Combination Promissory Note Btruthb in Blending Disclosureb Form

Understanding the Combination Promissory Note and Truth in Lending Disclosure

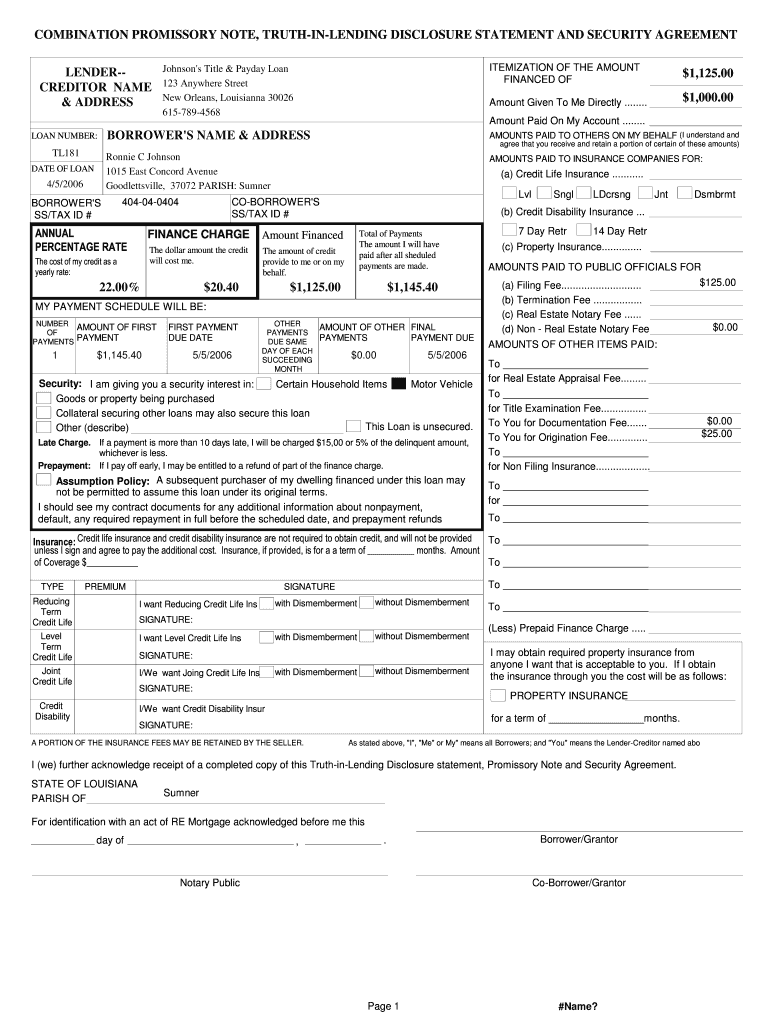

The combination promissory note and truth in lending disclosure is a crucial document in lending agreements. It serves to inform borrowers about the terms of their loan, including the interest rate, payment schedule, and any fees associated with the loan. This disclosure ensures that borrowers have a clear understanding of their financial obligations before signing the agreement. It is essential for promoting transparency and protecting consumers from irresponsible lending practices.

How to Complete the Combination Promissory Note and Truth in Lending Disclosure

Completing the combination promissory note and truth in lending disclosure involves several key steps. First, gather all necessary information, including the borrower's personal details, loan amount, interest rate, and repayment terms. Next, accurately fill out each section of the form, ensuring that all information is correct and up-to-date. It is important to review the completed document for any errors or omissions before signing. Finally, both parties should sign the document electronically or in person, depending on their preference and legal requirements.

Key Elements of the Combination Promissory Note and Truth in Lending Disclosure

Several key elements must be included in the combination promissory note and truth in lending disclosure. These include:

- Loan Amount: The total amount borrowed by the borrower.

- Interest Rate: The annual percentage rate (APR) that will be applied to the loan.

- Payment Schedule: Details on how and when payments are to be made.

- Fees: Any additional fees associated with the loan, such as origination fees or late payment charges.

- Right to Cancel: Information on the borrower's right to cancel the loan within a specified period.

Legal Considerations for the Combination Promissory Note and Truth in Lending Disclosure

The legal use of the combination promissory note and truth in lending disclosure is governed by federal and state laws. The Truth in Lending Act (TILA) requires lenders to provide clear and accurate disclosures to borrowers. Compliance with these regulations is essential to avoid penalties and ensure the enforceability of the loan agreement. Additionally, electronic signatures must meet the requirements set forth by the ESIGN Act and UETA to be considered legally binding.

Examples of the Combination Promissory Note and Truth in Lending Disclosure

Examples of the combination promissory note and truth in lending disclosure can vary based on the lender and the type of loan. Common scenarios include:

- A mortgage loan agreement that outlines the terms of a home loan.

- A personal loan where the borrower receives funds for various purposes.

- A car loan detailing the financing terms for purchasing a vehicle.

Each example will include the required disclosures to ensure that the borrower is fully informed of their obligations.

Obtaining the Combination Promissory Note and Truth in Lending Disclosure

To obtain the combination promissory note and truth in lending disclosure, borrowers can request it directly from their lender. Many lenders provide these documents as part of the loan application process. Additionally, templates may be available online for borrowers who wish to create their own documents. It is important to ensure that any template used complies with applicable laws and regulations to ensure its validity.

Quick guide on how to complete combination promissory note btruthb in blending disclosureb

Effortlessly Prepare Combination Promissory Note Btruthb in blending Disclosureb on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent sustainable alternative to conventional printed and signed papers, allowing you to access the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Combination Promissory Note Btruthb in blending Disclosureb on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Modify and Electronically Sign Combination Promissory Note Btruthb in blending Disclosureb with Ease

- Find Combination Promissory Note Btruthb in blending Disclosureb and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize key sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes moments and carries the same legal authority as a standard wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or errors that necessitate reprinting copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Combination Promissory Note Btruthb in blending Disclosureb to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How can I fill out a form to become a pilot in Nepal?

Obtain the forms. Read the forms. Add correct information.

-

What is the procedure to fill out the DU admission form? How many colleges and courses can I fill in?

It's as simple as filling any school admission form but you need to be quite careful while filling for courses ,don't mind you are from which stream in class 12 choose all the courses you feel like choosing,there is no limitations in choosing course and yes you must fill all the courses related to your stream ,additionally there is no choice for filling of college names in the application form .

-

How many application forms does a person need to fill out in his/her lifetime?

As many as you want to !

-

I have created a registration form in HTML. When someone fills it out, how do I get the filled out form sent to my email?

Are you assuming that the browser will send the email? That is not the way it is typically done. You include in your registration form a and use PHP or whatever on the server to send the email. In PHP it is PHP: mail - Manual But if you are already on the server it seems illogical to send an email. Just register the user immediately.

Create this form in 5 minutes!

How to create an eSignature for the combination promissory note btruthb in blending disclosureb

How to generate an eSignature for your Combination Promissory Note Btruthb In Blending Disclosureb in the online mode

How to generate an eSignature for your Combination Promissory Note Btruthb In Blending Disclosureb in Google Chrome

How to generate an eSignature for putting it on the Combination Promissory Note Btruthb In Blending Disclosureb in Gmail

How to make an eSignature for the Combination Promissory Note Btruthb In Blending Disclosureb from your mobile device

How to generate an eSignature for the Combination Promissory Note Btruthb In Blending Disclosureb on iOS devices

How to make an electronic signature for the Combination Promissory Note Btruthb In Blending Disclosureb on Android OS

People also ask

-

What is a Combination Promissory Note Btruthb in blending Disclosureb?

A Combination Promissory Note Btruthb in blending Disclosureb is a legal document that outlines the terms of a loan, combining elements of a promissory note and disclosure requirements. This document ensures that both parties understand the obligations and risks involved in the transaction. With airSlate SignNow, you can easily create, send, and eSign this document securely.

-

How does airSlate SignNow help with Combination Promissory Note Btruthb in blending Disclosureb?

airSlate SignNow provides a straightforward platform for creating and managing Combination Promissory Notes Btruthb in blending Disclosureb. Our solution allows users to customize templates, ensuring compliance with legal standards while saving time. The intuitive interface makes it easy to eSign documents, streamlining the process for both lenders and borrowers.

-

What features does airSlate SignNow offer for managing Combination Promissory Notes?

With airSlate SignNow, users can benefit from features like customizable templates, secure eSigning, and real-time tracking of document status. Additionally, our platform supports automated reminders and notifications, ensuring that both parties stay informed throughout the process. These features make managing Combination Promissory Notes Btruthb in blending Disclosureb efficient and hassle-free.

-

Is airSlate SignNow affordable for small businesses needing Combination Promissory Notes?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, including small enterprises. Our cost-effective solution enables small businesses to create and manage Combination Promissory Notes Btruthb in blending Disclosureb without breaking the bank. You can choose a plan that fits your budget while enjoying all the essential features.

-

Can I integrate airSlate SignNow with other tools for Combination Promissory Notes?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and CRM systems. This integration allows you to import and export documents easily, enabling a smoother workflow for managing your Combination Promissory Notes Btruthb in blending Disclosureb. Enhance your productivity by connecting with the tools you already use.

-

How secure is airSlate SignNow for handling sensitive Combination Promissory Notes?

airSlate SignNow prioritizes the security of your documents, including Combination Promissory Notes Btruthb in blending Disclosureb. We utilize advanced encryption protocols and secure cloud storage to protect your information. Additionally, our platform complies with industry standards to ensure that your sensitive data remains confidential and safe.

-

What are the benefits of using airSlate SignNow for Combination Promissory Notes?

Using airSlate SignNow for your Combination Promissory Notes Btruthb in blending Disclosureb provides numerous benefits, including faster processing times and improved accuracy. The platform's user-friendly interface simplifies the eSigning process, reducing the chances of errors. Moreover, you’ll have access to comprehensive tracking features, making it easy to manage your documents.

Get more for Combination Promissory Note Btruthb in blending Disclosureb

- Borang pekerja baru form

- Georgia bar foundation notice to financial institution form pdf gabar

- Reapers revenge waiver form

- Electronic diploma certificate blank form

- Savers application form

- Real estate exclusivity agreement template form

- Real estate fee agreement template form

- Real estate finders fee agreement template form

Find out other Combination Promissory Note Btruthb in blending Disclosureb

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document