Fannie Mae MCM & Buy Down 2 Fam 8 24 07 Form

Understanding the Fannie Mae MCM & Buy Down 2 Fam 8 24 07

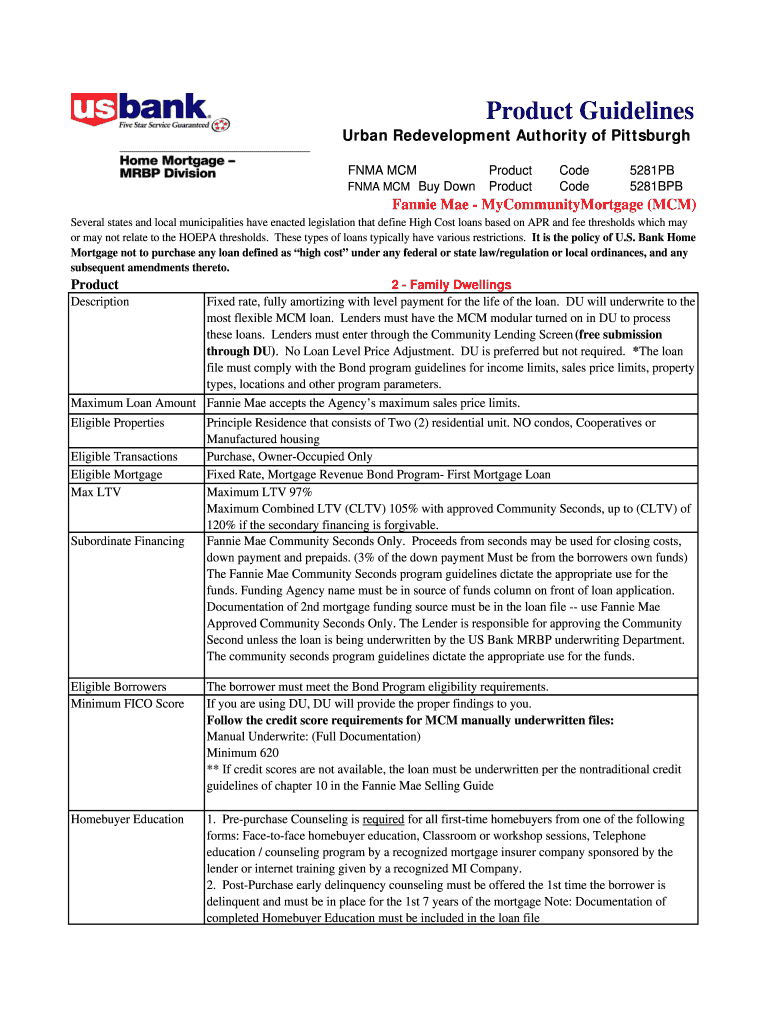

The Fannie Mae MCM & Buy Down 2 Fam 8 24 07 is a specific form related to mortgage financing options. This form is designed to assist borrowers in understanding and utilizing the buy-down feature, which allows for a temporary reduction in interest rates on home loans. The buy-down can be particularly beneficial for those looking to lower their monthly mortgage payments during the initial years of their loan. It is essential for potential homeowners and real estate professionals to familiarize themselves with this form to make informed financial decisions.

Steps to Complete the Fannie Mae MCM & Buy Down 2 Fam 8 24 07

Completing the Fannie Mae MCM & Buy Down 2 Fam 8 24 07 involves several key steps:

- Gather necessary personal and financial information, including income, credit history, and employment details.

- Review the specific terms of the buy-down option, including the duration and the amount of the interest rate reduction.

- Fill out the form accurately, ensuring all information is current and correct.

- Submit the completed form to your lender for processing.

Following these steps will help ensure a smooth application process and facilitate access to the benefits of the buy-down feature.

How to Obtain the Fannie Mae MCM & Buy Down 2 Fam 8 24 07

The Fannie Mae MCM & Buy Down 2 Fam 8 24 07 can typically be obtained through your mortgage lender or financial institution. Many lenders provide this form as part of their mortgage application package. Additionally, it may be available on the official Fannie Mae website or through authorized mortgage brokers. It is advisable to request this form directly from your lender to ensure you receive the most current version and any accompanying instructions.

Legal Use of the Fannie Mae MCM & Buy Down 2 Fam 8 24 07

The Fannie Mae MCM & Buy Down 2 Fam 8 24 07 must be used in compliance with federal and state regulations governing mortgage lending. It is essential to ensure that the information provided on the form is truthful and accurate, as any discrepancies may lead to legal complications or denial of the mortgage application. Borrowers should also be aware of their rights under the Fair Housing Act and other relevant legislation when using this form.

Key Elements of the Fannie Mae MCM & Buy Down 2 Fam 8 24 07

Several key elements are crucial when dealing with the Fannie Mae MCM & Buy Down 2 Fam 8 24 07:

- Interest Rate Reduction: Details on how much the interest rate can be reduced and for how long.

- Payment Structure: Explanation of how the payments will change over time due to the buy-down.

- Eligibility Criteria: Information on who qualifies for the buy-down option and any specific requirements.

- Impact on Loan Amount: How the buy-down feature affects the overall loan amount and terms.

Understanding these elements can help borrowers make informed decisions regarding their mortgage options.

Examples of Using the Fannie Mae MCM & Buy Down 2 Fam 8 24 07

Utilizing the Fannie Mae MCM & Buy Down 2 Fam 8 24 07 can be illustrated through various scenarios:

- A first-time homebuyer looking to reduce initial monthly payments may opt for a buy-down to ease their financial burden during the first few years of ownership.

- An investor purchasing a two-family home might use the buy-down feature to maximize cash flow in the early years while preparing for potential renovations.

- A homeowner refinancing their mortgage may choose to include a buy-down option to lower their payments temporarily, making it easier to manage other financial commitments.

These examples highlight the flexibility and advantages of the buy-down feature when used effectively.

Quick guide on how to complete fannie mae mcm amp buy down 2 fam 8 24 07

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed papers, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to swiftly create, modify, and eSign your documents without delays. Manage [SKS] from any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to alter and eSign [SKS] without stress

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of your documents or obscure sensitive details with the tools offered by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure excellent communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Fannie Mae MCM & Buy Down 2 Fam 8 24 07

Create this form in 5 minutes!

How to create an eSignature for the fannie mae mcm amp buy down 2 fam 8 24 07

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does it mean if Fannie Mae buys your mortgage?

Fannie Mae buys loans from lenders, replenishing the lenders' funds so they can provide new mortgages for more homebuyers. Your mortgage servicer — the company that you send your monthly payments to — and your loan terms remain the same when we purchase your loan.

-

What does it mean if Fannie Mae owns my mortgage?

Fannie Mae buys mortgage loans from lenders to free up your lender's ability to make new loans to homebuyers. Typically, you would continue to make your mortgage payment to the same mortgage servicer.

-

Is it good if Fannie Mae buys my mortgage?

Here's what you need to know Fannie Mae buys loans from lenders, replenishing the lenders' funds so they can provide new mortgages for more homebuyers. Your mortgage servicer — the company that you send your monthly payments to — and your loan terms remain the same when we purchase your loan.

-

Why does Fannie Mae buy mortgages?

By packaging mortgages into MBS and guaranteeing the timely payment of principal and interest on the underlying mortgages, Fannie Mae and Freddie Mac attract to the secondary mortgage market investors who might not otherwise invest in mortgages, thereby expanding the pool of funds available for housing.

-

Can you do a 2:1 buydown on a manufactured home?

2-1 buydown. It allows borrowers to benefit from lower monthly payments during the initial years of their mortgage. This is especially good news for first-time homebuyers and those looking into manufactured home options, offering a more feasible path to owning a home.

-

Why did my mortgage get sold to Fannie Mae?

By selling on these loan to Freddie and Fannie, it frees up capital for the bank , to enable further lending but still enabling your bank to collect its servicing fees. It most cases the loan risk also passes to Freddie or Fannie.

-

What is the down payment on a Fannie Mae loan?

Most mortgage loan options require a down payment of at least 3% of the home price, but some loan types and lenders can even require 5% down or more.

-

What happens to unused buydown funds?

Disposing of Buydown Funds The funds should be credited to the total amount required to pay off the mortgage, or they may be returned to either the borrower or the lender as specified in the buydown agreement.

Get more for Fannie Mae MCM & Buy Down 2 Fam 8 24 07

- Bajaj auto finance noc online form

- Boehringer ingelheim patient assistance form pdf

- Transfer of shotgun form scotland

- St 120 form 28427545

- Smouldering charcoal pdf form

- Police verification form 28515874

- Walmart pharmacy subpoena compliance address form

- How to get registered under sec 34ab of wealth tax act 1957 online form

Find out other Fannie Mae MCM & Buy Down 2 Fam 8 24 07

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself