Form FP L RSA 305 A2 Sos Nh

What is the Form FP l RSA 305 A2 Sos Nh

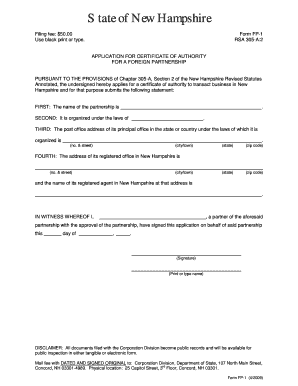

The Form FP l RSA 305 A2 Sos Nh is a specific document used for various administrative purposes, likely related to regulatory compliance or reporting within a particular field. This form may be required by certain government agencies or organizations to gather essential information from individuals or businesses. Understanding the purpose of this form is crucial for ensuring proper completion and submission.

How to use the Form FP l RSA 305 A2 Sos Nh

Using the Form FP l RSA 305 A2 Sos Nh involves several steps that ensure accurate and compliant submission. First, gather all necessary information that the form requests. This may include personal details, financial data, or other relevant information. Next, carefully fill out each section of the form, ensuring clarity and accuracy. Once completed, review the form for any errors before submission to avoid potential delays or complications.

Steps to complete the Form FP l RSA 305 A2 Sos Nh

Completing the Form FP l RSA 305 A2 Sos Nh requires a systematic approach:

- Read the instructions carefully to understand the requirements.

- Gather all necessary documents and information needed for the form.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check for any mistakes or missing information.

- Submit the form according to the specified guidelines, whether online, by mail, or in person.

Legal use of the Form FP l RSA 305 A2 Sos Nh

The legal use of the Form FP l RSA 305 A2 Sos Nh is essential for compliance with applicable laws and regulations. This form may be required by law for specific transactions or reporting purposes. Failing to use the form correctly can result in legal penalties or complications. It is important to understand the legal implications of the information provided on the form and ensure it is used in accordance with relevant statutes.

Key elements of the Form FP l RSA 305 A2 Sos Nh

The Form FP l RSA 305 A2 Sos Nh contains several key elements that are crucial for its validity:

- Identification Information: This section typically requires personal or business identification details.

- Financial Data: Relevant financial information may need to be disclosed, depending on the form's purpose.

- Signature: A signature may be required to validate the information provided.

- Date of Submission: Indicating the date ensures that the form is processed within the required timeframe.

Filing Deadlines / Important Dates

Filing deadlines for the Form FP l RSA 305 A2 Sos Nh can vary based on the specific requirements set by the governing body. It is important to be aware of these deadlines to avoid penalties or late fees. Keeping a calendar of important dates related to the form's submission can help ensure timely compliance.

Quick guide on how to complete form fp l rsa 305 a2 sos nh

Effortlessly Prepare [SKS] on Any Device

The management of online documents has gained popularity among companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the tools you need to create, adjust, and electronically sign your documents quickly and without complications. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and eSign [SKS] Without Stress

- Find [SKS] and click Get Form to commence.

- Utilize the tools available to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information using the tools that airSlate SignNow has specifically designed for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Edit and eSign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form FP l RSA 305 A2 Sos Nh

Create this form in 5 minutes!

How to create an eSignature for the form fp l rsa 305 a2 sos nh

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form FP l RSA 305 A2 Sos Nh used for?

Form FP l RSA 305 A2 Sos Nh is designed to streamline the process of signing and managing documents electronically. This form is essential for businesses that need to ensure compliance and secure handling of sensitive information in a digital format.

-

How can airSlate SignNow help with Form FP l RSA 305 A2 Sos Nh?

airSlate SignNow provides an efficient platform for managing Form FP l RSA 305 A2 Sos Nh by allowing users to send, sign, and store documents securely. The platform ensures that your form can be filled out and signed electronically, minimizing delays and physical paperwork.

-

What are the pricing plans for using airSlate SignNow with Form FP l RSA 305 A2 Sos Nh?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs. You can use Form FP l RSA 305 A2 Sos Nh within these plans, which include different features to support your document management effectively.

-

Are there any integrations available for managing Form FP l RSA 305 A2 Sos Nh?

Yes, airSlate SignNow integrates seamlessly with many popular platforms, enhancing the way you manage Form FP l RSA 305 A2 Sos Nh. Integrations with tools like Google Drive, Dropbox, and CRM systems help streamline your workflows and improve productivity.

-

What benefits does airSlate SignNow provide for handling Form FP l RSA 305 A2 Sos Nh?

By using airSlate SignNow for Form FP l RSA 305 A2 Sos Nh, businesses benefit from improved efficiency, security, and compliance. The platform automates the signing process, reduces manual errors, and ensures that all documents are legally binding.

-

How secure is airSlate SignNow when dealing with Form FP l RSA 305 A2 Sos Nh?

AirSlate SignNow takes security very seriously, particularly when handling Form FP l RSA 305 A2 Sos Nh. The platform is equipped with industry-standard encryption and compliance measures to protect your sensitive information and maintain privacy.

-

Can I access Form FP l RSA 305 A2 Sos Nh on mobile devices?

Absolutely! airSlate SignNow is compatible with mobile devices, allowing you to access and complete Form FP l RSA 305 A2 Sos Nh from anywhere. This flexibility ensures that you can manage your documents on the go without any hassle.

Get more for Form FP l RSA 305 A2 Sos Nh

Find out other Form FP l RSA 305 A2 Sos Nh

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile