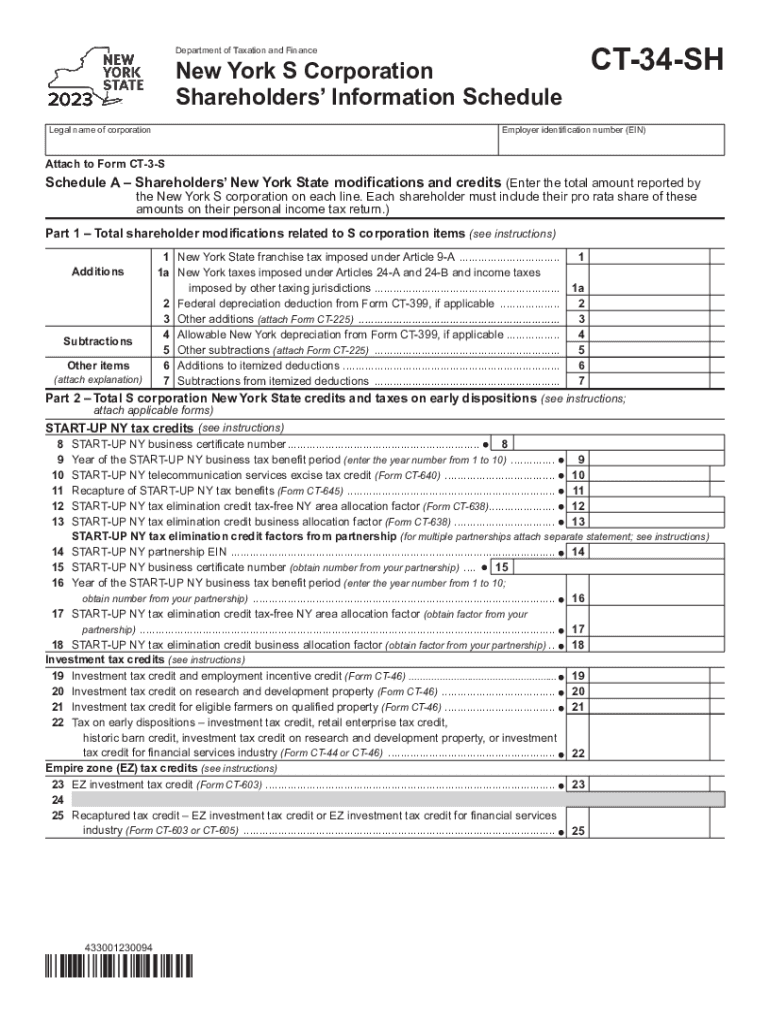

Ct 34 Sh 2023-2026

What is the CT 34 SH?

The CT 34 SH is a state tax form used in Connecticut for reporting and calculating the tax liability of certain entities, including corporations and limited liability companies (LLCs). This form is specifically designed for the purpose of claiming a credit for taxes paid to other jurisdictions, which can help reduce the overall tax burden for businesses operating in multiple states. Understanding the CT 34 SH is essential for compliance with Connecticut tax regulations.

How to Use the CT 34 SH

To effectively use the CT 34 SH, businesses must first gather all necessary financial information, including income, deductions, and taxes paid to other states. The form requires detailed entries that reflect the entity's financial activities for the tax year. It is important to follow the instructions carefully to ensure accurate reporting and to maximize any available tax credits. Businesses should also maintain documentation supporting the figures reported on the form.

Steps to Complete the CT 34 SH

Completing the CT 34 SH involves several key steps:

- Gather all relevant financial documents, including income statements and tax returns from other states.

- Fill out the identification section with the entity's name, address, and tax identification number.

- Report total income and deductions as required on the form.

- Calculate the credit for taxes paid to other jurisdictions, ensuring to follow the guidelines provided in the instructions.

- Review all entries for accuracy before submitting the form.

Legal Use of the CT 34 SH

The CT 34 SH must be used in accordance with Connecticut tax laws. It is legally binding and serves as an official document submitted to the state for tax purposes. Failure to accurately complete and submit this form can result in penalties, including fines and interest on unpaid taxes. Businesses must ensure compliance to avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the CT 34 SH typically align with the state’s corporate tax deadlines. Businesses should be aware of the specific due dates to avoid late filing penalties. Generally, the form is due on the fifteenth day of the fourth month following the end of the tax year. For entities operating on a calendar year, this means the form is due by April 15.

Required Documents

When completing the CT 34 SH, several documents are necessary to support the information reported. These may include:

- Previous year’s tax returns

- Income statements

- Proof of taxes paid to other states

- Documentation of deductions claimed

Having these documents ready will facilitate a smoother filing process and ensure accuracy in reporting.

Quick guide on how to complete ct 34 sh

Complete Ct 34 Sh seamlessly on any device

Digital document management has become favored by companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without delays. Manage Ct 34 Sh on any platform using airSlate SignNow Android or iOS applications and simplify any document-related workflow today.

How to edit and eSign Ct 34 Sh effortlessly

- Obtain Ct 34 Sh and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click the Done button to preserve your changes.

- Select your preferred method to submit your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Ct 34 Sh ensuring excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 34 sh

Create this form in 5 minutes!

How to create an eSignature for the ct 34 sh

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form ct 34 sh 2018 and why is it important?

The form ct 34 sh 2018 is a tax form used for specific reporting purposes in Connecticut. It is essential for businesses as it helps ensure compliance with state tax regulations. Properly completing this form can aid in avoiding potential penalties and ensures accurate tax filing.

-

How can airSlate SignNow help me with the form ct 34 sh 2018?

airSlate SignNow simplifies the process of eSigning and sending documents like the form ct 34 sh 2018. You can easily upload your form, add the required signatures, and share it securely. This streamlines your workflow and ensures that your documents are processed promptly.

-

What features does airSlate SignNow offer for managing the form ct 34 sh 2018?

airSlate SignNow provides features such as document templates, customizable signing workflows, and collaboration tools that help with the management of the form ct 34 sh 2018. You can also track document status and receive notifications when your form is signed, making the signing process more efficient.

-

Is airSlate SignNow cost-effective for submitting the form ct 34 sh 2018?

Yes, airSlate SignNow offers competitive pricing structures suitable for all business sizes, making it a cost-effective solution for submitting the form ct 34 sh 2018. With various plans available, you can select one that fits your needs and budget without compromising on features.

-

Can I integrate airSlate SignNow with other tools for managing the form ct 34 sh 2018?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, including CRM systems, document management tools, and cloud storage services. This allows you to manage the form ct 34 sh 2018 alongside your existing processes efficiently.

-

What are the security features of airSlate SignNow for handling the form ct 34 sh 2018?

airSlate SignNow prioritizes security, utilizing encryption and secure data storage to protect documents like the form ct 34 sh 2018. Additionally, it offers compliance with industry standards, ensuring your sensitive information remains safe during transmission and storage.

-

How does airSlate SignNow enhance the signing process for the form ct 34 sh 2018?

With airSlate SignNow, the signing process for the form ct 34 sh 2018 is enhanced through user-friendly interfaces and seamless electronic signing capabilities. Users can sign the form from any device at their convenience, reducing delays and improving efficiency in document management.

Get more for Ct 34 Sh

- Model student training form

- Cid nm form

- Nevada prepaid tuition forms

- Police report verification victims of crime program state of nevada voc nv form

- Form requesting copy of tasc

- Famis portal form

- Css communication profile 2011 form

- Career center customer registration form new york state opportunity fillable pdf

Find out other Ct 34 Sh

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document