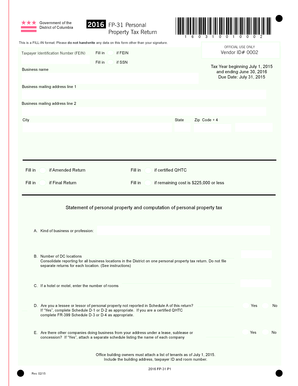

Print Clear Government of the District of Columbia FP31 Personal Property Tax Return *160310010002* This is a FILLIN Format Cfsa 2016-2026

Understanding the DC FP 31 Personal Property Tax Return

The DC FP 31 Personal Property Tax Return is a crucial document for individuals and businesses in the District of Columbia. This form is used to report personal property owned as of January first of the tax year. It is essential for determining the tax liability based on the value of personal property, which may include equipment, furniture, and other tangible assets. The form must be completed accurately to ensure compliance with local tax regulations.

Steps to Complete the DC FP 31 Personal Property Tax Return

Filling out the DC FP 31 form involves several key steps:

- Gather necessary information about your personal property, including descriptions and values.

- Obtain the latest version of the DC FP 31 form, which can be found in a fillable PDF format.

- Complete the form by entering the required details accurately, ensuring all property is accounted for.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the designated deadline to avoid penalties.

Required Documents for the DC FP 31 Personal Property Tax Return

To complete the DC FP 31, you will need several documents:

- Proof of ownership for all personal property being reported.

- Previous year’s tax return, if applicable, to reference past valuations.

- Any relevant financial statements that may assist in determining the value of the property.

Filing Deadlines for the DC FP 31 Personal Property Tax Return

It is important to be aware of the filing deadlines for the DC FP 31. Typically, the return must be filed annually by March fifteen. Late submissions can result in penalties and interest on unpaid taxes. Staying informed about these deadlines helps ensure compliance and avoids unnecessary fees.

Submission Methods for the DC FP 31 Personal Property Tax Return

The DC FP 31 form can be submitted in various ways:

- Online submission through the District of Columbia's Office of Tax and Revenue portal.

- Mailing a printed copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices for immediate processing.

Penalties for Non-Compliance with the DC FP 31 Personal Property Tax Return

Failure to file the DC FP 31 form on time or inaccuracies in the submission can lead to significant penalties. These may include:

- Late fees based on the amount of tax owed.

- Interest charges accruing on unpaid taxes.

- Potential legal action for persistent non-compliance.

Quick guide on how to complete print clear government of the district of columbia fp31 personal property tax return 160310010002 this is a fillin format cfsa

Complete Print Clear Government Of The District Of Columbia FP31 Personal Property Tax Return *160310010002* This Is A FILLIN Format Cfsa effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the appropriate form and securely archive it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents promptly without delays. Manage Print Clear Government Of The District Of Columbia FP31 Personal Property Tax Return *160310010002* This Is A FILLIN Format Cfsa on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Print Clear Government Of The District Of Columbia FP31 Personal Property Tax Return *160310010002* This Is A FILLIN Format Cfsa with ease

- Locate Print Clear Government Of The District Of Columbia FP31 Personal Property Tax Return *160310010002* This Is A FILLIN Format Cfsa and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to share your form, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign Print Clear Government Of The District Of Columbia FP31 Personal Property Tax Return *160310010002* This Is A FILLIN Format Cfsa and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct print clear government of the district of columbia fp31 personal property tax return 160310010002 this is a fillin format cfsa

Create this form in 5 minutes!

How to create an eSignature for the print clear government of the district of columbia fp31 personal property tax return 160310010002 this is a fillin format cfsa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dc fp 31 personal property tax return and why is it important?

The dc fp 31 personal property tax return is a mandatory document for individuals and businesses in Washington, DC, requiring them to report personal property for tax purposes. Accurately completing this return is crucial to ensure compliance with local laws and to avoid penalties. airSlate SignNow offers a straightforward solution to eSign and submit this return efficiently.

-

How does airSlate SignNow streamline the completion of the dc fp 31 personal property tax return?

airSlate SignNow simplifies the process of completing the dc fp 31 personal property tax return by providing intuitive document templates that are easy to customize. Users can fill out necessary information quickly and even collaborate with others in real-time. This feature ensures that your tax return is accurate and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the dc fp 31 personal property tax return?

Yes, airSlate SignNow offers competitive pricing plans tailored to businesses of all sizes. The service is designed to be cost-effective, providing great value for users needing to eSign and submit the dc fp 31 personal property tax return. A free trial is often available for new users to explore features before committing.

-

Can I store my dc fp 31 personal property tax return in airSlate SignNow?

Absolutely! With airSlate SignNow, you can securely store your dc fp 31 personal property tax return and other important documents in the cloud. This feature allows for easy retrieval and management of your returns anytime, anywhere, ensuring that you have access to your documents when needed.

-

What integrations does airSlate SignNow offer for handling the dc fp 31 personal property tax return?

airSlate SignNow seamlessly integrates with various platforms, including Google Drive, Dropbox, and Microsoft Office. This allows users to easily import, edit, and eSign their dc fp 31 personal property tax return alongside their other business documents. These integrations enhance workflow efficiency and document management.

-

How secure is my data when using airSlate SignNow for the dc fp 31 personal property tax return?

Security is a top priority for airSlate SignNow, which employs encryption and compliance standards to protect your data. When preparing your dc fp 31 personal property tax return, you can trust that your information is safe and secure from unauthorized access. Regular security audits further ensure the integrity of your data.

-

Can I get support while filling out the dc fp 31 personal property tax return using airSlate SignNow?

Yes, airSlate SignNow provides comprehensive support options, including live chat, email assistance, and an extensive Help Center. Whether you're new to eSigning or need expert guidance on the dc fp 31 personal property tax return, the support team is ready to help you navigate through the process.

Get more for Print Clear Government Of The District Of Columbia FP31 Personal Property Tax Return *160310010002* This Is A FILLIN Format Cfsa

- Chelsea gerbitz form

- Metlife insurance company of connecticut annuity service request form

- Statutory declaration of common law union single signature sc isp 3104e servicecanada gc form

- 4073200329 form

- Crew trainers name form

- Fitting instructions for a50 and a80 bicycle engine kits form

- El camino nursing application form

- Tc 94 192 615439852 form

Find out other Print Clear Government Of The District Of Columbia FP31 Personal Property Tax Return *160310010002* This Is A FILLIN Format Cfsa

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF