home health services, patient medical history, and insurance information. Additional documentation may be necessary based on specific service needs or state regulations. Ensuring that all required documents are completed accurately and submitted promptly is essential for a smooth onboarding process.

Form Submission Methods (Online / Mail / In-Person)

Submitting forms to Serenity Home Health Care LLC can be done through various methods to accommodate client preferences. Forms can typically be submitted online through the organization's secure portal, mailed directly to their office, or delivered in person. Each method is designed to ensure that the submission process is efficient and accessible, allowing for timely initiation of services. Clients are encouraged to choose the method that best suits their needs and comfort level.

Quick guide on how to complete serenity home health care llc

Complete SERENITY HOME HEALTH CARE LLC effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the proper form and securely save it online. airSlate SignNow provides you with all the essential tools needed to create, modify, and eSign your documents swiftly without delays. Manage SERENITY HOME HEALTH CARE LLC on any gadget using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign SERENITY HOME HEALTH CARE LLC with ease

- Find SERENITY HOME HEALTH CARE LLC and click Get Form to commence.

- Utilize the functionalities we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your alterations.

- Choose how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign SERENITY HOME HEALTH CARE LLC while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

What tax form do I need to fill out to convert from single member LLC to multi-member LLC?

When you add a member to your previously single member LLC (which you can do structurally by amending your operating agreement and filing an amended report, if required, with your secretary of state), you cease to be a 'disregarded entity' under the applicable Treasury Regulations.Going forward, you will either be a (a) partnership, by default, and will have to file a partnership income tax return on Form 1065, or (b) a corporation, if you so elect, and will have to file a Form 1120 if you are a C corporation or Form 1120S if you elect to be taxed as an S corporation.There can be other tax issues as well, and these need to be addressed with a business CPA.

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

Create this form in 5 minutes!

How to create an eSignature for the serenity home health care llc

How to create an eSignature for your Serenity Home Health Care Llc online

How to generate an electronic signature for the Serenity Home Health Care Llc in Chrome

How to create an electronic signature for putting it on the Serenity Home Health Care Llc in Gmail

How to create an eSignature for the Serenity Home Health Care Llc from your mobile device

How to generate an electronic signature for the Serenity Home Health Care Llc on iOS

How to make an eSignature for the Serenity Home Health Care Llc on Android OS

People also ask

-

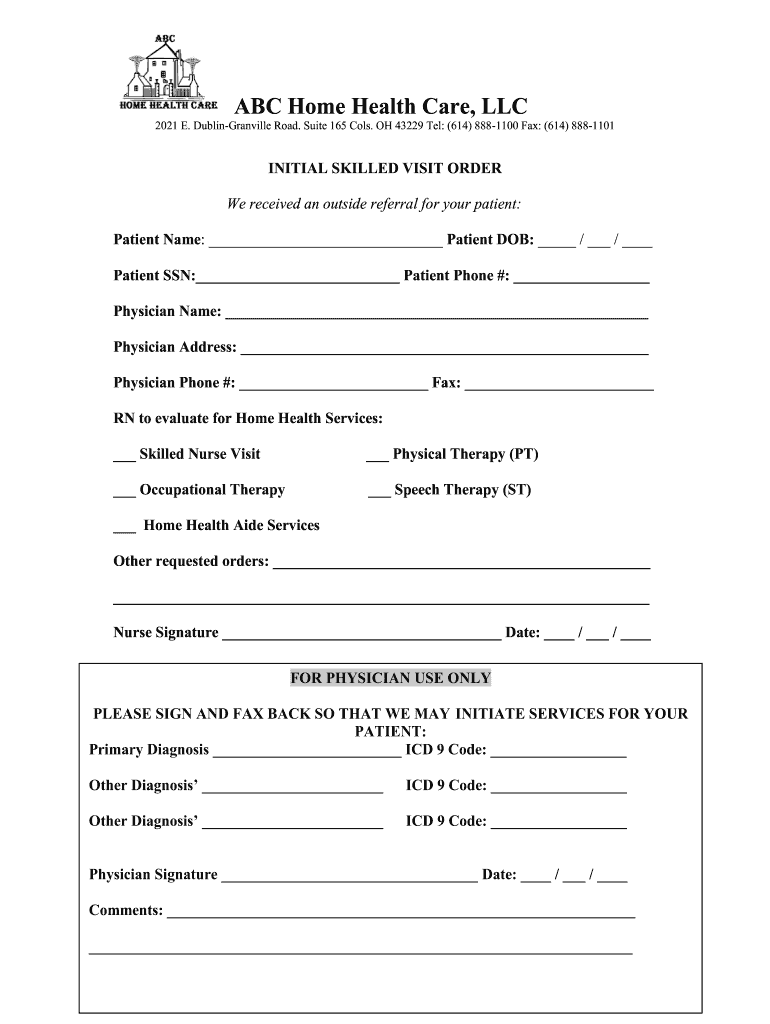

What is a home health order template?

A home health order template is a standardized form used by healthcare professionals to document patient care instructions for at-home services. By utilizing a home health order template, providers ensure consistency and clarity in communication, which can enhance patient outcomes and compliance.

-

How can airSlate SignNow improve my use of a home health order template?

airSlate SignNow streamlines the process of managing home health order templates by allowing users to create, send, and eSign documents efficiently. This reduces the administrative burden, ensures that orders are processed quickly, and promotes better patient care through timely service delivery.

-

Is there a cost associated with using airSlate SignNow for home health order templates?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. These plans are designed to provide cost-effective solutions for managing home health order templates, ensuring that businesses can optimize their workflow without exceeding their budgets.

-

What features does airSlate SignNow provide for home health order templates?

airSlate SignNow includes features such as customizable templates, real-time tracking of document status, and easy integration with other applications. These functionalities make it simple to manage home health order templates, ensuring that healthcare providers can focus on patient care instead of paperwork.

-

Can I customize my home health order template using airSlate SignNow?

Absolutely! airSlate SignNow allows users to fully customize their home health order templates to meet specific healthcare requirements. This flexibility ensures that the templates adhere to your organization's protocols while providing relevant information for effective patient care.

-

How does airSlate SignNow ensure the security of my home health order templates?

airSlate SignNow prioritizes data security with encryption, secure cloud storage, and compliance with industry standards. This guarantees that your home health order templates and sensitive patient information remain protected from unauthorized access and bsignNowes.

-

What integrations are available for managing home health order templates?

airSlate SignNow offers seamless integrations with popular healthcare management systems and applications, enhancing the workflow for managing home health order templates. By connecting your existing tools, you can streamline operations and improve overall efficiency in patient care.

Get more for SERENITY HOME HEALTH CARE LLC

Find out other SERENITY HOME HEALTH CARE LLC

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure