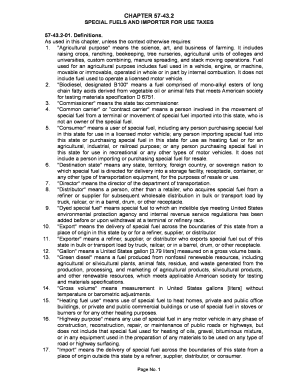

SPECIAL FUELS and IMPORTER for USE TAXES 57 43 Legis Nd Form

What is the SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd

The SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd is a specific form utilized in the United States for reporting and paying taxes related to special fuels. This form is essential for businesses and individuals who import or use special fuels, ensuring compliance with state and federal tax regulations. It serves to document the quantity of special fuels used and the associated tax obligations, providing a clear record for both taxpayers and tax authorities.

How to use the SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd

Using the SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd involves accurately filling out the required fields, which typically include details about the fuel type, quantity, and the importer’s information. It is important to gather all necessary data before starting the form to ensure a smooth completion process. Once filled, the form must be submitted according to the specified guidelines, which may include electronic submission or mailing it to the appropriate tax authority.

Steps to complete the SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd

Completing the SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd requires several key steps:

- Gather necessary information, including the type and amount of special fuels used.

- Access the official form, ensuring you have the latest version.

- Fill out the form accurately, providing all required details such as your name, address, and tax identification number.

- Review the completed form for accuracy and completeness.

- Submit the form through the designated method, whether online or by mail.

Key elements of the SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd

The key elements of the SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd include the identification of the fuel type, the total volume of fuel imported or used, and the calculation of applicable taxes. Additionally, it requires the taxpayer's identification information and any relevant exemptions or deductions that may apply. Understanding these elements is crucial for accurate reporting and compliance with tax obligations.

State-specific rules for the SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd

Each state in the U.S. may have specific rules regarding the use and taxation of special fuels. These rules can vary significantly, affecting how the SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd is completed and submitted. It is important for taxpayers to be aware of their state's regulations, including any additional documentation required, specific filing deadlines, and unique tax rates applicable to special fuels.

Required Documents

When completing the SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd, certain documents may be required to support the information provided. These documents can include purchase invoices for the special fuels, previous tax filings, and any permits or licenses related to the importation or use of special fuels. Having these documents ready can facilitate a smoother filing process and help ensure compliance with tax regulations.

Quick guide on how to complete special fuels and importer for use taxes 57 43 legis nd

Complete [SKS] effortlessly on any device

Online document management has gained fame among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign [SKS] without hassle

- Locate [SKS] and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about misplaced or lost files, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from a device of your choice. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd

Create this form in 5 minutes!

How to create an eSignature for the special fuels and importer for use taxes 57 43 legis nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd and why are they important?

SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd are essential for businesses that deal with specific fuel types in compliance with legislation. Understanding these regulations helps ensure your business remains compliant and avoids potential penalties.

-

How can airSlate SignNow assist with SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd documentation?

airSlate SignNow provides a platform to efficiently manage and sign documents related to SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd. Our eSignature solution streamlines the documentation process, ensuring full compliance without the hassle.

-

What pricing options are available for airSlate SignNow services related to SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd?

airSlate SignNow offers flexible pricing plans tailored to your business needs, including options for those specifically handling SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd. Each plan comes with a range of features to enhance your document management experience.

-

What are the key features of airSlate SignNow that support SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd?

Key features of airSlate SignNow include user-friendly eSigning, secure document storage, and customizable templates. These features effectively facilitate compliance with SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd regulations, improving efficiency.

-

What benefits does airSlate SignNow offer for managing SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd paperwork?

Using airSlate SignNow simplifies the management of SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd paperwork by reducing processing time and ensuring documents are handled securely. This leads to increased productivity and peace of mind for your business.

-

Can airSlate SignNow integrate with other tools for handling SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd?

Yes, airSlate SignNow offers integrations with various tools and platforms, enhancing the overall management of SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd processes. This allows you to centralize your workflows and improve collaboration within your team.

-

Is there customer support available for questions regarding SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd?

Absolutely! airSlate SignNow provides dedicated customer support to assist with any questions regarding SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd. Our support team is available to ensure you get the guidance you need.

Get more for SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd

Find out other SPECIAL FUELS AND IMPORTER FOR USE TAXES 57 43 Legis Nd

- Sign Colorado Profit Sharing Agreement Template Secure

- Sign Connecticut Profit Sharing Agreement Template Computer

- How Can I Sign Maryland Profit Sharing Agreement Template

- How To Sign New York Profit Sharing Agreement Template

- Sign Pennsylvania Profit Sharing Agreement Template Simple

- Help Me With Sign Delaware Electrical Services Contract

- Sign Louisiana Electrical Services Contract Safe

- How Can I Sign Mississippi Electrical Services Contract

- Help Me With Sign West Virginia Electrical Services Contract

- Can I Sign Wyoming Electrical Services Contract

- Sign Ohio Non-Solicitation Agreement Now

- How Can I Sign Alaska Travel Agency Agreement

- How Can I Sign Missouri Travel Agency Agreement

- How Can I Sign Alabama Amendment to an LLC Operating Agreement

- Can I Sign Alabama Amendment to an LLC Operating Agreement

- How To Sign Arizona Amendment to an LLC Operating Agreement

- Sign Florida Amendment to an LLC Operating Agreement Now

- How To Sign Florida Amendment to an LLC Operating Agreement

- How Do I Sign Illinois Amendment to an LLC Operating Agreement

- How Do I Sign New Hampshire Amendment to an LLC Operating Agreement