Bonus Form D Format in Excel

What is the Bonus Form D Format in Excel

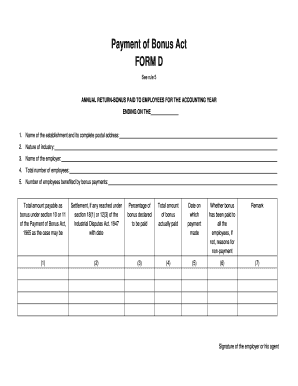

The Bonus Form D format in Excel is a structured template used by businesses to record and manage bonus payments to employees. This form ensures compliance with the Bonus Act, which mandates the payment of bonuses to eligible employees based on their earnings. The Excel format allows for easy data entry, calculations, and organization of information related to bonus payments. Key components typically include employee details, bonus amounts, and the calculation of total bonuses payable.

Steps to Complete the Bonus Form D Format in Excel

Completing the Bonus Form D in Excel involves several straightforward steps:

- Download the Template: Obtain the Bonus Form D template in Excel format from a reliable source.

- Enter Employee Information: Fill in the necessary details for each employee, including their name, identification number, and department.

- Input Earnings Data: Enter the earnings data for each employee, which will be used to calculate the bonus.

- Calculate Bonuses: Use formulas to calculate the bonus amounts based on the specified criteria outlined in the Bonus Act.

- Review and Verify: Double-check all entries for accuracy to ensure compliance with legal requirements.

- Save and Submit: Save the completed form and submit it to the appropriate department or authority as required.

Legal Use of the Bonus Form D Format in Excel

The Bonus Form D format in Excel is legally recognized for documenting bonus payments in accordance with the Bonus Act. It is essential for employers to use this form to maintain transparency and compliance with labor laws. Proper use of this form helps avoid penalties associated with non-compliance and ensures that employees receive their entitled bonuses based on the stipulated guidelines.

Key Elements of the Bonus Form D Format in Excel

Several key elements should be included in the Bonus Form D format to ensure it meets legal and operational requirements:

- Employee Details: Name, identification number, and department of each employee.

- Earnings Information: Total earnings for the period, which is crucial for calculating the bonus.

- Bonus Calculation: Clear formulas that determine the bonus amount based on earnings and applicable rates.

- Approval Signatures: Space for authorized personnel to sign off on the bonus distribution.

How to Obtain the Bonus Form D Format in Excel

The Bonus Form D format in Excel can be obtained through various means. Many organizations provide downloadable templates on their websites, ensuring they comply with the latest regulations. Additionally, businesses can create their own version using Excel by incorporating the required elements and calculations as per the Bonus Act guidelines. It is advisable to consult with a legal or HR professional to ensure the form meets all necessary compliance standards.

Examples of Using the Bonus Form D Format in Excel

Using the Bonus Form D format in Excel can vary based on the specific needs of a business. For example:

- A small business may use the form to calculate annual bonuses for its employees based on performance metrics.

- A larger corporation might implement the form to manage bonuses across multiple departments, ensuring consistent calculations and compliance.

- Non-profit organizations can also utilize this format to reward employees or volunteers based on contributions and achievements.

Quick guide on how to complete bonus form d format in excel

Effortlessly Prepare Bonus Form D Format In Excel on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a great eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly and without any delays. Handle Bonus Form D Format In Excel on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Modify and eSign Bonus Form D Format In Excel with Ease

- Find Bonus Form D Format In Excel and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight relevant sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to submit your form, via email, SMS, an invitation link, or download it to your computer.

No more lost or misplaced files, tedious searches for forms, or errors requiring new document prints. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Bonus Form D Format In Excel to ensure clear communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bonus form d format in excel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form D for bonus and how does it work with airSlate SignNow?

Form D for bonus is a document used to report certain types of securities offerings. With airSlate SignNow, you can easily create, send, and eSign your Form D for bonus, making compliance and documentation more efficient. The platform streamlines the entire process, ensuring that your documents are securely signed and stored.

-

How much does it cost to use airSlate SignNow for Form D for bonus?

airSlate SignNow offers competitive pricing plans that cater to various business needs. Whether you're an individual or a large enterprise, you'll find an affordable plan that allows you to manage your Form D for bonus efficiently. Visit our pricing page for detailed options and choose the plan that fits your budget.

-

What are the main features of airSlate SignNow for managing Form D for bonus?

airSlate SignNow provides a range of features designed to optimize the handling of Form D for bonus. Key features include customizable templates, real-time tracking, secure cloud storage, and advanced security protocols. These functions help ensure that your documents are processed accurately and swiftly.

-

Can I integrate airSlate SignNow with other tools for handling Form D for bonus?

Yes, airSlate SignNow offers seamless integrations with popular tools and platforms, enhancing your experience in managing Form D for bonus. Connect with CRM systems, cloud storage solutions, and productivity apps to streamline your workflow and improve document efficiency. Explore our integration options to see what works best for your needs.

-

Is it safe to use airSlate SignNow for sensitive documents like Form D for bonus?

Absolutely! airSlate SignNow employs industry-leading security measures to protect your sensitive documents, including Form D for bonus. With end-to-end encryption, secure cloud storage, and compliance with data protection regulations, you can trust that your information is safe and confidential.

-

How long does it take to process Form D for bonus with airSlate SignNow?

The processing time for Form D for bonus using airSlate SignNow is signNowly reduced compared to traditional methods. The platform enables quick sending, signing, and tracking, allowing you to complete your processes in just minutes. This efficiency can save you valuable time in your business operations.

-

Can I track the status of my Form D for bonus with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking of your Form D for bonus documents. You can easily monitor who has viewed or signed the document, ensuring you're always informed of its status. This feature adds an extra layer of transparency and accountability to your document management.

Get more for Bonus Form D Format In Excel

Find out other Bonus Form D Format In Excel

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template