Withholding Tax Forms and Publicationsotr DC Gov 2023-2026

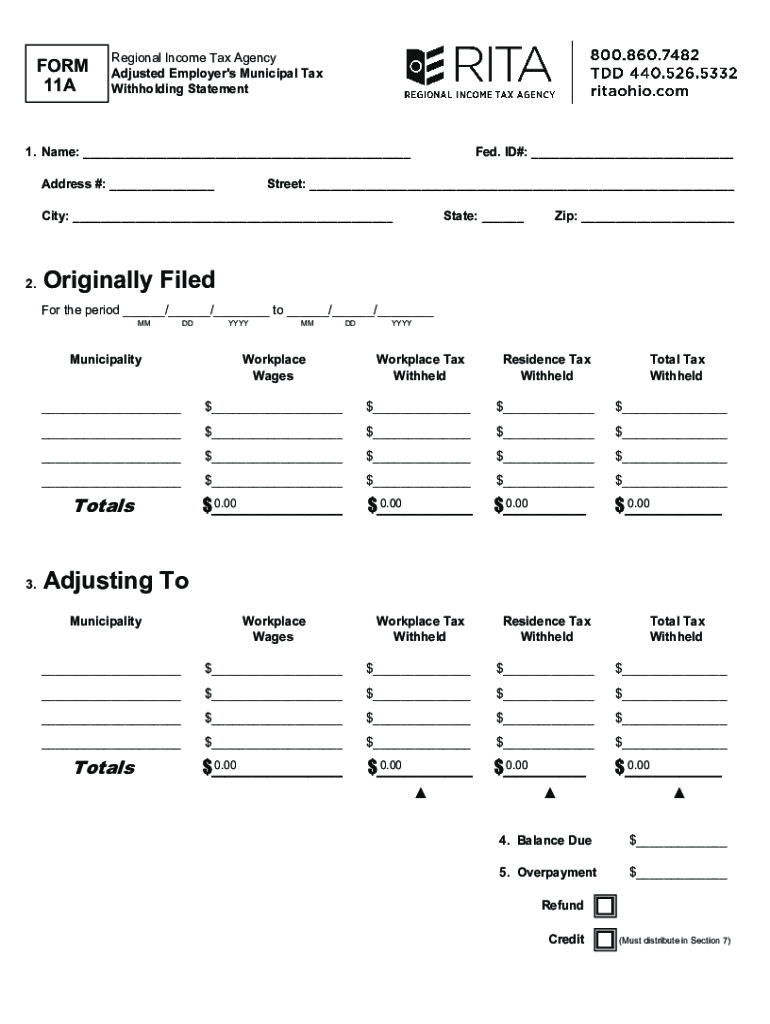

Understanding the RITA Form 11A

The RITA Form 11A is a crucial document used for withholding tax purposes in certain jurisdictions. This form is specifically designed for individuals and businesses to report income and calculate the appropriate withholding tax. Understanding the purpose of this form is essential for compliance with local tax regulations.

Steps to Complete the RITA Form 11A

Completing the RITA Form 11A involves several key steps:

- Gather necessary information, including your personal details and income sources.

- Fill out the form accurately, ensuring all fields are completed as required.

- Calculate the withholding amount based on your income and applicable tax rates.

- Review the form for accuracy before submission.

Legal Use of the RITA Form 11A

The RITA Form 11A is legally recognized for reporting income and withholding tax. It is important to use this form in accordance with local laws to avoid any legal repercussions. Proper use ensures that individuals and businesses meet their tax obligations and maintain compliance with tax authorities.

Filing Deadlines for the RITA Form 11A

Filing deadlines for the RITA Form 11A can vary based on the specific tax year and local regulations. Typically, it is important to submit the form by the designated due date to avoid penalties. Staying informed about these deadlines is crucial for timely compliance.

Required Documents for the RITA Form 11A

To complete the RITA Form 11A, certain documents are required:

- Proof of income, such as pay stubs or tax returns.

- Identification documents, including Social Security numbers.

- Any previous tax documents that may be relevant.

Form Submission Methods for the RITA Form 11A

The RITA Form 11A can typically be submitted through various methods, including:

- Online submission via the appropriate tax authority's website.

- Mailing a physical copy to the designated tax office.

- In-person submission at local tax offices, if available.

Penalties for Non-Compliance with the RITA Form 11A

Failure to comply with the requirements of the RITA Form 11A can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential to adhere to all filing requirements to avoid these consequences.

Create this form in 5 minutes or less

Find and fill out the correct withholding tax forms and publicationsotr dc gov

Create this form in 5 minutes!

How to create an eSignature for the withholding tax forms and publicationsotr dc gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rita form 11a and how can airSlate SignNow help?

The rita form 11a is a specific document used for various administrative purposes. airSlate SignNow simplifies the process of filling out and signing the rita form 11a by providing an intuitive platform that allows users to easily create, send, and eSign documents securely.

-

How much does it cost to use airSlate SignNow for the rita form 11a?

airSlate SignNow offers competitive pricing plans that cater to different business needs. Users can choose from various subscription options, ensuring that they can efficiently manage the rita form 11a without breaking the bank.

-

What features does airSlate SignNow offer for managing the rita form 11a?

airSlate SignNow provides a range of features for the rita form 11a, including customizable templates, automated workflows, and secure eSigning capabilities. These features enhance productivity and ensure that your documents are handled efficiently.

-

Can I integrate airSlate SignNow with other applications for the rita form 11a?

Yes, airSlate SignNow offers seamless integrations with various applications, making it easy to manage the rita form 11a alongside your existing tools. This integration capability enhances workflow efficiency and document management.

-

What are the benefits of using airSlate SignNow for the rita form 11a?

Using airSlate SignNow for the rita form 11a provides numerous benefits, including time savings, improved accuracy, and enhanced security. The platform streamlines the signing process, allowing businesses to focus on their core activities.

-

Is airSlate SignNow secure for handling the rita form 11a?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including the rita form 11a. With encryption and secure storage, you can trust that your sensitive information is safe.

-

How can I get started with airSlate SignNow for the rita form 11a?

Getting started with airSlate SignNow for the rita form 11a is easy. Simply sign up for an account, choose a pricing plan that suits your needs, and start creating and sending your documents in minutes.

Get more for Withholding Tax Forms And Publicationsotr DC gov

- Printable teacher observation form

- Indiana driving test score sheet form

- Bharti axa neft form

- Stellenbosch student contract form

- Identifying ionic and covalent bonds worksheet answer key form

- Caltrans corrosion guidelines form

- Boston brace scoliosis measurement form

- Business license application elsmere form

Find out other Withholding Tax Forms And Publicationsotr DC gov

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document