Dc Form Fp 31 2013

What is the DC Form FP 31?

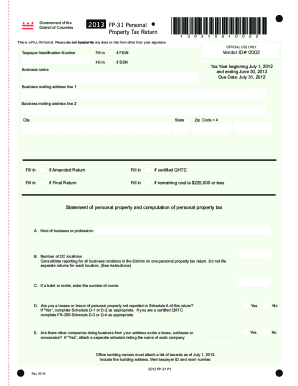

The DC Form FP 31, also known as the DC Personal Property Tax Return, is a crucial document for individuals and businesses in Washington, D.C. This form is used to report personal property owned as of January first of each year. It is essential for ensuring that property is accurately assessed for tax purposes. This includes items such as machinery, equipment, and furniture. The information provided on the FP 31 is used by the Office of Tax and Revenue to determine the taxable value of personal property, which ultimately affects the amount of property tax owed.

Steps to Complete the DC Form FP 31

Completing the DC Form FP 31 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation regarding your personal property, including purchase invoices and previous tax returns. Next, accurately fill out the form by listing all personal property owned, along with its corresponding value. It is important to provide detailed descriptions to avoid discrepancies. After completing the form, review it for any errors before submission. Finally, submit the form by the specified deadline to avoid penalties.

How to Obtain the DC Form FP 31

The DC Form FP 31 can be obtained through the Office of Tax and Revenue's official website or by visiting their office in person. The form is available in both digital and printable formats, making it accessible for all users. If you prefer a physical copy, you can request one directly from the office. It is advisable to ensure you have the most current version of the form to comply with any updates or changes in tax regulations.

Legal Use of the DC Form FP 31

The legal use of the DC Form FP 31 is governed by local tax laws and regulations. When properly completed and submitted, the form serves as a declaration of personal property for tax assessment purposes. It is crucial to adhere to all legal requirements, including accurate reporting and timely submission, to avoid penalties. The information provided on the form is subject to verification by tax authorities, and any discrepancies may lead to legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for the DC Form FP 31 are typically set for April fifteen of each year. It is important to be aware of these dates to ensure timely submission and avoid late fees. Additionally, if you are unable to meet the deadline, you may be eligible to request an extension. However, it is essential to check with the Office of Tax and Revenue for specific guidelines regarding extensions and any associated requirements.

Required Documents

When completing the DC Form FP 31, certain documents are required to substantiate the information provided. These may include purchase invoices, previous tax returns, and any other documentation that supports the valuation of personal property. Keeping accurate records is essential, as this documentation may be requested by tax authorities during the review process. Ensuring all required documents are readily available can streamline the completion of the form and facilitate a smoother filing experience.

Quick guide on how to complete dc form fp 31

Complete Dc Form Fp 31 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without interruptions. Manage Dc Form Fp 31 on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Dc Form Fp 31 with ease

- Locate Dc Form Fp 31 and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a manual ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Choose how you want to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Dc Form Fp 31 to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dc form fp 31

Create this form in 5 minutes!

How to create an eSignature for the dc form fp 31

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FP 31 form and why is it important?

The FP 31 form is a crucial document used for various business processes, including compliance and official documentation. Understanding its requirements ensures that your business meets necessary regulations, which can help avoid legal issues and streamline operations.

-

How can airSlate SignNow help me manage FP 31 forms?

airSlate SignNow provides an easy-to-use platform for electronically signing and managing FP 31 forms. Our solution allows you to send, sign, and securely store these documents, ensuring efficiency and compliance in your processes.

-

Is airSlate SignNow a cost-effective solution for handling FP 31 forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. By minimizing paper usage and enabling efficient eSignature workflows, you can save time and money while managing your FP 31 forms.

-

What features does airSlate SignNow offer for FP 31 forms?

airSlate SignNow offers features such as customizable templates, automatic reminders, and mobile access which facilitate the management of FP 31 forms. These tools streamline the process, reducing manual errors and increasing productivity.

-

Can I integrate airSlate SignNow with other software for FP 31 form management?

Absolutely! airSlate SignNow seamlessly integrates with a variety of applications, making it easier to manage FP 31 forms alongside your existing software. This integration enhances workflow efficiency and allows for better data synchronization.

-

What benefits can I expect when using airSlate SignNow for FP 31 forms?

Using airSlate SignNow for FP 31 forms brings many benefits, including faster turnaround times, reduced paperwork, and improved document accuracy. These advantages help optimize your workflow and enhance overall operational efficiency.

-

Is airSlate SignNow secure for handling sensitive FP 31 forms?

Yes, airSlate SignNow prioritizes security with features such as encryption and secure access to ensure that your FP 31 forms remain confidential. You can have peace of mind knowing that your important documents are protected.

Get more for Dc Form Fp 31

- Biosolids annual report form

- Point source application department of environmental quality deq state or form

- Sgt vernon walker acc form

- Fictitious firm name clark county nevada clarkcountynv form

- Received flu shot fillable form

- A 0361 a0 2013 form

- Disability extension form

- On builders letterhead us this form to certify the residence and heirs of a deceased nsli policyholder or beneficiary benefits

Find out other Dc Form Fp 31

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document