Form 13 34 After November 1, Application for Registration of Aircraft and Report of Excise Tax Aircraft Purchased on or After No 2021-2026

Understanding Form 13 34 After November 1

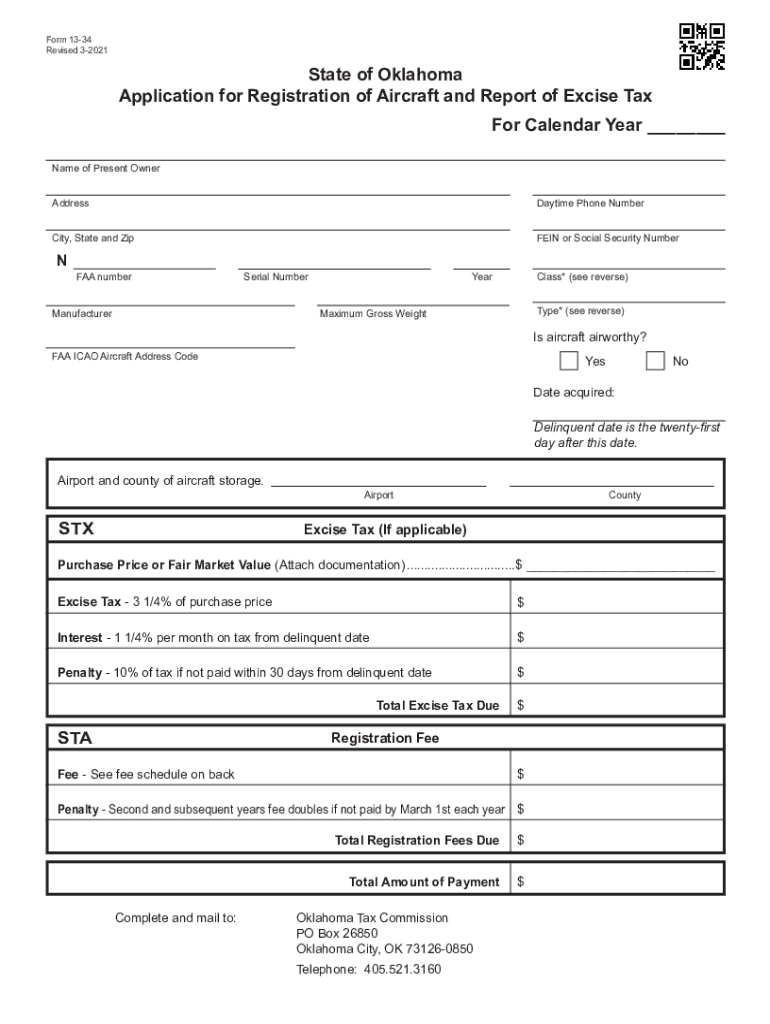

The Form 13 34 After November 1 is a crucial document for individuals and businesses seeking to register an aircraft in the United States. This form also serves as a report of excise tax for aircraft purchased on or after November 1. It is essential for compliance with federal regulations regarding aircraft ownership and taxation. Proper completion of this form ensures that the aircraft is legally registered and that any applicable taxes are reported accurately.

Steps to Complete Form 13 34 After November 1

Completing the Form 13 34 involves several key steps:

- Gather necessary documentation, including proof of purchase and identification.

- Provide accurate details about the aircraft, such as make, model, and serial number.

- Fill in the purchaser's information, including name, address, and contact details.

- Calculate and report the excise tax based on the purchase price of the aircraft.

- Review the completed form for accuracy before submission.

It is advisable to consult with a tax professional if there are any uncertainties regarding the tax calculations or reporting requirements.

How to Obtain Form 13 34 After November 1

Form 13 34 can be obtained through various channels. It is typically available on the official government website responsible for aviation and tax regulation. Additionally, local offices that handle aviation registrations may provide physical copies of the form. Ensuring that you have the most current version of the form is essential, as regulations may change.

Legal Use of Form 13 34 After November 1

The legal use of Form 13 34 is vital for compliance with federal and state regulations regarding aircraft ownership. This form must be filed accurately to avoid penalties and ensure that the aircraft is recognized as legally registered. Misrepresentation or failure to file can lead to legal consequences, including fines or difficulties in transferring ownership in the future.

Key Elements of Form 13 34 After November 1

Several key elements must be included in Form 13 34 to ensure its validity:

- Aircraft identification details, including make, model, and serial number.

- Purchaser's complete contact information.

- Accurate calculation of excise tax based on the purchase price.

- Signature of the purchaser or authorized representative.

Each of these elements plays a critical role in the processing of the form and the subsequent registration of the aircraft.

Filing Deadlines and Important Dates

It is important to be aware of filing deadlines associated with Form 13 34. Typically, the form must be submitted within a specific timeframe following the purchase of the aircraft. Missing these deadlines can result in penalties or complications with the registration process. Keeping track of these dates ensures compliance and helps avoid unnecessary issues.

Quick guide on how to complete form 13 34 after november 1 application for registration of aircraft and report of excise tax aircraft purchased on or after

Effortlessly Prepare Form 13 34 After November 1, Application For Registration Of Aircraft And Report Of Excise Tax Aircraft Purchased On Or After No on Any Device

Digital document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Handle Form 13 34 After November 1, Application For Registration Of Aircraft And Report Of Excise Tax Aircraft Purchased On Or After No on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

Edit and eSign Form 13 34 After November 1, Application For Registration Of Aircraft And Report Of Excise Tax Aircraft Purchased On Or After No with Ease

- Obtain Form 13 34 After November 1, Application For Registration Of Aircraft And Report Of Excise Tax Aircraft Purchased On Or After No and click Get Form to begin.

- Make use of the tools provided to fill out your form.

- Emphasize important sections of your documents or obscure confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form navigation, or errors requiring new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choosing. Edit and eSign Form 13 34 After November 1, Application For Registration Of Aircraft And Report Of Excise Tax Aircraft Purchased On Or After No to ensure clear communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 13 34 after november 1 application for registration of aircraft and report of excise tax aircraft purchased on or after

Create this form in 5 minutes!

How to create an eSignature for the form 13 34 after november 1 application for registration of aircraft and report of excise tax aircraft purchased on or after

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 13 34 After November 1, Application For Registration Of Aircraft?

The Form 13 34 After November 1, Application For Registration Of Aircraft is a crucial document that must be completed to register an aircraft purchased on or after November 1. This form collects essential information regarding aircraft details and ownership. Ensuring accuracy on this form is vital to comply with related regulations.

-

How does the Form 13 34 After November 1 impact excise tax for aircraft purchases?

The Form 13 34 After November 1 is also used to report excise tax on aircraft purchased after this date. Accurate completion of this form ensures proper reporting of the excise tax owed, thus preventing future penalties. airSlate SignNow simplifies this process by providing tools that make tax reporting straightforward.

-

What features does airSlate SignNow offer for completing Form 13 34 After November 1?

airSlate SignNow offers user-friendly features such as eSignature capabilities, document templates, and collaboration tools for completing the Form 13 34 After November 1 efficiently. You can easily fill out, sign, and send this important document electronically. This streamlines the registration process for aircraft purchases.

-

Is airSlate SignNow suitable for businesses of all sizes to manage Form 13 34 After November 1?

Yes, airSlate SignNow is designed to be scalable and meets the needs of businesses of all sizes. Whether you are a small firm or a large enterprise, its cost-effective solution allows you to manage the Form 13 34 After November 1 effortlessly. This makes it accessible for varying budgets and operational scales.

-

What integrations does airSlate SignNow provide for managing aircraft registration documents?

airSlate SignNow integrates seamlessly with various tools and platforms, making it easier to manage the Form 13 34 After November 1 and related documents. These integrations allow for streamlined workflows, ensuring data from other applications can be easily incorporated. This enhances overall operational efficiency.

-

How does airSlate SignNow ensure the security and compliance of the Form 13 34 After November 1?

airSlate SignNow prioritizes security and compliance by utilizing advanced encryption and secure data storage. This ensures that sensitive information related to the Form 13 34 After November 1 is protected. Additionally, the platform regularly updates its security measures to adhere to the latest regulations and standards.

-

What are the pricing options for using airSlate SignNow for Form 13 34 After November 1?

Pricing for airSlate SignNow is flexible and designed to accommodate varying needs. Plans start at competitive rates, offering core features to help with the Form 13 34 After November 1 process. You can opt for different tiers based on your required functionalities and team size.

Get more for Form 13 34 After November 1, Application For Registration Of Aircraft And Report Of Excise Tax Aircraft Purchased On Or After No

- Tml flexible spending claim reimbursement form port texas

- Add drop withdrawal formindd quincy college

- Palmer staffing services form

- Opers form

- The teacher divided the class into three groups ten form

- Certified birth certificate request form cass county indiana

- Lsu sap appeal form

- President39s volunteer service award pvsa log sheet student39s hscssa form

Find out other Form 13 34 After November 1, Application For Registration Of Aircraft And Report Of Excise Tax Aircraft Purchased On Or After No

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney