Texas Trec Seller 2022-2026

Understanding the Texas TREC Seller Financing Addendum

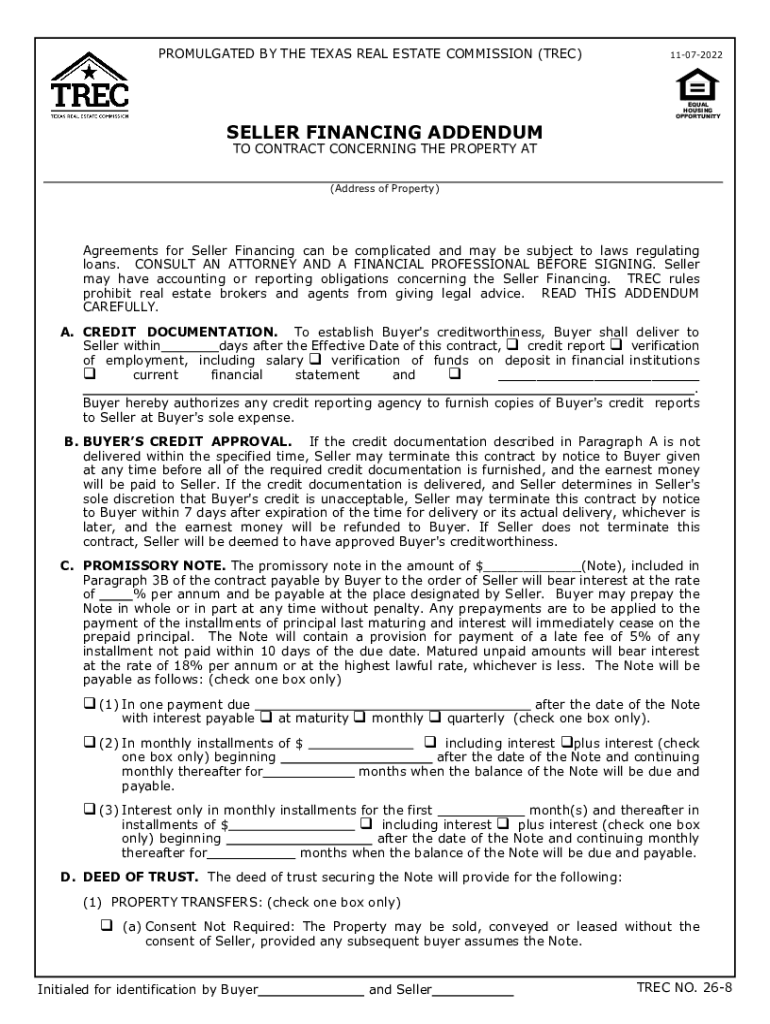

The Texas Real Estate Commission (TREC) Seller Financing Addendum is a crucial document for real estate transactions involving seller financing in Texas. This addendum outlines the terms and conditions under which the seller agrees to finance the purchase of the property. It includes details such as the interest rate, payment schedule, and any contingencies that may apply. Understanding this addendum is essential for both buyers and sellers to ensure compliance with Texas real estate laws.

Key Elements of the Texas TREC Seller Financing Addendum

Several important elements must be included in the TREC Seller Financing Addendum to ensure its effectiveness and legality. These elements typically consist of:

- Property Description: A clear identification of the property being financed.

- Loan Amount: The total amount being financed by the seller.

- Interest Rate: The agreed-upon interest rate for the financing.

- Payment Terms: Details regarding the payment schedule, including due dates and amounts.

- Default Provisions: Conditions under which the seller may declare a default and the remedies available.

Steps to Complete the Texas TREC Seller Financing Addendum

Completing the Texas TREC Seller Financing Addendum involves several important steps. These steps ensure that all parties understand the terms and that the document is legally binding:

- Gather Information: Collect all necessary details about the property and financing terms.

- Fill Out the Addendum: Accurately complete the addendum with the required information.

- Review the Document: Both parties should review the addendum to ensure all terms are clear and agreed upon.

- Sign the Addendum: Obtain signatures from both the buyer and seller to execute the document.

- Store the Document Securely: Keep a copy of the signed addendum for future reference.

Legal Use of the Texas TREC Seller Financing Addendum

The legal use of the Texas TREC Seller Financing Addendum is governed by state laws and regulations. It is essential for both buyers and sellers to understand their rights and obligations under this addendum. Proper execution of the addendum ensures that the financing agreement is enforceable and protects the interests of both parties. Compliance with applicable laws, such as the Texas Property Code, is necessary to avoid potential disputes.

State-Specific Rules for the Texas TREC Seller Financing Addendum

Texas has specific rules that govern the use of seller financing in real estate transactions. These rules are designed to protect both buyers and sellers and include:

- Disclosure Requirements: Sellers must provide buyers with clear disclosures regarding the financing terms.

- Interest Rate Limits: Texas law may impose limits on the interest rates that can be charged in seller financing agreements.

- Documentation Standards: The addendum must meet specific documentation standards to be considered valid.

Examples of Using the Texas TREC Seller Financing Addendum

Real estate transactions often involve unique scenarios where the Texas TREC Seller Financing Addendum is applicable. For instance:

- A seller may offer financing to a buyer with a lower credit score, providing an opportunity for homeownership.

- Investors may use seller financing to acquire properties quickly without traditional bank financing.

- In a competitive market, sellers may offer financing as an incentive to attract buyers.

Quick guide on how to complete texas trec seller

Complete Texas Trec Seller effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly solution to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Texas Trec Seller on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Texas Trec Seller with ease

- Obtain Texas Trec Seller and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you prefer to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks, accessible from any device of your preference. Modify and eSign Texas Trec Seller and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct texas trec seller

Create this form in 5 minutes!

How to create an eSignature for the texas trec seller

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Texas seller financing?

Texas seller financing is an arrangement where the seller of a property provides the buyer with a loan to purchase the property. This option is often used when traditional mortgage financing is not available. It allows for more flexible terms and can benefit both sellers and buyers in the Texas real estate market.

-

How does airSlate SignNow facilitate Texas seller financing agreements?

airSlate SignNow streamlines the process of creating and managing Texas seller financing agreements by providing easy-to-use document templates and eSignature capabilities. This allows both parties to review, sign, and store contracts digitally, ensuring a smooth transaction. With SignNow, you can ensure compliance and maintain accurate records.

-

What are the costs associated with using airSlate SignNow for Texas seller financing?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes involved in Texas seller financing. Our pricing models are transparent with no hidden fees, allowing you to choose the plan that best suits your needs. We also provide a free trial, enabling you to assess our services before committing.

-

Can I customize documents for Texas seller financing using airSlate SignNow?

Yes, airSlate SignNow allows you to customize documents specifically for Texas seller financing agreements. You can easily modify templates to include terms that reflect your unique agreement, such as payment schedules and interest rates. This flexibility ensures that your financing terms meet both parties' requirements.

-

What benefits does airSlate SignNow offer for Texas seller financing?

Using airSlate SignNow for Texas seller financing provides several benefits, including improved efficiency, reduced paperwork, and enhanced security for your documents. Our platform allows for real-time collaboration among parties, making it easier to finalize and execute agreements quickly. Additionally, eSigning eliminates the need for in-person meetings.

-

Is airSlate SignNow compliant with Texas real estate laws?

Yes, airSlate SignNow is designed to assist users in staying compliant with Texas real estate laws regarding seller financing. Our templates are regularly updated to reflect current regulations, ensuring that your documents meet legal requirements. We also offer resources to educate users on compliance matters.

-

What kind of integrations does airSlate SignNow support for Texas seller financing?

airSlate SignNow seamlessly integrates with various business applications essential for managing Texas seller financing. Whether you need CRM solutions, cloud storage, or productivity tools, our platform can connect and streamline your workflows. This integration ensures that your financing process remains organized and efficient.

Get more for Texas Trec Seller

Find out other Texas Trec Seller

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure