Nm Update Form

What is the NM Update

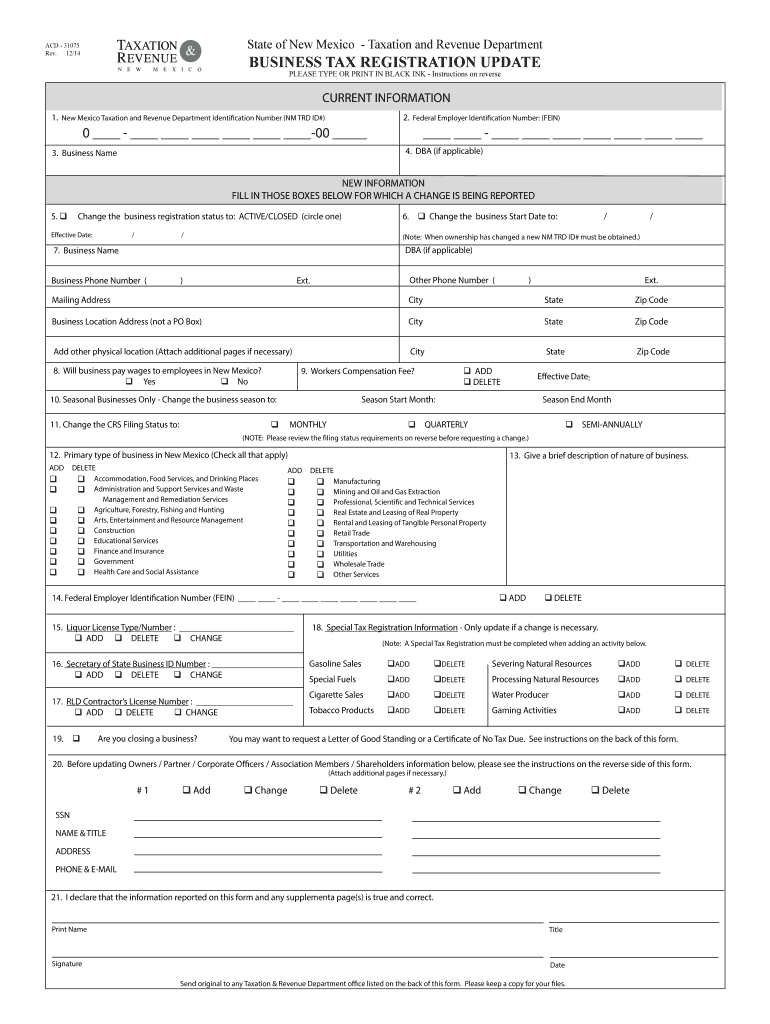

The NM Update, specifically the acd 31075 form, is a crucial document for businesses operating in New Mexico. It serves as a business tax registration update, allowing entities to report changes in their business structure, ownership, or operational status. This form is essential for maintaining compliance with state regulations and ensuring that the New Mexico Taxation and Revenue Department has accurate information regarding your business activities.

Steps to Complete the NM Update

Completing the acd 31075 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your business, including your current business structure, tax identification number, and any relevant changes that need to be reported. Next, fill out the form carefully, ensuring that all fields are completed accurately. After completing the form, review it for any errors or omissions before submitting it to the appropriate state agency.

Legal Use of the NM Update

The acd 31075 form is legally recognized as a valid method for updating business tax information in New Mexico. When completed and submitted correctly, it fulfills the requirements set forth by state law for businesses to keep their registration information current. This legal standing is bolstered by compliance with electronic signature regulations, ensuring that the form can be submitted online securely.

Required Documents

To complete the acd 31075 form, you may need to provide supporting documentation. This can include proof of your business's current tax status, identification numbers, and any legal documents that reflect changes in ownership or structure. Having these documents ready will facilitate a smoother completion process and help ensure that your updates are processed without delay.

Form Submission Methods

The acd 31075 form can be submitted through various methods to accommodate different preferences. Businesses can choose to file the form online through the New Mexico Taxpayer Access Point, which provides a convenient and efficient way to manage tax-related documents. Alternatively, the form can be mailed to the appropriate state office or submitted in person, depending on your business's needs and preferences.

Penalties for Non-Compliance

Failure to submit the acd 31075 form or to keep your business registration information up to date can result in penalties. These may include fines or additional scrutiny from state tax authorities. It is crucial for businesses to understand the importance of timely updates to avoid any legal repercussions and maintain good standing with the state.

Quick guide on how to complete acd 31075 business tax registration update new mexicogov

Manage Nm Update seamlessly on any device

Digital document administration has become increasingly favored by enterprises and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed paperwork, as you can easily find the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and eSign your documents promptly without delays. Handle Nm Update on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Nm Update effortlessly

- Find Nm Update and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Select how you'd like to send your form, via email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Alter and eSign Nm Update and ensure seamless communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the acd 31075 business tax registration update new mexicogov

How to make an electronic signature for your Acd 31075 Business Tax Registration Update New Mexicogov online

How to make an electronic signature for your Acd 31075 Business Tax Registration Update New Mexicogov in Chrome

How to create an electronic signature for signing the Acd 31075 Business Tax Registration Update New Mexicogov in Gmail

How to make an eSignature for the Acd 31075 Business Tax Registration Update New Mexicogov right from your mobile device

How to make an electronic signature for the Acd 31075 Business Tax Registration Update New Mexicogov on iOS

How to generate an electronic signature for the Acd 31075 Business Tax Registration Update New Mexicogov on Android

People also ask

-

What is the New Mexico form 31075?

The New Mexico form 31075 is a crucial document used for specific tax filing purposes in the state. Understanding its structure and requirements is vital for compliance and avoiding penalties. With airSlate SignNow, you can easily eSign and submit this form, streamlining your filing process.

-

How much does it cost to eSign New Mexico form 31075 using airSlate SignNow?

airSlate SignNow offers a range of pricing plans to accommodate various business needs. Whether you are a small business or a large enterprise, you can find a cost-effective solution that suits your budget for eSigning the New Mexico form 31075. The pricing is transparent and easy to understand, ensuring you get the best value.

-

What features does airSlate SignNow offer for handling New Mexico form 31075?

airSlate SignNow provides a suite of features specifically designed for document management and eSigning. For the New Mexico form 31075, you can utilize customizable templates, in-app editing, and secure sharing options. These features enhance efficiency and ensure compliance with state requirements.

-

How can airSlate SignNow benefit my business when processing New Mexico form 31075?

Using airSlate SignNow for the New Mexico form 31075 can signNowly streamline your document workflow. It reduces the time spent on manual signatures and paperwork, allowing your team to focus on more critical tasks. The efficiency gained can lead to greater productivity and reduced operational costs.

-

Can I integrate airSlate SignNow with other software for managing New Mexico form 31075?

Yes, airSlate SignNow seamlessly integrates with various software and applications, enhancing your capacity to manage the New Mexico form 31075. Whether you use CRMs, project management tools, or cloud storage solutions, you can connect these systems to improve your overall workflow. Integration ensures you have all necessary resources at your fingertips.

-

Is it secure to eSign the New Mexico form 31075 with airSlate SignNow?

Absolutely, airSlate SignNow prioritizes security in all transactions and document handling, including the New Mexico form 31075. With advanced encryption and compliance with industry standards, you can trust that your documents are safe, preserving confidentiality and integrity throughout the eSigning process.

-

How do I get started with eSigning New Mexico form 31075 on airSlate SignNow?

Getting started with airSlate SignNow for the New Mexico form 31075 is simple. Sign up for an account, upload your document, and customize it as necessary. Once you're ready, you can easily send it for eSigning, making the process efficient and straightforward.

Get more for Nm Update

- Coordination of benefits form city of colorado springs

- Declaration certification of finances dcf uic form

- Big white waiver form

- Proof of loss form 43578482

- Infraction deferral agreement pdf file clark county prosecuting clarkprosecutor form

- Ameren bill pdf form

- Ace yacht app under 5 mil form

- Promise of sale agreement template form

Find out other Nm Update

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple