Form 4506 T Rev 6 Request for Transcript of Tax Return

What is the Form 4506 T Rev 6 Request For Transcript Of Tax Return

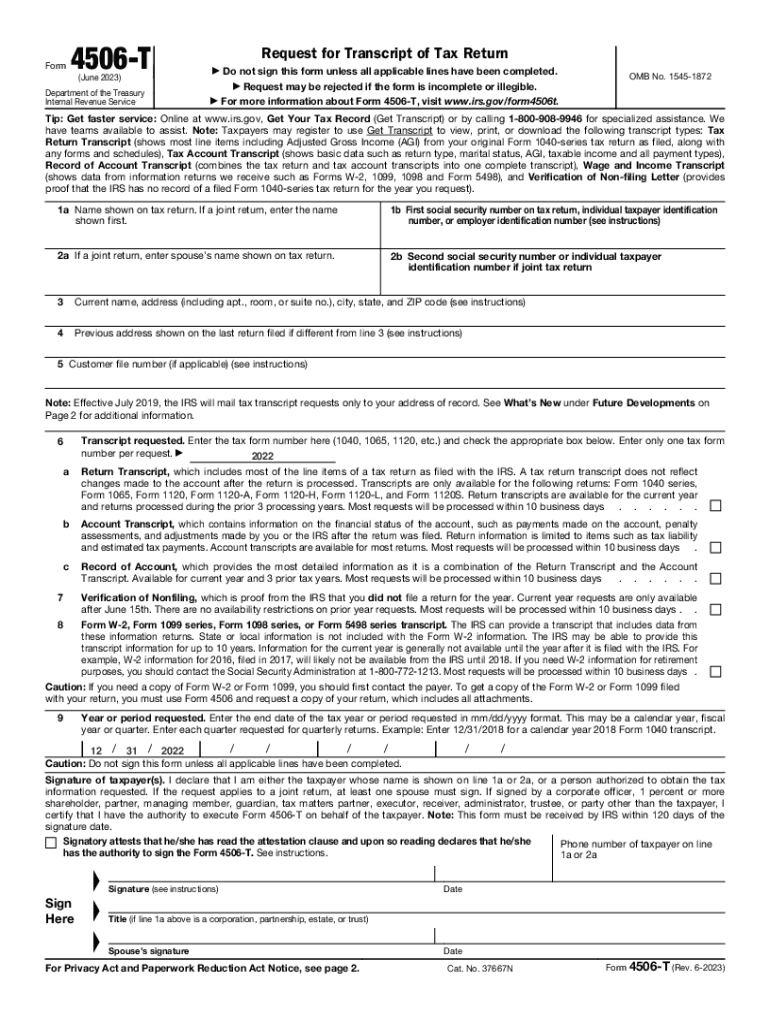

The Form 4506 T Rev 6 Request For Transcript Of Tax Return is a document used by taxpayers in the United States to request a transcript of their tax returns from the Internal Revenue Service (IRS). This form allows individuals and businesses to obtain copies of their tax information for various purposes, including loan applications, financial aid, or personal record-keeping. The transcript provides a summary of the taxpayer's return, including adjusted gross income, filing status, and other essential details without providing the full return.

How to use the Form 4506 T Rev 6 Request For Transcript Of Tax Return

To use the Form 4506 T Rev 6, taxpayers must complete the form with accurate information, including their name, Social Security number, and the tax years for which they are requesting transcripts. The form can be submitted electronically or via mail. When filling out the form, it is important to specify the type of transcript needed, such as a return transcript or account transcript, depending on the intended use. After submission, taxpayers typically receive their transcripts within five to ten business days.

Steps to complete the Form 4506 T Rev 6 Request For Transcript Of Tax Return

Completing the Form 4506 T Rev 6 involves several straightforward steps:

- Provide your personal information, including your name, address, and Social Security number.

- Indicate the type of transcript you are requesting and the tax years needed.

- Specify the purpose of the request, which helps the IRS process your request appropriately.

- Sign and date the form to validate your request.

- Submit the form electronically through an authorized e-filing service or mail it to the appropriate IRS address.

Legal use of the Form 4506 T Rev 6 Request For Transcript Of Tax Return

The Form 4506 T Rev 6 is legally binding when properly completed and submitted. It complies with IRS regulations, allowing taxpayers to access their tax information securely. By signing the form, taxpayers authorize the IRS to release their tax data to the specified recipient, ensuring that the request is legitimate and meets legal standards. This form is essential for individuals and businesses needing to verify income or tax history for loans, grants, or other financial transactions.

Required Documents

When submitting the Form 4506 T Rev 6, no additional documents are required. However, it is advisable to have personal identification information ready, such as your Social Security number and any relevant tax information. If the request is for a business, the Employer Identification Number (EIN) should also be included. Ensuring that all information on the form is accurate will facilitate a smoother processing experience.

Form Submission Methods

The Form 4506 T Rev 6 can be submitted through various methods:

- Online: Use an authorized e-filing service to submit the form electronically.

- Mail: Print the completed form and send it to the appropriate IRS address based on your location.

- In-Person: Although less common, some taxpayers may choose to visit a local IRS office to submit the form directly.

Quick guide on how to complete form 4506 t rev 6 request for transcript of tax return

Easily prepare Form 4506 T Rev 6 Request For Transcript Of Tax Return on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Form 4506 T Rev 6 Request For Transcript Of Tax Return on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

Effortlessly edit and eSign Form 4506 T Rev 6 Request For Transcript Of Tax Return

- Locate Form 4506 T Rev 6 Request For Transcript Of Tax Return and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which only takes a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 4506 T Rev 6 Request For Transcript Of Tax Return to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4506 t rev 6 request for transcript of tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 4506 T Rev 6 Request For Transcript Of Tax Return?

The Form 4506 T Rev 6 Request For Transcript Of Tax Return is a document used to request a transcript of your tax return from the IRS. This form is essential for businesses and individuals who need to verify their income for loans or financing. airSlate SignNow makes it easy to complete and eSign this form, streamlining the process.

-

How do I fill out the Form 4506 T Rev 6 Request For Transcript Of Tax Return using airSlate SignNow?

Filling out the Form 4506 T Rev 6 Request For Transcript Of Tax Return with airSlate SignNow is simple. You can access the form within our platform and complete the necessary fields electronically. Once filled, you can easily eSign and send the form directly to the IRS.

-

Is there a cost associated with using airSlate SignNow for the Form 4506 T Rev 6 Request For Transcript Of Tax Return?

Yes, airSlate SignNow offers various pricing plans to suit your business needs. Our plans are designed to provide cost-effective solutions for sending and eSigning documents, including the Form 4506 T Rev 6 Request For Transcript Of Tax Return. Check our website for detailed pricing information.

-

What features does airSlate SignNow provide for the Form 4506 T Rev 6 Request For Transcript Of Tax Return?

airSlate SignNow offers a range of features to enhance your experience with the Form 4506 T Rev 6 Request For Transcript Of Tax Return. These include easy document preparation, secure eSigning, tracking options, and the ability to store completed forms securely. Our platform ensures you can handle your requests efficiently.

-

Can airSlate SignNow assist with submitting the Form 4506 T Rev 6 Request For Transcript Of Tax Return?

Yes, airSlate SignNow can assist you in submitting the Form 4506 T Rev 6 Request For Transcript Of Tax Return after it has been completed and eSigned. Although we cannot submit it directly to the IRS, our platform allows you to download and send the form via your preferred method.

-

What are the benefits of using airSlate SignNow for tax-related forms like the Form 4506 T Rev 6 Request For Transcript Of Tax Return?

Using airSlate SignNow for tax-related forms, including the Form 4506 T Rev 6 Request For Transcript Of Tax Return, offers numerous benefits. You gain a secure, efficient means of handling important documents, saving time and reducing the risk of errors. Plus, our user-friendly platform simplifies the entire process.

-

Does airSlate SignNow integrate with other applications for processing the Form 4506 T Rev 6 Request For Transcript Of Tax Return?

Absolutely! airSlate SignNow offers seamless integrations with various applications that can enhance your experience while processing the Form 4506 T Rev 6 Request For Transcript Of Tax Return. This allows you to utilize existing workflows and improve overall efficiency in your document management.

Get more for Form 4506 T Rev 6 Request For Transcript Of Tax Return

Find out other Form 4506 T Rev 6 Request For Transcript Of Tax Return

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure