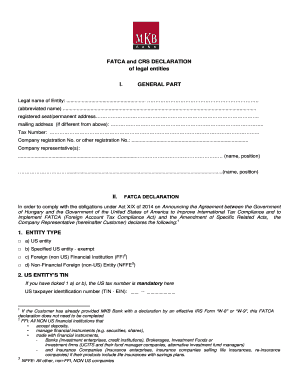

FATCA and CRS DECLARATION of Legal Entities I MKB Bank Form

What is the FATCA and CRS Declaration of Legal Entities I MKB Bank

The FATCA and CRS Declaration of Legal Entities I MKB Bank is a critical document that facilitates compliance with international tax regulations. FATCA, or the Foreign Account Tax Compliance Act, aims to prevent tax evasion by U.S. taxpayers holding accounts outside the United States. The Common Reporting Standard (CRS) is a global standard for the automatic exchange of financial account information between governments. This declaration ensures that legal entities, such as corporations and partnerships, provide necessary information about their tax residency and ownership structure to comply with these regulations.

Steps to Complete the FATCA and CRS Declaration of Legal Entities I MKB Bank

Completing the FATCA and CRS Declaration involves several key steps:

- Gather required information about the legal entity, including its tax identification number and country of incorporation.

- Identify the controlling persons of the entity, as their tax residency information must also be reported.

- Fill out the declaration form accurately, ensuring that all information is current and complete.

- Review the completed form for any errors or omissions before submission.

- Submit the form to MKB Bank through the designated channels, whether online or via mail.

Legal Use of the FATCA and CRS Declaration of Legal Entities I MKB Bank

The FATCA and CRS Declaration serves a legal purpose by ensuring compliance with U.S. tax laws and international agreements. By submitting this declaration, legal entities confirm their tax status and provide necessary disclosures to avoid penalties associated with non-compliance. This document is essential for maintaining good standing with financial institutions and regulatory bodies, as it helps mitigate risks related to tax evasion and financial crime.

Required Documents for the FATCA and CRS Declaration of Legal Entities I MKB Bank

To complete the FATCA and CRS Declaration, entities must prepare specific documents, including:

- Proof of the entity's legal status, such as articles of incorporation or partnership agreements.

- Tax identification numbers for the entity and its controlling persons.

- Documentation verifying the tax residency of the controlling persons, such as tax returns or residency certificates.

Penalties for Non-Compliance with the FATCA and CRS Declaration of Legal Entities I MKB Bank

Failure to comply with the FATCA and CRS Declaration requirements can result in significant penalties. Legal entities may face fines, increased scrutiny from tax authorities, and potential legal actions. Additionally, financial institutions may impose withholding taxes on certain payments made to non-compliant entities. Understanding these penalties emphasizes the importance of timely and accurate submissions of the declaration.

Examples of Using the FATCA and CRS Declaration of Legal Entities I MKB Bank

Legal entities may encounter various scenarios where the FATCA and CRS Declaration is applicable. For instance:

- A U.S.-based corporation with foreign subsidiaries must declare its foreign accounts and report the tax residency of its controlling persons.

- A partnership with international partners may need to submit the declaration to ensure compliance with both U.S. and foreign tax regulations.

These examples illustrate the importance of the declaration in maintaining compliance and transparency in global financial operations.

Quick guide on how to complete fatca and crs declaration of legal entities i mkb bank

Effortlessly Prepare FATCA And CRS DECLARATION Of Legal Entities I MKB Bank on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly and without interruptions. Manage FATCA And CRS DECLARATION Of Legal Entities I MKB Bank on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The Easiest Way to Edit and eSign FATCA And CRS DECLARATION Of Legal Entities I MKB Bank Without Strain

- Search for FATCA And CRS DECLARATION Of Legal Entities I MKB Bank and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information using tools designed specifically for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes moments and carries the same legal authority as a traditional handwritten signature.

- Review all details and then select the Done button to save your modifications.

- Choose your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and eSign FATCA And CRS DECLARATION Of Legal Entities I MKB Bank while ensuring effective communication at all stages of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fatca and crs declaration of legal entities i mkb bank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FATCA And CRS DECLARATION Of Legal Entities I MKB Bank?

The FATCA And CRS DECLARATION Of Legal Entities I MKB Bank is a compliance solution designed to assist businesses in meeting their tax reporting obligations. This tool simplifies the reporting process, ensuring that legal entities fulfill their requirements under both the FATCA and CRS regulations efficiently and accurately.

-

How does airSlate SignNow facilitate the FATCA And CRS DECLARATION Of Legal Entities I MKB Bank?

airSlate SignNow offers a seamless way to prepare, sign, and store documents related to the FATCA And CRS DECLARATION Of Legal Entities I MKB Bank. The platform provides templates and intuitive workflows to simplify the document management process, helping businesses stay compliant with minimal effort.

-

What features does airSlate SignNow provide for FATCA And CRS DECLARATION Of Legal Entities I MKB Bank?

The features include eSignature capabilities, document templates specifically for FATCA And CRS DECLARATION Of Legal Entities I MKB Bank, secure cloud storage, and tracking options. These functionalities make it easy to manage the declaration process and enhance productivity for legal entities.

-

Is there a cost associated with the FATCA And CRS DECLARATION Of Legal Entities I MKB Bank services?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, including those related to the FATCA And CRS DECLARATION Of Legal Entities I MKB Bank. These plans provide flexibility, allowing users to choose a solution that fits their budget while ensuring compliance.

-

Can airSlate SignNow integrate with existing financial software for FATCA And CRS DECLARATION Of Legal Entities I MKB Bank?

Absolutely! airSlate SignNow integrates seamlessly with numerous financial software applications, making it easier to manage the FATCA And CRS DECLARATION Of Legal Entities I MKB Bank. This integration streamlines workflows and enhances data accuracy for businesses.

-

What are the benefits of using airSlate SignNow for FATCA And CRS DECLARATION Of Legal Entities I MKB Bank?

Using airSlate SignNow for the FATCA And CRS DECLARATION Of Legal Entities I MKB Bank reduces the risk of errors, speeds up the submission process, and ensures compliance. Additionally, the user-friendly interface and robust security features provide peace of mind for businesses managing sensitive information.

-

How can I get started with airSlate SignNow for FATCA And CRS DECLARATION Of Legal Entities I MKB Bank?

Getting started is easy! Simply sign up for an account on airSlate SignNow and explore the templates available for the FATCA And CRS DECLARATION Of Legal Entities I MKB Bank. The platform also offers tutorials and customer support to guide you through the setup process.

Get more for FATCA And CRS DECLARATION Of Legal Entities I MKB Bank

Find out other FATCA And CRS DECLARATION Of Legal Entities I MKB Bank

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT