MONTHLY DEPOSITARY PAYMENTS Forms Online

What is the MONTHLY DEPOSITARY PAYMENTS Forms Online

The MONTHLY DEPOSITARY PAYMENTS Forms Online are essential documents used for reporting and managing monthly depositary payments. These forms facilitate the electronic submission of payment information to relevant authorities, ensuring compliance with financial regulations. Utilizing digital formats streamlines the process, allowing users to fill out, sign, and submit their forms securely and efficiently. This online approach not only saves time but also reduces the risk of errors associated with manual entry.

Steps to complete the MONTHLY DEPOSITARY PAYMENTS Forms Online

Completing the MONTHLY DEPOSITARY PAYMENTS Forms Online involves several straightforward steps:

- Access the form through a secure online platform.

- Fill in the required fields, including personal and financial information.

- Review the details for accuracy to avoid potential issues.

- Sign the form electronically, ensuring that all necessary signatures are included.

- Submit the completed form electronically to the appropriate authority.

Following these steps helps ensure that your submission is processed smoothly and complies with legal requirements.

Legal use of the MONTHLY DEPOSITARY PAYMENTS Forms Online

The legal validity of the MONTHLY DEPOSITARY PAYMENTS Forms Online is supported by various regulations, including the ESIGN Act and UETA. These laws affirm that electronic signatures and documents hold the same legal weight as their paper counterparts, provided certain conditions are met. It is crucial to use a reliable e-signature solution that offers compliance with these legal frameworks to ensure that your submissions are recognized by financial institutions and courts.

Key elements of the MONTHLY DEPOSITARY PAYMENTS Forms Online

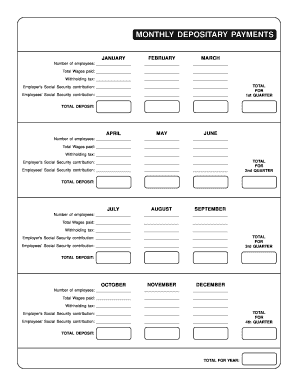

Key elements of the MONTHLY DEPOSITARY PAYMENTS Forms Online include:

- Identification information of the individual or entity making the payment.

- Details of the payment, including amounts and dates.

- Signature fields for electronic verification.

- Any additional documentation required to support the payment claim.

Understanding these elements is essential for accurate completion and compliance with submission requirements.

Who Issues the Form

The MONTHLY DEPOSITARY PAYMENTS Forms Online are typically issued by financial institutions or government agencies responsible for collecting depositary payments. These entities provide the necessary guidelines and requirements for completing the forms, ensuring that users have access to the correct documentation for their specific needs.

Form Submission Methods

Submitting the MONTHLY DEPOSITARY PAYMENTS Forms Online can be done through various methods:

- Direct electronic submission via a secure online portal.

- Emailing the completed form to the designated authority.

- Uploading the form to a specified platform for processing.

Choosing the appropriate submission method is crucial for timely processing and compliance with deadlines.

Quick guide on how to complete monthly depositary payments forms online

Effortlessly prepare [SKS] on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, as it allows you to locate the appropriate form and securely keep it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

The easiest method to modify and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Use the tools available to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from your chosen device. Modify and electronically sign [SKS] and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MONTHLY DEPOSITARY PAYMENTS Forms Online

Create this form in 5 minutes!

How to create an eSignature for the monthly depositary payments forms online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are MONTHLY DEPOSITARY PAYMENTS Forms Online?

MONTHLY DEPOSITARY PAYMENTS Forms Online are digital documents designed to facilitate the monthly deposit payment process. By using these forms, businesses can streamline their billing and enhance efficiency in processing payments. They allow for easy electronic signatures and secure submission.

-

How can I create MONTHLY DEPOSITARY PAYMENTS Forms Online?

Creating MONTHLY DEPOSITARY PAYMENTS Forms Online is simple with airSlate SignNow. You can use our user-friendly platform to customize pre-existing templates or build your own forms from scratch. Just drag and drop the required fields and integrate your business branding.

-

What is the pricing for using MONTHLY DEPOSITARY PAYMENTS Forms Online?

Pricing for MONTHLY DEPOSITARY PAYMENTS Forms Online varies based on your business needs and the volume of documents required. airSlate SignNow offers flexible subscription plans starting from a basic tier that includes essential features to premium plans with advanced capabilities. Contact our sales team for detailed pricing based on your needs.

-

What features do MONTHLY DEPOSITARY PAYMENTS Forms Online offer?

MONTHLY DEPOSITARY PAYMENTS Forms Online come with a variety of features such as customizable templates, eSignature capabilities, and secure cloud storage. Our platform also offers tracking tools to monitor payment statuses and reminders for both senders and recipients, ensuring efficient payment collection.

-

Are my MONTHLY DEPOSITARY PAYMENTS Forms Online secure?

Yes, your MONTHLY DEPOSITARY PAYMENTS Forms Online are highly secure. airSlate SignNow employs industry-standard encryption and compliance with regulations such as GDPR and HIPAA to protect your data. You can confidently send and receive sensitive payment information without compromising security.

-

Can I integrate MONTHLY DEPOSITARY PAYMENTS Forms Online with other tools?

Absolutely! MONTHLY DEPOSITARY PAYMENTS Forms Online can easily integrate with various business applications like CRM systems, payment processors, and document management tools. This flexibility allows you to streamline your workflow and centralize your document processes for better efficiency.

-

What are the benefits of using MONTHLY DEPOSITARY PAYMENTS Forms Online?

Utilizing MONTHLY DEPOSITARY PAYMENTS Forms Online can signNowly reduce manual processes and save time for your business. They help in minimizing errors tied to paper forms and provide instant access to documents. Additionally, automated reminders enhance payment collection efficiency and customer follow-up.

Get more for MONTHLY DEPOSITARY PAYMENTS Forms Online

Find out other MONTHLY DEPOSITARY PAYMENTS Forms Online

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online