LIVING TRUST CHARITABLE REMAINDER MyWillOnline Com Form

What is the Living Trust Charitable Remainder MyWillOnline Com

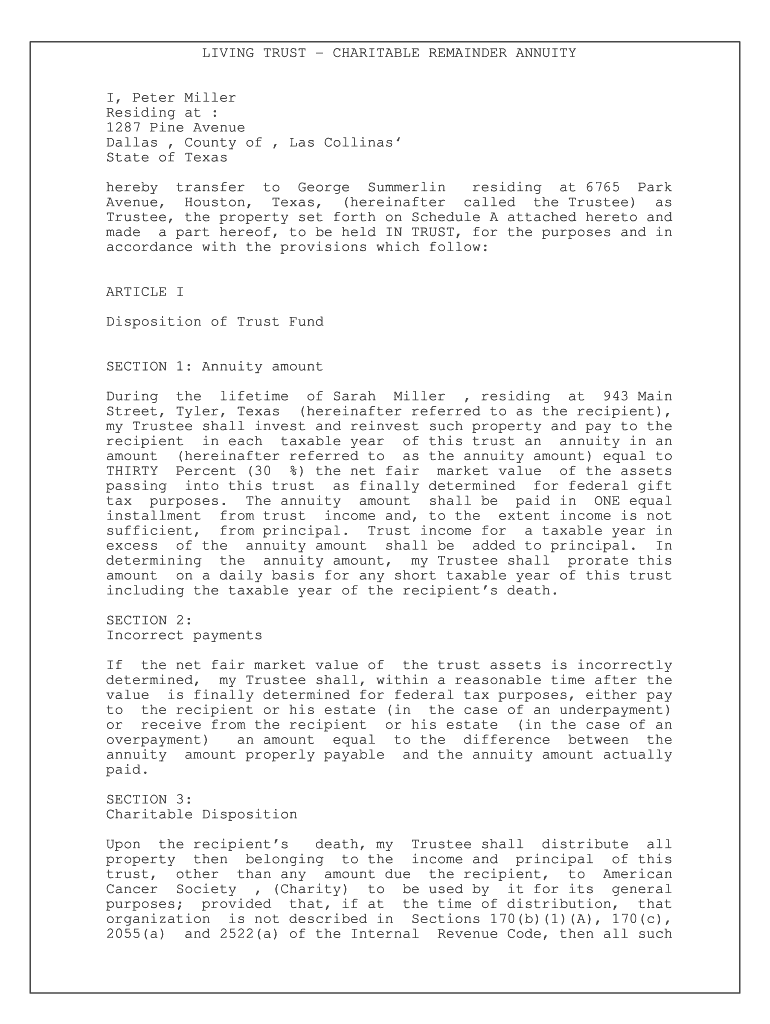

The Living Trust Charitable Remainder MyWillOnline Com form is a legal document that allows individuals to create a trust designed to benefit charitable organizations while providing income to the trustor or their beneficiaries. This trust structure enables the trustor to donate assets to a charity while retaining the right to receive income from those assets during their lifetime. Upon the trustor's passing, the remaining assets in the trust are transferred to the designated charitable organization.

Key Elements of the Living Trust Charitable Remainder MyWillOnline Com

Understanding the key elements of the Living Trust Charitable Remainder MyWillOnline Com form is essential for effective estate planning. Important components include:

- Trustor: The individual who establishes the trust and contributes assets.

- Beneficiaries: Individuals or entities who receive income from the trust during the trustor's lifetime.

- Charitable Organization: The designated charity that will receive the remaining assets after the trustor's death.

- Income Distribution: The terms outlining how and when income is distributed to beneficiaries.

- Tax Implications: Potential tax benefits for the trustor, including income tax deductions for charitable contributions.

Steps to Complete the Living Trust Charitable Remainder MyWillOnline Com

Completing the Living Trust Charitable Remainder MyWillOnline Com form involves several key steps:

- Gather necessary information about assets, beneficiaries, and the chosen charitable organization.

- Access the MyWillOnline platform to initiate the form.

- Fill out the required fields, ensuring accurate details regarding income distribution and trust terms.

- Review the completed form for accuracy and compliance with legal standards.

- Submit the form electronically, ensuring all required signatures are obtained.

Legal Use of the Living Trust Charitable Remainder MyWillOnline Com

The legal use of the Living Trust Charitable Remainder MyWillOnline Com form is governed by various laws and regulations. To ensure the document is legally binding:

- Ensure compliance with state laws regarding trusts and charitable contributions.

- Utilize a reliable electronic signature platform that adheres to the ESIGN and UETA acts.

- Maintain proper documentation of the trust's terms and conditions.

- Consult with a legal professional to confirm that the trust meets all legal requirements.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding charitable remainder trusts. Key considerations include:

- Tax deductions for contributions made to the trust.

- Requirements for reporting income generated by the trust.

- Rules governing the distribution of assets to charitable organizations.

Eligibility Criteria

To establish a Living Trust Charitable Remainder MyWillOnline Com, individuals must meet certain eligibility criteria, including:

- Being of legal age to create a trust.

- Possessing assets that can be contributed to the trust.

- Having a clear intention to benefit a charitable organization.

Quick guide on how to complete living trust charitable remainder mywillonline com

Prepare [SKS] effortlessly on any device

Managing documents online has gained popularity among both businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to alter and eSign [SKS] without hassle

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to LIVING TRUST CHARITABLE REMAINDER MyWillOnline Com

Create this form in 5 minutes!

How to create an eSignature for the living trust charitable remainder mywillonline com

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a living trust charitable remainder and how can 'MyWillOnline Com' help?

A living trust charitable remainder is a financial tool that allows individuals to leave a portion of their estate to charity after their passing. At 'MyWillOnline Com', we provide a user-friendly platform to create these trusts efficiently, ensuring your charitable goals are met while enjoying potential tax benefits.

-

How does pricing work for 'MyWillOnline Com' when setting up a living trust charitable remainder?

Unlike traditional estate planning services that can be expensive, 'MyWillOnline Com' offers competitive pricing for setting up a living trust charitable remainder. Our transparent pricing model ensures you understand all costs upfront, enabling you to manage your estate wisely without breaking the bank.

-

What features does 'MyWillOnline Com' offer for living trust charitable remainder setups?

'MyWillOnline Com' provides a range of features for creating a living trust charitable remainder, including customizable templates, step-by-step guidance, and easy integration with other financial planning tools. Our platform is designed to simplify the process, making estate planning accessible to everyone.

-

What are the benefits of using 'MyWillOnline Com' for creating a living trust charitable remainder?

Using 'MyWillOnline Com' for a living trust charitable remainder ensures a seamless and efficient process, maximizing your legacy while supporting charitable causes. You'll save time and money while benefiting from our intuitive interface and expert support.

-

Can I integrate 'MyWillOnline Com' with other estate planning tools for a comprehensive approach?

Yes, 'MyWillOnline Com' allows for integration with various estate planning tools, enhancing your ability to manage a living trust charitable remainder effectively. This interconnected approach simplifies the entire planning process, giving you a holistic view of your estate.

-

How do I ensure my living trust charitable remainder is legally binding with 'MyWillOnline Com'?

At 'MyWillOnline Com', we prioritize legal compliance for all living trust charitable remainder documents. Our platform is designed to generate legally binding documents that meet all necessary requirements, ensuring your wishes are upheld.

-

What kind of customer support can I expect from 'MyWillOnline Com'?

'MyWillOnline Com' offers robust customer support to assist you in creating and managing your living trust charitable remainder. Our knowledgeable team is available via chat, phone, or email to provide guidance and answer any questions you may have during the process.

Get more for LIVING TRUST CHARITABLE REMAINDER MyWillOnline Com

Find out other LIVING TRUST CHARITABLE REMAINDER MyWillOnline Com

- How To eSignature Kansas Construction Separation Agreement

- eSignature Iowa Construction Memorandum Of Understanding Easy

- eSignature Iowa Construction Memorandum Of Understanding Safe

- eSignature Kansas Construction Emergency Contact Form Free

- How Do I eSignature Kansas Construction Separation Agreement

- eSignature Kansas Construction Emergency Contact Form Secure

- How To eSignature Kansas Construction Emergency Contact Form

- How Do I eSignature Kansas Construction Emergency Contact Form

- Help Me With eSignature Kansas Construction Separation Agreement

- Help Me With eSignature Kansas Construction Emergency Contact Form

- eSignature Kansas Construction Emergency Contact Form Fast

- How Can I eSignature Kansas Construction Emergency Contact Form

- Can I eSignature Kansas Construction Emergency Contact Form

- eSignature Kansas Construction Emergency Contact Form Simple

- How Can I eSignature Kansas Construction Separation Agreement

- eSignature Kansas Construction Emergency Contact Form Easy

- How Do I eSignature Iowa Construction Memorandum Of Understanding

- How To eSignature Iowa Construction Memorandum Of Understanding

- Can I eSignature Kansas Construction Separation Agreement

- Help Me With eSignature Iowa Construction Memorandum Of Understanding