URA CONV W Freddie US Bank Form

What is the URA CONV W Freddie US Bank

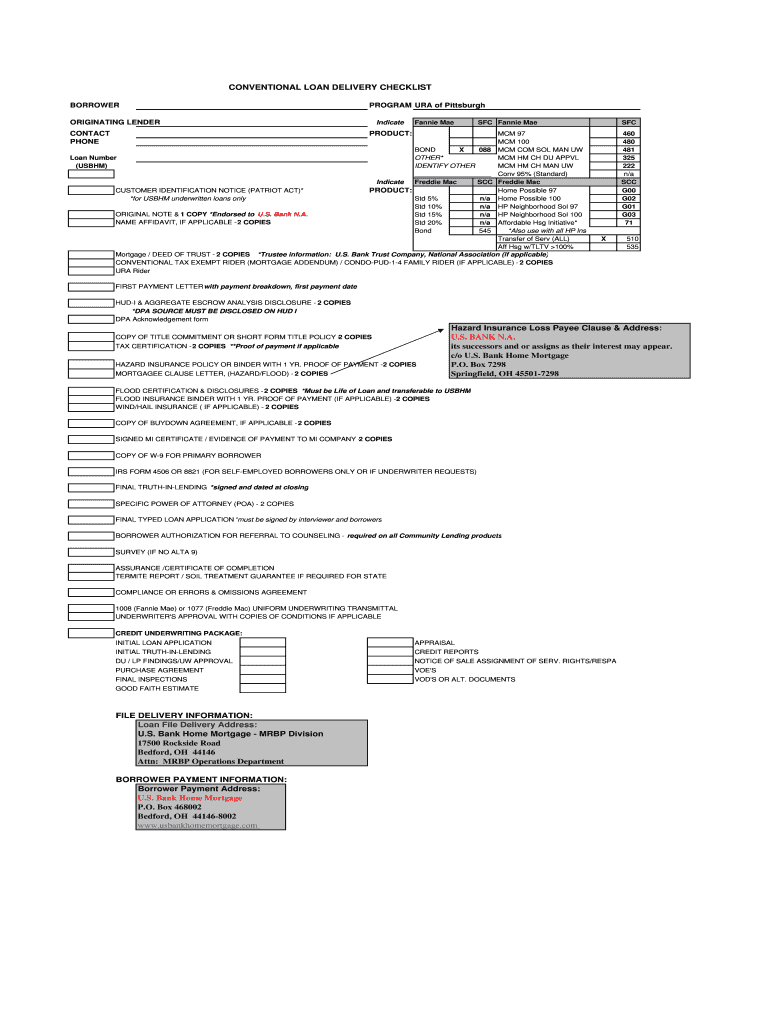

The URA CONV W Freddie US Bank is a specific form used in the context of mortgage financing and real estate transactions. This form is primarily associated with the conversion of loans backed by Freddie Mac, a government-sponsored enterprise that provides liquidity in the housing market. The URA CONV W Freddie US Bank facilitates the process of converting a conventional loan into a more manageable structure, allowing borrowers to benefit from lower interest rates or different repayment terms. It is essential for homeowners looking to refinance or modify their existing mortgage agreements.

How to use the URA CONV W Freddie US Bank

Using the URA CONV W Freddie US Bank involves several straightforward steps. First, borrowers should gather all necessary financial documents, including income statements, tax returns, and current mortgage details. Next, they should fill out the form accurately, ensuring that all information matches the supporting documents. After completing the form, it should be submitted to the appropriate bank representative or through the designated online portal. It is important to keep copies of all submitted documents for personal records and future reference.

Steps to complete the URA CONV W Freddie US Bank

Completing the URA CONV W Freddie US Bank requires careful attention to detail. Here are the essential steps:

- Collect necessary documents: Gather your income verification, tax returns, and current mortgage information.

- Fill out the form: Enter all required information, ensuring accuracy and consistency with your documents.

- Review the form: Double-check for any errors or missing information before submission.

- Submit the form: Send the completed form to your lender or submit it via the online platform, if available.

- Follow up: Confirm receipt with your lender and inquire about the processing timeline.

Eligibility Criteria

Eligibility for using the URA CONV W Freddie US Bank typically includes several key factors. Borrowers must have an existing mortgage that is eligible for conversion under Freddie Mac guidelines. Additionally, they should demonstrate a stable income and a satisfactory credit history. It is also important that the property in question meets specific criteria set forth by Freddie Mac, including being owner-occupied and not exceeding certain loan limits. Understanding these criteria can help borrowers determine if they qualify for the conversion process.

Required Documents

To successfully complete the URA CONV W Freddie US Bank, borrowers need to prepare a set of required documents. These commonly include:

- Proof of income, such as pay stubs or tax returns.

- Current mortgage statement detailing the existing loan terms.

- Credit report to assess creditworthiness.

- Property appraisal report, if applicable.

Having these documents ready can streamline the application process and improve the chances of a successful conversion.

Legal use of the URA CONV W Freddie US Bank

The URA CONV W Freddie US Bank is designed to comply with federal regulations and guidelines set forth by Freddie Mac. It is legally binding once signed and submitted, meaning that borrowers must ensure all provided information is truthful and accurate. Misrepresentation or fraud can lead to serious legal consequences, including penalties or loan denial. Therefore, it is crucial for users to understand the legal implications of this form and to complete it with integrity.

Quick guide on how to complete ura conv w freddie us bank

Complete [SKS] seamlessly on any device

Online document administration has gained traction among companies and individuals. It serves as a flawless eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly and without holdups. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest method to modify and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow delivers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional hand-written signature.

- Verify all details and click on the Done button to retain your adjustments.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

No more worrying about lost or misplaced files, bothersome document searching, or errors that require reprinting new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to URA CONV W Freddie US Bank

Create this form in 5 minutes!

How to create an eSignature for the ura conv w freddie us bank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is URA CONV W Freddie US Bank?

URA CONV W Freddie US Bank refers to a unique financing option under the Freddie Mac guidelines that provides borrowers with competitive rates and flexible terms. This program offers distinctly structured loans for buyers looking to purchase homes efficiently, making homeownership more accessible.

-

How can airSlate SignNow facilitate the URA CONV W Freddie US Bank process?

airSlate SignNow streamlines the eSigning of necessary documents for the URA CONV W Freddie US Bank program. Our platform simplifies the workflow, allowing users to send, sign, and manage documents securely and efficiently from anywhere, making the entire process faster and more user-friendly.

-

What are the pricing options for using airSlate SignNow with URA CONV W Freddie US Bank?

Our pricing model for airSlate SignNow is competitive and designed to provide value based on your usage. We offer various plans to accommodate different user needs, ensuring that whether you are a small business or a larger enterprise, you can manage documentation for URA CONV W Freddie US Bank affordably.

-

What features does airSlate SignNow offer for URA CONV W Freddie US Bank transactions?

AirSlate SignNow provides a range of features essential for URA CONV W Freddie US Bank transactions, including customizable templates, real-time tracking, and secure cloud storage. These features enhance efficiency and ensure compliance with lending standards, making your documentation process smoother.

-

Are there any integrations available for airSlate SignNow to support the URA CONV W Freddie US Bank process?

Yes, airSlate SignNow offers multiple integrations with popular platforms and services that can complement your URA CONV W Freddie US Bank transactions. Whether it's CRM systems or accounting software, our integrations help centralize your work and enhance productivity.

-

What are the main benefits of using airSlate SignNow with URA CONV W Freddie US Bank?

The primary benefits of using airSlate SignNow alongside URA CONV W Freddie US Bank include enhanced efficiency, reduced turnaround times, and improved document security. With our easy-to-use platform, businesses can enjoy a seamless experience, ensuring all paperwork is handled promptly and safely.

-

Is airSlate SignNow compliant with the requirements for URA CONV W Freddie US Bank?

Absolutely! airSlate SignNow complies with all the necessary requirements for URA CONV W Freddie US Bank transactions, providing users with a legally binding eSignature solution. Our platform meets industry standards to ensure all documents are valid and secure.

Get more for URA CONV W Freddie US Bank

Find out other URA CONV W Freddie US Bank

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word