Orthopedic Disability Sales Tax Rebate Claim Louisiana Revised Statute 47305 Revenue Louisiana Form

Understanding the Orthopedic Disability Sales Tax Rebate Claim

The Orthopedic Disability Sales Tax Rebate Claim is a provision under Louisiana Revised Statute 47305, designed to provide financial relief to individuals with orthopedic disabilities. This statute allows eligible residents to claim a rebate on sales tax paid for certain medical equipment and supplies that assist with mobility and daily living. The aim is to reduce the financial burden associated with necessary medical expenses, ensuring that individuals with orthopedic disabilities have access to essential resources.

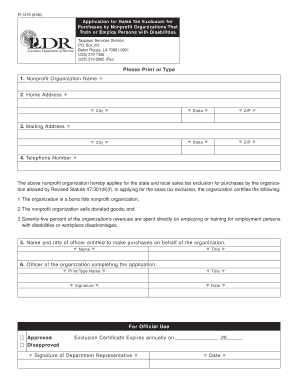

Eligibility Criteria for the Rebate

To qualify for the Orthopedic Disability Sales Tax Rebate Claim, applicants must meet specific criteria outlined in the statute. Generally, the individual must have a documented orthopedic disability, which can include conditions affecting the bones, joints, or muscles. Additionally, the items purchased must be directly related to the treatment or management of the disability. Proof of purchase and medical documentation may be required to substantiate the claim.

Steps to Complete the Rebate Claim

Filing a claim for the Orthopedic Disability Sales Tax Rebate involves several steps. First, individuals should gather all necessary documentation, including receipts for qualifying purchases and medical records. Next, complete the rebate claim form accurately, ensuring all information is filled out correctly. Once the form is completed, submit it along with the required documents to the appropriate state revenue office. Keeping copies of all submitted materials is advisable for personal records.

Required Documents for Submission

When applying for the Orthopedic Disability Sales Tax Rebate Claim, several documents are typically required. These may include:

- Completed rebate claim form

- Receipts for qualifying medical equipment or supplies

- Medical documentation verifying the orthopedic disability

- Any additional forms as specified by the Louisiana Department of Revenue

Having these documents organized will facilitate a smoother application process and help avoid delays in processing the claim.

Form Submission Methods

Applicants can submit the Orthopedic Disability Sales Tax Rebate Claim through various methods. The options typically include:

- Online submission via the Louisiana Department of Revenue website

- Mailing the completed form and documents to the designated office

- In-person submission at local revenue offices

Choosing the most convenient method based on personal circumstances can help ensure timely processing of the rebate claim.

Legal Use of the Rebate Claim

The Orthopedic Disability Sales Tax Rebate Claim is legally sanctioned under Louisiana Revised Statute 47305. This means that individuals are entitled to the rebate as long as they meet the eligibility requirements and follow the proper application procedures. Understanding the legal framework surrounding the rebate can empower applicants to utilize their rights effectively and ensure compliance with state regulations.

Quick guide on how to complete orthopedic disability sales tax rebate claim louisiana revised statute 47305 revenue louisiana

Prepare [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly substitute to traditional printed and signed forms, as you can easily locate the correct document and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents promptly without any delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to adjust and eSign [SKS] with ease

- Obtain [SKS] and select Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method for submitting your form, whether via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Alter and eSign [SKS] while ensuring outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Orthopedic Disability Sales Tax Rebate Claim Louisiana Revised Statute 47305 Revenue Louisiana

Create this form in 5 minutes!

How to create an eSignature for the orthopedic disability sales tax rebate claim louisiana revised statute 47305 revenue louisiana

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Orthopedic Disability Sales Tax Rebate Claim Louisiana Revised Statute 47305 Revenue Louisiana?

The Orthopedic Disability Sales Tax Rebate Claim Louisiana Revised Statute 47305 Revenue Louisiana provides eligible residents with a means to reclaim sales tax paid on specific orthopedic equipment and services. This statute is designed to assist individuals who have qualifying disabilities, ensuring they are not unduly burdened by these necessary expenses.

-

How can airSlate SignNow help with my Orthopedic Disability Sales Tax Rebate Claim Louisiana Revised Statute 47305 Revenue Louisiana documentation?

airSlate SignNow simplifies the process of preparing and submitting your Orthopedic Disability Sales Tax Rebate Claim Louisiana Revised Statute 47305 Revenue Louisiana documentation. With our platform, you can easily create, edit, and eSign forms, making it more efficient to manage your claims and ensuring all necessary paperwork is completed correctly.

-

What are the benefits of using airSlate SignNow for my sales tax rebate claims?

Using airSlate SignNow for your Orthopedic Disability Sales Tax Rebate Claim Louisiana Revised Statute 47305 Revenue Louisiana brings signNow benefits, including streamlined document management, secure eSigning, and ease of collaboration. Our user-friendly interface makes it accessible for everyone, ensuring you can focus on your claim rather than paperwork.

-

Are there any costs associated with filing an Orthopedic Disability Sales Tax Rebate Claim Louisiana?

While there are no fees directly related to filing your Orthopedic Disability Sales Tax Rebate Claim Louisiana Revised Statute 47305 Revenue Louisiana, there might be costs associated with obtaining necessary documentation or using services like airSlate SignNow to facilitate the process. However, our solution is cost-effective and can save you time and potential hassle.

-

What types of documents can I prepare with airSlate SignNow for my sales tax rebate claim?

With airSlate SignNow, you can prepare a variety of documents needed for your Orthopedic Disability Sales Tax Rebate Claim Louisiana Revised Statute 47305 Revenue Louisiana, including claim forms, supporting documentation, and letters of medical necessity. Our platform supports various file formats, making it easy to gather everything in one place.

-

Can I track the status of my Orthopedic Disability Sales Tax Rebate Claim Louisiana with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your documentation associated with the Orthopedic Disability Sales Tax Rebate Claim Louisiana Revised Statute 47305 Revenue Louisiana. You can receive notifications when documents are opened, signed, and completed, keeping you informed throughout the process.

-

How secure is my data when using airSlate SignNow for my sales tax rebate claims?

Data security is a top priority for airSlate SignNow. We utilize advanced encryption methods to protect your documents and information while preparing your Orthopedic Disability Sales Tax Rebate Claim Louisiana Revised Statute 47305 Revenue Louisiana. Rest assured that your sensitive data is safe and complies with industry standards.

Get more for Orthopedic Disability Sales Tax Rebate Claim Louisiana Revised Statute 47305 Revenue Louisiana

- County phone number form

- Ppt 2022 alabama department of revenue form

- Alabama list of current forms cch answerconnect

- Individual income tax electronic filing options alabama form

- Understanding your cp01h noticeinternal revenue service form

- Declaration of estimated tax for individuals general form

- Fillable il 4506 request for copy of tax return illinois fill io form

- Form 40a ty 2022

Find out other Orthopedic Disability Sales Tax Rebate Claim Louisiana Revised Statute 47305 Revenue Louisiana

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed