Reset Form Michigan Department of Treasury Rev 1 2023

Understanding the MI 2210 Form

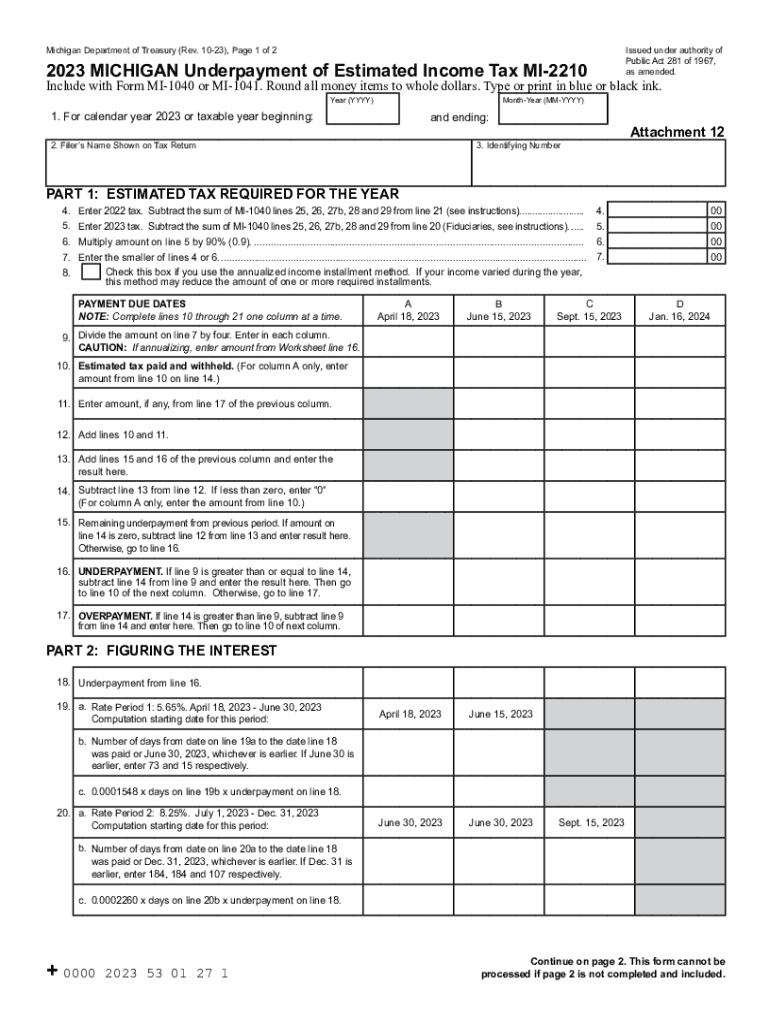

The MI 2210 form is a Michigan state tax form used to report underpayment of estimated income tax. Taxpayers who do not pay enough tax throughout the year may need to file this form to calculate any penalties owed. This form is particularly relevant for individuals who earn income that is not subject to withholding, such as self-employed individuals or those with significant investment income.

Steps to Complete the MI 2210 Form

Filling out the MI 2210 form involves several key steps:

- Gather your income information, including W-2s and 1099s.

- Calculate your total tax liability for the year.

- Determine the amount of tax you have already paid through withholding or estimated payments.

- Complete the form by entering your income, tax liability, and payments made.

- Review the calculations for any penalties due to underpayment.

Filing Deadlines for the MI 2210 Form

It is essential to be aware of the filing deadlines associated with the MI 2210 form. Typically, the form must be submitted by the same deadline as your annual tax return, which is usually April 15 for most taxpayers. However, if you are granted an extension for your tax return, the MI 2210 form must also be filed by the extended deadline.

Required Documents for the MI 2210 Form

To accurately complete the MI 2210 form, you will need several documents:

- Your federal tax return, which provides a basis for your state tax calculations.

- Any W-2 forms from employers showing withheld taxes.

- 1099 forms for non-employee compensation or other income sources.

- Records of estimated tax payments made throughout the year.

Penalties for Non-Compliance with the MI 2210 Form

Failing to file the MI 2210 form when required can result in penalties. The state of Michigan may impose a penalty based on the amount of underpayment, which can accumulate over time. It is crucial to file the form accurately and on time to avoid these financial repercussions.

Digital vs. Paper Version of the MI 2210 Form

The MI 2210 form can be completed and submitted either digitally or on paper. Digital submission is often faster and can reduce the risk of errors. However, some taxpayers may prefer the traditional paper method, especially if they are more comfortable with physical documents. Both methods require careful attention to detail to ensure compliance with state tax regulations.

Quick guide on how to complete reset form michigan department of treasury rev 1

Prepare Reset Form Michigan Department Of Treasury Rev 1 effortlessly on any device

Web-based document organization has gained traction among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Reset Form Michigan Department Of Treasury Rev 1 on any platform with airSlate SignNow Android or iOS applications and simplify any document-centric operation today.

The easiest way to modify and eSign Reset Form Michigan Department Of Treasury Rev 1 without hassle

- Obtain Reset Form Michigan Department Of Treasury Rev 1 and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Reset Form Michigan Department Of Treasury Rev 1 and ensure outstanding communication at any step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct reset form michigan department of treasury rev 1

Create this form in 5 minutes!

How to create an eSignature for the reset form michigan department of treasury rev 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 5080 form 2024 and how is it used?

The 5080 form 2024 is an official document required for specific compliance and reporting requirements. It is essential for businesses looking to stay compliant and streamline their documentation process. Using airSlate SignNow, you can easily create, send, and eSign the 5080 form 2024, ensuring efficiency and accuracy in your submissions.

-

How does airSlate SignNow simplify the 5080 form 2024 process?

airSlate SignNow simplifies the 5080 form 2024 process by providing an intuitive platform that allows for easy document creation, signing, and management. Its user-friendly interface ensures that businesses can handle the 5080 form 2024 with minimal training. Additionally, the automated workflows reduce errors and enhance productivity.

-

What are the pricing options for using airSlate SignNow for the 5080 form 2024?

airSlate SignNow offers various pricing plans to fit different business needs when managing the 5080 form 2024. Plans range from basic solutions for startups to comprehensive packages for larger enterprises. This flexibility allows businesses to choose a plan that suits their budget while still addressing the needs for the 5080 form 2024.

-

Does airSlate SignNow offer integrations for managing the 5080 form 2024?

Yes, airSlate SignNow provides seamless integrations with popular tools and software to facilitate the management of the 5080 form 2024. These integrations allow for smooth data transfer and efficient document workflows. As a result, businesses can enhance their document management processes while ensuring compliance.

-

Can I track the status of my 5080 form 2024 submissions with airSlate SignNow?

Absolutely! airSlate SignNow allows users to track the status of their 5080 form 2024 submissions in real-time. This feature lets businesses monitor progress, ensuring that all documents are completed on time and reducing any potential delays in the submission process.

-

What security measures does airSlate SignNow implement for the 5080 form 2024?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the 5080 form 2024. The platform uses advanced encryption and secure storage to protect user data. Additionally, compliance with industry standards ensures that all transactions involving the 5080 form 2024 are safe and secure.

-

Is it easy to collaborate with team members on the 5080 form 2024 using airSlate SignNow?

Yes, airSlate SignNow facilitates easy collaboration among team members when working on the 5080 form 2024. The platform allows multiple users to access, edit, and sign the document simultaneously, improving teamwork and reducing the turnaround time for submissions. This collaborative approach enhances overall productivity.

Get more for Reset Form Michigan Department Of Treasury Rev 1

Find out other Reset Form Michigan Department Of Treasury Rev 1

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document