St 120 Form

What is the St 120 Form

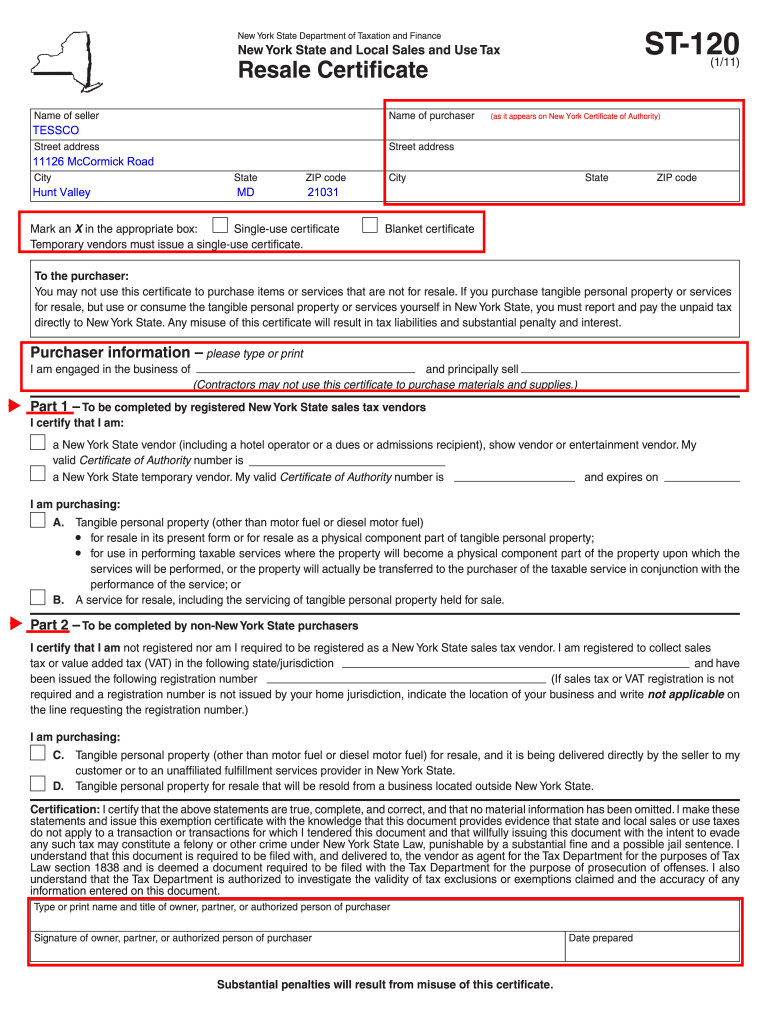

The St 120 form, also known as the New York State Resale Certificate, is a crucial document used by businesses in New York to purchase goods without paying sales tax. This form is typically utilized by retailers and wholesalers who intend to resell the purchased items. By submitting the St 120 form to suppliers, businesses can affirm that the items will not be used for personal consumption but rather for resale, thus exempting them from sales tax at the point of purchase.

How to Use the St 120 Form

Using the St 120 form involves several straightforward steps. First, the buyer must complete the form with accurate details, including the seller's name, address, and the type of goods being purchased. Once filled out, the buyer presents the form to the seller at the time of purchase. It is essential for the seller to retain this form for their records, as it serves as proof that the sale was exempt from sales tax due to resale intentions.

Steps to Complete the St 120 Form

Completing the St 120 form requires careful attention to detail. Here are the steps to follow:

- Provide your business name and address at the top of the form.

- Include the seller's name and address.

- Specify the type of goods being purchased.

- Sign and date the form to certify the information is accurate.

Once completed, present the form to the seller to finalize the transaction without incurring sales tax.

Legal Use of the St 120 Form

The St 120 form is legally binding when used correctly. It must be filled out accurately to avoid any potential legal issues. Misuse of the form, such as using it for personal purchases, can lead to penalties. The form is governed by New York State tax laws, which require that it be used solely for qualifying purchases intended for resale. Businesses should maintain copies of the form for their records to ensure compliance with tax regulations.

Examples of Using the St 120 Form

There are various scenarios in which the St 120 form can be utilized. For instance, a retail store purchasing clothing from a wholesaler would complete the St 120 form to avoid paying sales tax on the items intended for resale. Similarly, a restaurant purchasing bulk food supplies from a distributor can use the form to exempt these purchases from sales tax, provided the food will be sold to customers. Each example underscores the importance of the St 120 form in facilitating tax-exempt transactions for businesses.

Form Submission Methods

The St 120 form can be submitted in several ways, depending on the seller's preferences. Typically, it is presented in person at the point of sale. However, some sellers may accept the form via email or fax. It is crucial to check with the seller regarding their preferred submission method to ensure compliance and proper record-keeping.

Quick guide on how to complete st 120 form 28427545

Effortlessly Complete St 120 Form on Any Gadget

Managing documents online has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing users to obtain the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without any interruptions. Manage St 120 Form on any gadget with the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to Alter and Electronically Sign St 120 Form with Ease

- Obtain St 120 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how to send your form, either via email, SMS, or through an invitation link, or download it onto your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Edit and electronically sign St 120 Form to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 120 form 28427545

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ST-120 form and why is it important?

The ST-120 form is a sales tax exemption certificate that allows qualified buyers to make purchases without paying sales tax. Understanding how to fill out the ST-120 form correctly is crucial for businesses to ensure compliance with state tax regulations, ultimately saving money on applicable taxes.

-

How can airSlate SignNow help me fill out the ST-120 form?

With airSlate SignNow, you can easily fill out the ST-120 form online. Our intuitive platform streamlines the process, allowing you to input necessary details, sign, and send the document electronically, all while ensuring that you know how to fill out the ST-120 form accurately.

-

Are there any costs associated with using airSlate SignNow for ST-120 forms?

AirSlate SignNow offers a variety of pricing plans to cater to different business needs, making it an affordable option for filling out the ST-120 form. Our subscription includes unlimited document signing and templates, ensuring you get the best value while learning how to fill out the ST-120 form efficiently.

-

What features does airSlate SignNow offer for filling out forms?

AirSlate SignNow offers features such as document templates, electronic signatures, and real-time collaboration to simplify form filling. These tools will help you understand how to fill out the ST-120 form quickly and effectively, streamlining your entire document workflow.

-

Can I integrate airSlate SignNow with other applications for managing ST-120 forms?

Yes, airSlate SignNow integrates seamlessly with many applications, including CRM and accounting software. This integration allows for easier management of documents, enabling you to focus on how to fill out the ST-120 form without missing any important details.

-

Is it easy to access and share the filled-out ST-120 form with others?

Absolutely! AirSlate SignNow allows you to access your filled-out ST-120 form from any device. You can easily share the document via email or through secure links, ensuring you and your clients have the correct documentation for tax exemption.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow to handle the ST-120 form enhances efficiency by reducing paperwork and saving time. Additionally, our platform's user-friendly interface empowers your team with the ability to learn how to fill out the ST-120 form quickly, ultimately improving productivity.

Get more for St 120 Form

Find out other St 120 Form

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement