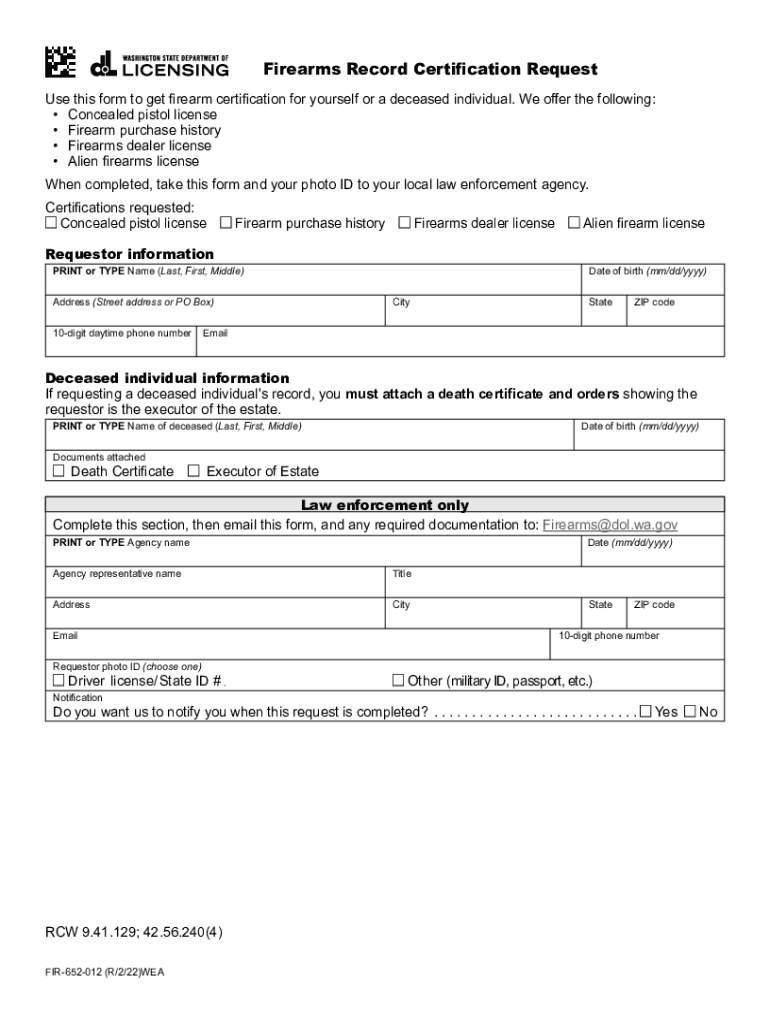

Firearms Record Certification Request Request Firearm Certification for Yourself or a Deceased Individual Form

Understanding FATCA Registration

The Foreign Account Tax Compliance Act (FATCA) requires foreign financial institutions to report information about financial accounts held by U.S. taxpayers. FATCA registration is essential for compliance, enabling institutions to avoid penalties and maintain good standing with the IRS. This process involves submitting specific forms and providing detailed information about account holders.

Steps for Completing FATCA Registration

Completing FATCA registration involves several key steps:

- Determine if your institution meets the criteria for FATCA registration.

- Gather necessary documentation, including taxpayer identification numbers and account information.

- Access the IRS FATCA registration portal to create an account.

- Fill out the required forms accurately, ensuring all information is complete.

- Submit the registration and keep track of your submission status.

Required Documents for FATCA Registration

When registering for FATCA, institutions must prepare various documents, including:

- Proof of the institution's legal status.

- Taxpayer identification numbers for all U.S. account holders.

- Details of financial accounts held by U.S. taxpayers.

- Any relevant agreements or certifications.

Filing Deadlines for FATCA Registration

It is crucial to be aware of the filing deadlines associated with FATCA registration. Institutions must register by specific dates to ensure compliance and avoid penalties. Generally, the registration should be completed before the end of the calendar year to align with annual reporting requirements.

Legal Implications of FATCA Registration

FATCA registration carries significant legal implications. Failure to comply can result in substantial penalties, including withholding taxes on U.S.-source income. Institutions must understand their obligations under FATCA to mitigate risks and ensure they meet all regulatory requirements.

IRS Guidelines for FATCA Compliance

The IRS provides comprehensive guidelines for FATCA compliance. These guidelines outline the responsibilities of foreign financial institutions, including reporting requirements and the consequences of non-compliance. Institutions should regularly review these guidelines to stay informed about any changes or updates.

Eligibility Criteria for FATCA Registration

To be eligible for FATCA registration, institutions must meet specific criteria, including being a foreign financial institution or a non-financial foreign entity. It is essential to assess eligibility carefully to ensure compliance with FATCA regulations and avoid potential penalties.

Quick guide on how to complete firearms record certification request request firearm certification for yourself or a deceased individual

Effortlessly Prepare Firearms Record Certification Request Request Firearm Certification For Yourself Or A Deceased Individual on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly and seamlessly. Handle Firearms Record Certification Request Request Firearm Certification For Yourself Or A Deceased Individual on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Edit and Electronically Sign Firearms Record Certification Request Request Firearm Certification For Yourself Or A Deceased Individual with Ease

- Locate Firearms Record Certification Request Request Firearm Certification For Yourself Or A Deceased Individual and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to store your changes.

- Choose your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow manages all your document needs in a few clicks from any device you prefer. Modify and electronically sign Firearms Record Certification Request Request Firearm Certification For Yourself Or A Deceased Individual and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the firearms record certification request request firearm certification for yourself or a deceased individual

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FATCA registration and why is it important?

FATCA registration is a process that financial institutions must undergo to comply with the Foreign Account Tax Compliance Act. It is crucial as it helps ensure tax compliance for U.S. taxpayers holding accounts outside the United States, thereby avoiding hefty penalties and ensuring smooth operations.

-

How can airSlate SignNow assist with FATCA registration?

airSlate SignNow provides a streamlined platform that simplifies document management required for FATCA registration. With our solution, users can securely send, sign, and store the necessary paperwork, reducing errors and saving time.

-

What are the costs associated with FATCA registration using airSlate SignNow?

The costs for FATCA registration using airSlate SignNow are competitive and designed to fit various business needs. Our pricing plans are transparent, allowing businesses to choose the options that best align with their document management requirements.

-

What features of airSlate SignNow facilitate FATCA registration?

airSlate SignNow features advanced eSignature capabilities, document templates, and cloud storage, which are instrumental for FATCA registration. These features streamline the process, ensuring that documents are completed, signed, and stored efficiently.

-

Are there integration options for airSlate SignNow relevant to FATCA registration?

Yes, airSlate SignNow offers integration with a variety of software solutions, enhancing the FATCA registration process. This allows users to seamlessly connect with existing systems, improving workflow and making document management more efficient.

-

How does airSlate SignNow ensure security during the FATCA registration process?

Security is a top priority at airSlate SignNow, especially during FATCA registration. Our platform employs advanced encryption protocols and complies with international security standards, ensuring that all sensitive documents remain secure.

-

Can airSlate SignNow help with compliance issues related to FATCA registration?

Absolutely, airSlate SignNow is designed to help users navigate compliance issues associated with FATCA registration. Our platform provides templates and guidance to ensure that all documentation meets regulatory requirements.

Get more for Firearms Record Certification Request Request Firearm Certification For Yourself Or A Deceased Individual

- World food safety guidelines for airline catering form

- Id 622d9268715d7fcdddfa2c3786d2b461512dfcd5 form

- Mercy care prior auth form pdf

- School bus drivers daily pre trip inspection form

- Zs ad pdf form

- Change of county request form

- Right to agreement template form

- Educational consultant contract template form

Find out other Firearms Record Certification Request Request Firearm Certification For Yourself Or A Deceased Individual

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe