Form 944 Example

What is the Form 944 Example

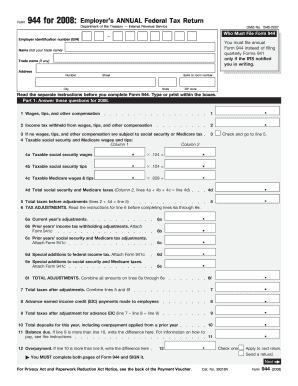

The Form 944 is an annual tax return used by small employers to report their federal payroll tax liabilities. It is designed for businesses that expect to owe less than one thousand dollars in payroll taxes for the year. This form allows eligible employers to file their taxes on a yearly basis rather than quarterly, simplifying the process for those with lower payroll tax obligations. The Form 944 example serves as a template for understanding how to complete the form accurately.

How to use the Form 944 Example

Using the Form 944 example involves several steps. First, employers need to gather all relevant payroll records for the year, including wages paid, taxes withheld, and any adjustments. Next, they should fill out the form by entering the required information in the designated fields. This includes reporting total wages, calculating the tax owed, and providing any necessary details about the business. Finally, once the form is completed, it can be submitted to the IRS either electronically or via mail, depending on the employer's preference.

Steps to complete the Form 944 Example

Completing the Form 944 example requires careful attention to detail. Here are the steps involved:

- Gather payroll records, including total wages and tax withholdings.

- Fill in the business information, such as name, address, and Employer Identification Number (EIN).

- Report total wages paid and calculate the payroll taxes owed for the year.

- Include any adjustments or credits that may apply.

- Review the form for accuracy before submission.

Legal use of the Form 944 Example

The Form 944 example is legally binding when completed accurately and submitted in compliance with IRS regulations. Employers must ensure that the information provided is truthful and reflects their actual payroll tax obligations. Failure to comply with IRS guidelines can result in penalties or legal repercussions. Utilizing a reliable digital solution for completing the form can enhance security and ensure compliance with eSignature laws.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the Form 944. The form is due annually on January 31 of the following year. If January 31 falls on a weekend or holiday, the deadline is extended to the next business day. It is crucial for employers to mark these dates on their calendars to avoid late filing penalties. Additionally, any payments owed should be made timely to ensure compliance with federal tax laws.

Form Submission Methods (Online / Mail / In-Person)

The Form 944 can be submitted through various methods, providing flexibility for employers. The options include:

- Online: Employers can file electronically using the IRS e-file system, which is a secure and efficient method.

- Mail: The completed form can be printed and sent to the appropriate IRS address, based on the employer's location.

- In-Person: While not common, some employers may choose to deliver their forms directly to an IRS office.

Quick guide on how to complete form 944 example

Complete Form 944 Example effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to easily locate the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your papers quickly without delays. Handle Form 944 Example on any platform with airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to edit and eSign Form 944 Example with ease

- Find Form 944 Example and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for those purposes by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether it be via email, text message (SMS), invite link, or by downloading it to your computer.

Leave behind the worry of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements through just a few clicks from any device you choose. Modify and eSign Form 944 Example and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 944 example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 944 and how does it work with airSlate SignNow?

Form 944 is an annual payroll tax return used by small businesses to report their federal tax liability. With airSlate SignNow, you can easily eSign and send Form 944 securely, streamlining your payroll reporting process and ensuring compliance.

-

How much does it cost to use airSlate SignNow for Form 944?

airSlate SignNow offers various pricing plans to fit different business needs. All plans provide the essential features for eSigning and sending Form 944, ensuring that you get a cost-effective solution for your document management.

-

Can I integrate airSlate SignNow with other software for Form 944 processing?

Yes, airSlate SignNow seamlessly integrates with popular software applications, allowing you to connect your tools easily for efficient Form 944 processing. This enhances your workflow by automating tasks and eliminating manual data entry.

-

What are the benefits of using airSlate SignNow for Form 944?

Using airSlate SignNow for Form 944 offers numerous benefits including increased efficiency, secure document management, and compliance with IRS regulations. The platform ensures that your tax forms are eSigned and submitted accurately and on time.

-

Is airSlate SignNow compliant with eSignature laws for Form 944?

Absolutely, airSlate SignNow complies with the ESIGN Act and UETA, ensuring that eSignatures on Form 944 are legally binding. This compliance gives you peace of mind while managing your payroll tax submissions.

-

How can I track the status of my Form 944 using airSlate SignNow?

AirSlate SignNow provides tracking features that allow you to monitor the status of your Form 944 at every stage. You will receive notifications when your document is viewed, signed, or completed, ensuring you stay informed.

-

Does airSlate SignNow offer templates for Form 944?

Yes, airSlate SignNow offers customizable templates for Form 944, making the document preparation process quick and straightforward. You can tailor these templates to suit your specific business needs while ensuring all necessary information is included.

Get more for Form 944 Example

Find out other Form 944 Example

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template