Withdrawal One Time Fidelity Form

What is the Withdrawal One Time Fidelity

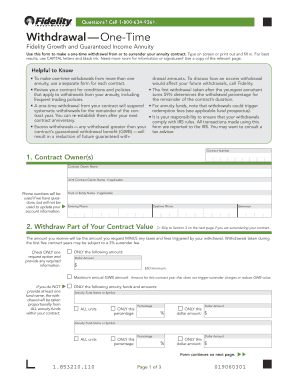

The Withdrawal One Time Fidelity form is a specific document used primarily by individuals to request a one-time withdrawal from their Fidelity investment accounts. This form is essential for managing personal finances, especially for those who wish to access their funds without setting up recurring withdrawals. It serves as a formal request to Fidelity, ensuring that the withdrawal process is documented and compliant with financial regulations.

How to use the Withdrawal One Time Fidelity

Using the Withdrawal One Time Fidelity form involves a straightforward process. First, ensure that you have your Fidelity account information readily available. Next, complete the form by providing the necessary details, including your account number, the amount you wish to withdraw, and your personal identification information. Once filled out, you can submit the form electronically through Fidelity’s online platform or print it for mailing. Utilizing digital tools can streamline this process, making it easier to manage your finances.

Steps to complete the Withdrawal One Time Fidelity

Completing the Withdrawal One Time Fidelity form requires several key steps:

- Gather your Fidelity account details and personal identification.

- Access the Withdrawal One Time Fidelity form through Fidelity’s website or your account portal.

- Fill in the required fields, including the withdrawal amount and your account information.

- Review the form for accuracy to avoid any delays in processing.

- Submit the form electronically or print it for mailing, depending on your preference.

Legal use of the Withdrawal One Time Fidelity

The legal use of the Withdrawal One Time Fidelity form is governed by financial regulations that dictate how withdrawals from investment accounts should be handled. By completing this form, you are providing a legally binding request for funds, which Fidelity must process in accordance with applicable laws. Ensuring that the form is filled out correctly is crucial for compliance and to avoid any potential legal issues.

Key elements of the Withdrawal One Time Fidelity

Key elements of the Withdrawal One Time Fidelity form include:

- Account Information: Your Fidelity account number and personal details.

- Withdrawal Amount: The specific amount you wish to withdraw.

- Signature: Your signature to authorize the transaction.

- Date: The date on which the form is completed.

Required Documents

To successfully complete the Withdrawal One Time Fidelity form, you may need to provide certain documents, including:

- Proof of identity, such as a driver's license or passport.

- Account statements or documentation verifying your Fidelity account.

- Any additional forms required by Fidelity for processing withdrawals.

Form Submission Methods

The Withdrawal One Time Fidelity form can be submitted through various methods, ensuring flexibility for users. You can choose to:

- Submit the form electronically via Fidelity's online platform.

- Print the form and mail it to the designated address provided by Fidelity.

- Visit a Fidelity branch location to submit the form in person, if available.

Quick guide on how to complete withdrawal one time fidelity

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained traction among organizations and individuals alike. It offers an excellent eco-conscious substitute for conventional printed and signed documents, allowing you to locate the right template and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your files quickly and efficiently. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to edit and electronically sign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign tool, which takes just a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, or invitation link, or download it directly to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign [SKS] and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Withdrawal One Time Fidelity

Create this form in 5 minutes!

How to create an eSignature for the withdrawal one time fidelity

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for a Withdrawal One Time Fidelity?

To complete a Withdrawal One Time Fidelity, you simply need to access your account settings and select the withdrawal option. Follow the prompts to provide the necessary information for your transaction, ensuring all details are accurate. Once submitted, your request will be processed promptly.

-

Are there any fees associated with Withdrawal One Time Fidelity?

Yes, when making a Withdrawal One Time Fidelity, it's important to review any applicable fees. These may vary depending on your account type and the amount being withdrawn. Always check the fee structure before proceeding to avoid unexpected costs.

-

How long does it take to complete a Withdrawal One Time Fidelity?

Typically, a Withdrawal One Time Fidelity is processed within 1-3 business days. However, processing times may vary based on your financial institution and any specific requirements they might have. It's recommended to check with your bank for detailed timelines.

-

Can I schedule a Withdrawal One Time Fidelity for a future date?

Currently, airSlate SignNow does not support scheduling a Withdrawal One Time Fidelity in advance. Withdrawals must be initiated in real-time, allowing for immediate processing of your requests. Ensure to plan accordingly based on your needs.

-

Is there a minimum amount required for a Withdrawal One Time Fidelity?

Yes, there is usually a minimum amount set for a Withdrawal One Time Fidelity to ensure efficient processing. This amount may vary by account type or provider, so it’s essential to check the specific policies associated with your account before initiating a withdrawal.

-

What documents do I need for a Withdrawal One Time Fidelity?

For a Withdrawal One Time Fidelity, you may need to provide identification and possibly additional documentation to verify your account. Ensure that all documents are current and match the details in your account to avoid delays in processing.

-

Does airSlate SignNow provide tracking for Withdrawal One Time Fidelity?

Yes, airSlate SignNow allows you to track the status of your Withdrawal One Time Fidelity directly through your account dashboard. You will receive notifications about the progress of your request, providing you with peace of mind throughout the process.

Get more for Withdrawal One Time Fidelity

Find out other Withdrawal One Time Fidelity

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy