Form 3602 G

What is the Form 3602 G

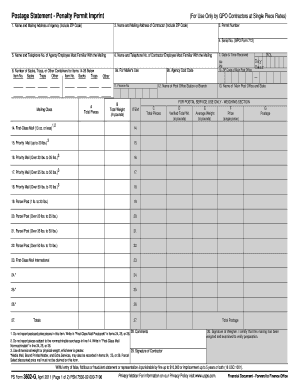

The Form 3602 G is a specific tax form used by certain businesses and individuals in the United States to report income and expenses. It is primarily utilized by self-employed individuals or small business owners to document their earnings and calculate their tax obligations. This form is essential for ensuring compliance with federal tax regulations and helps taxpayers accurately report their financial activities.

How to use the Form 3602 G

Using the Form 3602 G involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and expense receipts. Next, fill out the form by entering your income and expenses in the designated sections. Be sure to follow the instructions carefully to avoid errors. Once completed, review the form for accuracy before submitting it to the IRS. Utilizing electronic tools can simplify this process, allowing for easy eSigning and secure submission.

Steps to complete the Form 3602 G

Completing the Form 3602 G requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including income and expense records.

- Fill in your personal information at the top of the form.

- Report your total income in the appropriate section.

- List all allowable business expenses, ensuring you have supporting documentation.

- Calculate your net income by subtracting expenses from income.

- Review the form for any errors or omissions.

- Sign and date the form before submission.

Legal use of the Form 3602 G

The legal use of the Form 3602 G is critical for compliance with IRS regulations. To be considered valid, the form must be completed accurately and submitted by the appropriate deadlines. Electronic signatures are legally binding, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act. Using a reputable eSignature platform ensures that the form meets legal standards, protecting both the signer and the recipient.

Key elements of the Form 3602 G

Several key elements are crucial to the Form 3602 G. These include:

- Personal Information: This section requires the taxpayer's name, address, and identification number.

- Income Reporting: Accurate reporting of all income sources is essential for tax calculations.

- Expense Documentation: Taxpayers must provide detailed records of all business-related expenses.

- Signature: A valid signature is required to certify the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3602 G are crucial for taxpayers to avoid penalties. Generally, the form must be submitted by April fifteenth of the tax year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time to file without incurring penalties.

Quick guide on how to complete form 3602 g

Complete [SKS] with ease on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-conscious alternative to traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without hindrances. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Use the tools we offer to finalize your document.

- Mark important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 3602 G

Create this form in 5 minutes!

How to create an eSignature for the form 3602 g

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 3602 G?

The Form 3602 G is a crucial tax document used by businesses to report certain income and expenses. Understanding how to accurately fill out this form is essential for legal compliance and maximizing your deductions. Using airSlate SignNow, you can easily prepare and eSign your Form 3602 G securely and efficiently.

-

How does airSlate SignNow simplify the signing process for Form 3602 G?

airSlate SignNow offers a user-friendly interface that makes it simple to complete and eSign your Form 3602 G. The platform allows you to upload your document, invite others to sign, and track the signing process in real-time, ensuring that your tax filings are submitted promptly.

-

Is there a cost associated with using airSlate SignNow for Form 3602 G?

Yes, airSlate SignNow operates on a subscription model, offering various pricing plans depending on your business needs. This makes it a cost-effective solution for both small businesses and larger enterprises looking to manage multiple Form 3602 G submissions efficiently.

-

What features does airSlate SignNow provide for handling Form 3602 G?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage to enhance your experience with Form 3602 G. These tools help streamline document management and ensure compliance with legal requirements while saving time and reducing errors.

-

Can I integrate airSlate SignNow with other tools for my Form 3602 G submissions?

Absolutely! airSlate SignNow supports integration with various popular applications and systems, allowing you to connect your workflows for Form 3602 G seamlessly. This integration capability ensures that all your data stays synchronized and organized across platforms, improving your overall efficiency.

-

What are the benefits of using airSlate SignNow for Form 3602 G?

Using airSlate SignNow for your Form 3602 G submissions provides numerous benefits, including enhanced security, ease of access, and reduced turnaround time. With its reliable technology, you can focus more on your business operations and less on administrative tasks, ultimately fostering growth.

-

Is it easy to collaborate with others on Form 3602 G using airSlate SignNow?

Yes, collaboration is a key feature of airSlate SignNow. You can easily invite team members, accountants, or clients to review and sign the Form 3602 G, making it a highly collaborative tool for ensuring that everyone gets involved in the document workflow.

Get more for Form 3602 G

Find out other Form 3602 G

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization