BFormb B13b 79 Exemption BCertificateb Oklahoma Ok

Understanding the Oklahoma Tax 1379 Exemption Certificate

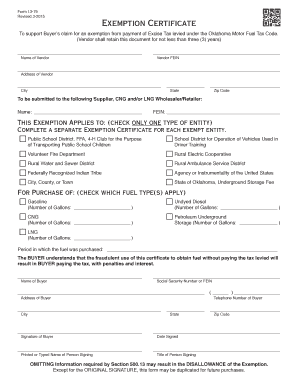

The Oklahoma Tax 1379 Exemption Certificate is a crucial document for individuals and businesses seeking tax exemptions within the state. This form is primarily used to claim exemption from sales tax for certain purchases. It is essential for qualifying entities, such as non-profit organizations and government agencies, to utilize this certificate to avoid unnecessary tax burdens on eligible transactions.

How to Complete the Oklahoma Tax 1379 Exemption Certificate

Filling out the Oklahoma Tax 1379 Exemption Certificate requires careful attention to detail. The form typically includes sections for the purchaser's name, address, and the nature of the exemption being claimed. It is important to accurately complete each section to ensure compliance with state tax regulations. Incomplete or incorrect forms may lead to delays or denial of the exemption.

Eligibility Criteria for the Oklahoma Tax 1379 Exemption

To qualify for the Oklahoma Tax 1379 Exemption, the applicant must meet specific criteria established by the state. Generally, eligible entities include non-profit organizations, government bodies, and certain educational institutions. Each category has distinct requirements that must be documented to support the exemption claim. Understanding these criteria is vital for successful application.

Steps to Obtain the Oklahoma Tax 1379 Exemption Certificate

Obtaining the Oklahoma Tax 1379 Exemption Certificate involves a straightforward process. First, applicants must gather necessary documentation that proves their eligibility. Next, they should complete the form accurately, ensuring all required information is provided. Finally, the completed form can be submitted to the appropriate state tax authority for approval. Keeping copies of all submitted documents is advisable for future reference.

Legal Use of the Oklahoma Tax 1379 Exemption Certificate

The legal use of the Oklahoma Tax 1379 Exemption Certificate is strictly regulated. It is important for users to understand that this certificate is intended solely for qualifying purchases. Misuse of the exemption certificate, such as using it for personal purchases or for items not eligible for exemption, can result in penalties and fines. Compliance with state laws is essential to maintain the integrity of the exemption process.

Examples of Using the Oklahoma Tax 1379 Exemption Certificate

Real-world applications of the Oklahoma Tax 1379 Exemption Certificate can vary widely. For instance, a non-profit organization purchasing supplies for a community event may use the certificate to avoid sales tax on those items. Similarly, a government agency acquiring materials for public projects can also utilize the exemption. These examples illustrate the practical benefits of the certificate for eligible entities.

Quick guide on how to complete bformb b13b 79 exemption bcertificateb oklahoma ok

Complete BFormb B13b 79 Exemption BCertificateb Oklahoma Ok effortlessly on any device

Online document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without hindrances. Manage BFormb B13b 79 Exemption BCertificateb Oklahoma Ok on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign BFormb B13b 79 Exemption BCertificateb Oklahoma Ok with ease

- Locate BFormb B13b 79 Exemption BCertificateb Oklahoma Ok and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature with the Sign tool, which takes moments and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from a device of your choosing. Edit and eSign BFormb B13b 79 Exemption BCertificateb Oklahoma Ok and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bformb b13b 79 exemption bcertificateb oklahoma ok

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Oklahoma tax 1379 form?

The Oklahoma tax 1379 form is a document used for specific tax reporting requirements in the state of Oklahoma. It helps taxpayers report their income, deductions, and credits accurately. Understanding its purpose is crucial for compliance and ensuring you take advantage of available tax benefits.

-

How can airSlate SignNow assist with submitting my Oklahoma tax 1379?

AirSlate SignNow simplifies the process of preparing and submitting your Oklahoma tax 1379 form by allowing you to easily eSign documents. With its user-friendly interface, you can ensure that all your paperwork is completed accurately and securely. This efficiency helps reduce the risk of errors, making your tax submission process smoother.

-

What features does airSlate SignNow offer for tax professionals handling Oklahoma tax 1379?

AirSlate SignNow offers several features beneficial for tax professionals, including customizable templates for the Oklahoma tax 1379, secure eSigning options, and easy document sharing. It also allows for real-time collaboration, ensuring that all parties can track changes and updates. These features save time and improve accuracy in tax management.

-

Is airSlate SignNow cost-effective for small businesses dealing with Oklahoma tax 1379?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing Oklahoma tax 1379 submissions. The pricing plans are designed to fit various budgets while providing essential features needed for efficient document management and eSigning. By streamlining the tax process, businesses can save on time and administrative costs.

-

Can I integrate airSlate SignNow with other accounting software for Oklahoma tax 1379?

Absolutely! AirSlate SignNow offers seamless integrations with popular accounting software, making it easy to manage your Oklahoma tax 1379 alongside your financial records. This integration ensures that your documents and data are synchronized, enhancing efficiency and reducing manual entry errors.

-

What are the benefits of using airSlate SignNow for Oklahoma tax 1379?

Using airSlate SignNow for your Oklahoma tax 1379 offers numerous benefits, including enhanced security for your sensitive tax information, easy accessibility from any device, and an organized document management system. This allows for greater peace of mind when dealing with tax matters and helps ensure that you meet all necessary deadlines.

-

How secure is airSlate SignNow when handling sensitive documents like the Oklahoma tax 1379?

AirSlate SignNow prioritizes security, employing advanced encryption protocols to protect sensitive information, including the Oklahoma tax 1379 form. This security ensures that your documents are safe from unauthorized access. Additionally, all transactions and eSignatures are logged, providing an extra layer of accountability.

Get more for BFormb B13b 79 Exemption BCertificateb Oklahoma Ok

- Direct deposit enrollment form rs6370l 3 instructions

- Mda complete new patient form marcelino dental arts

- Lease for vehicle agreement template form

- Lease for a tenant agreement template form

- Lease for a trucking company agreement template form

- Lease to own agreement template form

- Lease to buy agreement template form

- Lease to own business agreement template form

Find out other BFormb B13b 79 Exemption BCertificateb Oklahoma Ok

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online