Form 540

What is the Form 540

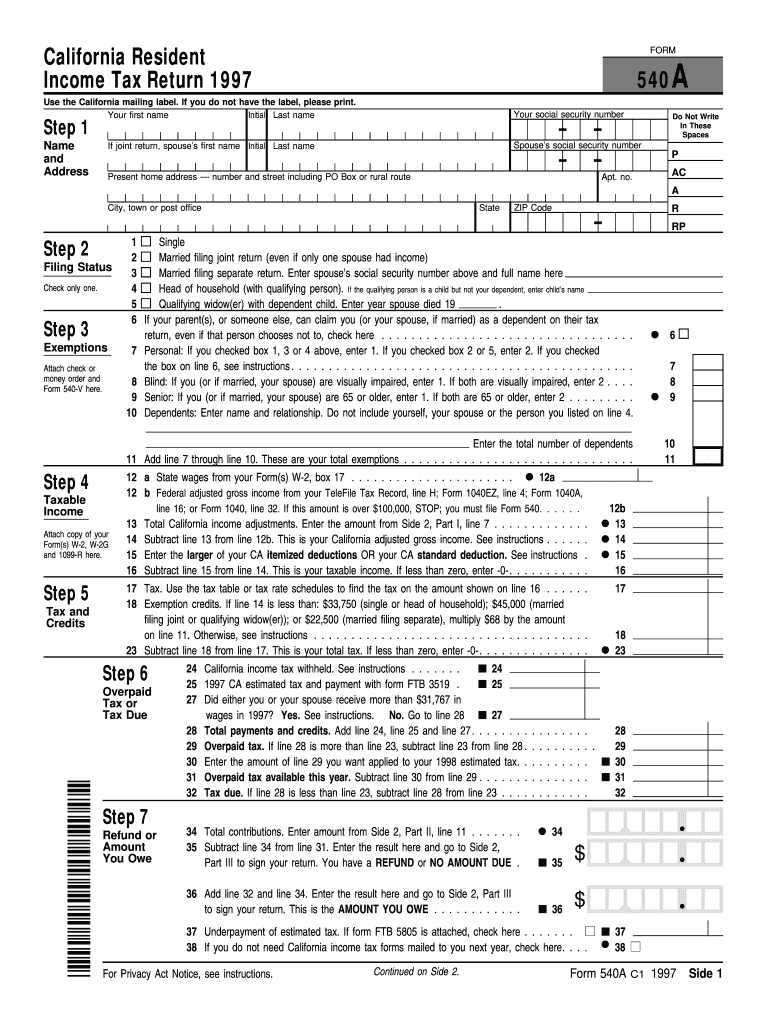

The Form 540 is a California state income tax return used by residents to report their income, claim deductions, and calculate their tax liability. It is essential for individuals who earn income within the state, allowing them to fulfill their tax obligations. The form is designed to accommodate various income sources, including wages, interest, dividends, and capital gains. Understanding the purpose of the Form 540 is crucial for ensuring compliance with state tax laws.

How to use the Form 540

Using the Form 540 involves a series of steps to accurately report your income and calculate your taxes owed. First, gather all necessary financial documents, such as W-2s, 1099s, and any records of deductions. Next, fill out the form by entering your personal information, income details, and applicable deductions. It is important to follow the instructions carefully to avoid errors that could lead to delays or penalties. Once completed, you can submit the form electronically or via mail, depending on your preference.

Steps to complete the Form 540

Completing the Form 540 requires attention to detail. Start by entering your personal information, including your name, address, and Social Security number. Next, report your income by adding all sources of earnings, such as employment income and investment returns. After calculating your total income, move on to deductions. Common deductions include mortgage interest, property taxes, and charitable contributions. Finally, calculate your tax liability and determine if you owe taxes or are due a refund. Review the form for accuracy before submission.

Legal use of the Form 540

The legal use of the Form 540 is governed by California tax regulations. To ensure that your submission is valid, it must be signed and dated. Electronic signatures are acceptable if you are filing online. It is also important to keep copies of your submitted form and any supporting documents for your records, as they may be required for future reference or in case of an audit. Compliance with state tax laws is crucial to avoid penalties and interest on unpaid taxes.

Filing Deadlines / Important Dates

Filing deadlines for the Form 540 are typically aligned with federal tax deadlines. For most taxpayers, the due date is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers can request an extension to file, but any taxes owed must still be paid by the original due date to avoid penalties. Staying informed about these deadlines is essential for timely and compliant tax filing.

Required Documents

To complete the Form 540, certain documents are necessary. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of deductible expenses, such as mortgage interest and property taxes

- Any relevant receipts for charitable contributions

- Documentation of health insurance coverage

Having these documents ready will streamline the completion process and help ensure accuracy in reporting income and deductions.

Form Submission Methods (Online / Mail / In-Person)

The Form 540 can be submitted through various methods. Online filing is the most efficient option, allowing for quick processing and confirmation of receipt. Taxpayers can also choose to mail their completed forms to the appropriate address based on their location. In-person submission is available at designated tax offices, providing assistance if needed. Each method has its advantages, and choosing the right one depends on individual preferences and circumstances.

Quick guide on how to complete form 540 103033

Effortlessly Prepare Form 540 on Any Device

The management of online documents has gained popularity among organizations and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Handle Form 540 on any platform using the airSlate SignNow applications for Android or iOS and enhance your document-centered operations today.

The Easiest Way to Edit and Electronically Sign Form 540 with Ease

- Locate Form 540 and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Review the details and click the Done button to finalize your changes.

- Choose your preferred method of delivering your form, whether via email, SMS, invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 540 and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 540 103033

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CA 1997 540 fillable form?

The CA 1997 540 fillable form is a state tax return for California residents. It allows users to report their income and calculate their tax liability for the year. This form can be easily completed online, ensuring accurate submissions.

-

How can airSlate SignNow assist with completing the CA 1997 540 fillable form?

airSlate SignNow streamlines the process of filling out the CA 1997 540 fillable form by providing user-friendly tools for e-signatures and document management. With our platform, you can securely complete and send your form digitally. This not only saves time but also enhances accuracy.

-

Is airSlate SignNow affordable for individual users needing the CA 1997 540 fillable form?

Yes, airSlate SignNow offers competitive pricing plans to fit various budgets. Our services are designed to be cost-effective, especially for individuals needing to complete forms like the CA 1997 540 fillable. You can choose a plan that best suits your needs without breaking the bank.

-

What features does airSlate SignNow offer for e-signing the CA 1997 540 fillable form?

airSlate SignNow provides robust features for e-signing the CA 1997 540 fillable form, including customizable templates and secure signing options. Users can sign documents from any device, track document status, and ensure compliance with legal standards, making the process hassle-free.

-

Can I integrate airSlate SignNow with other software when using the CA 1997 540 fillable form?

Absolutely! airSlate SignNow supports integrations with a variety of popular software applications. This ensures that you can seamlessly connect your workflows while working on the CA 1997 540 fillable form, enhancing productivity and efficiency.

-

Are there any benefits to using airSlate SignNow for the CA 1997 540 fillable form?

Using airSlate SignNow for the CA 1997 540 fillable form offers numerous benefits, including enhanced security, ease of use, and faster processing times. Our platform eliminates the need for physical paperwork, reducing clutter and improving eco-friendliness while ensuring your data remains protected.

-

What customer support options are available while using the CA 1997 540 fillable form with airSlate SignNow?

airSlate SignNow provides a variety of customer support options including live chat, email support, and extensive online resources. Our team is dedicated to assisting you with any issues related to the CA 1997 540 fillable form, ensuring you have the help needed to navigate the process smoothly.

Get more for Form 540

Find out other Form 540

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe