OK Resident Fiduciary Income Tax Forms and Instructions

What is the OK Resident Fiduciary Income Tax Forms And Instructions

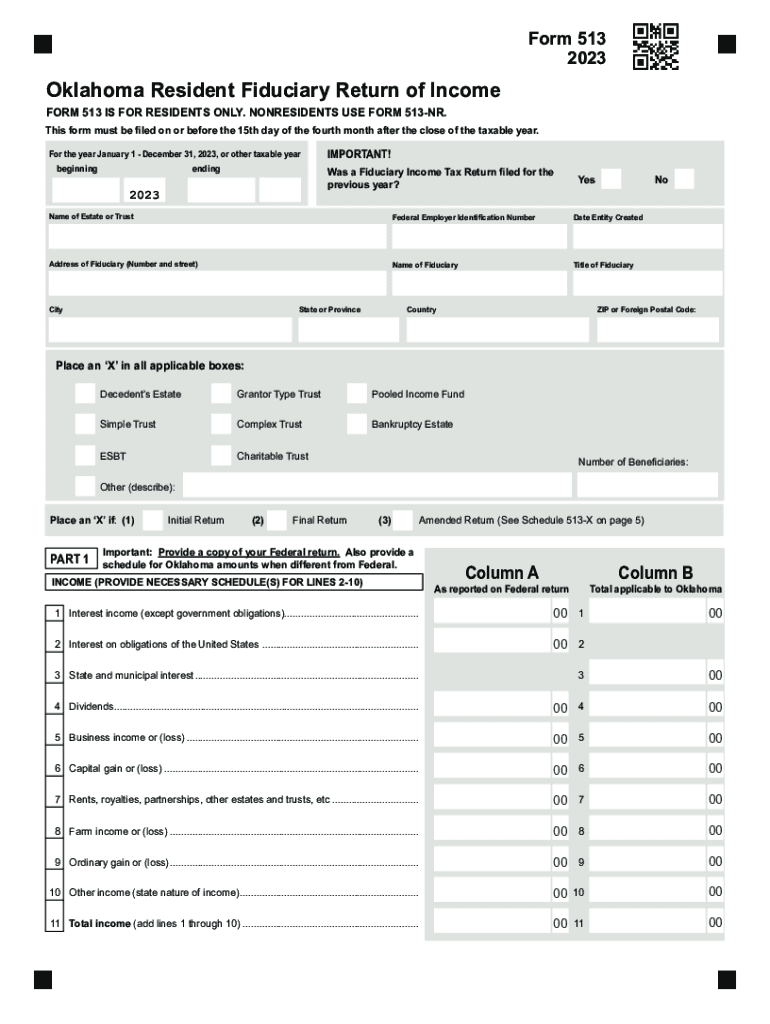

The OK Resident Fiduciary Income Tax Forms and Instructions are essential documents for fiduciaries managing the income tax obligations of estates or trusts in Oklahoma. These forms facilitate the reporting of income earned by the estate or trust, ensuring compliance with state tax laws. Fiduciaries, who are responsible for managing the financial affairs of the deceased or incapacitated individuals, must accurately complete these forms to reflect the income generated during the tax year.

How to use the OK Resident Fiduciary Income Tax Forms And Instructions

Using the OK Resident Fiduciary Income Tax Forms involves several steps. First, fiduciaries should gather all necessary financial documents related to the estate or trust, including income statements, expense records, and any deductions applicable. Next, the fiduciary completes the forms by accurately reporting the income and deductions. It is crucial to follow the instructions carefully to avoid errors that could lead to penalties. Once completed, the forms must be submitted to the appropriate state tax authority by the designated deadline.

Steps to complete the OK Resident Fiduciary Income Tax Forms And Instructions

Completing the OK Resident Fiduciary Income Tax Forms requires careful attention to detail. The following steps outline the process:

- Gather all relevant financial documents, including income and expense records.

- Review the instructions provided with the forms to understand the requirements.

- Fill out the forms, ensuring that all income and deductions are reported accurately.

- Double-check the completed forms for any errors or omissions.

- Submit the forms by mail or electronically, as specified in the instructions.

Filing Deadlines / Important Dates

Filing deadlines for the OK Resident Fiduciary Income Tax Forms are typically aligned with the federal tax deadlines. Fiduciaries should be aware that the forms are generally due on the fifteenth day of the fourth month following the end of the tax year. For estates or trusts operating on a calendar year basis, this means the forms are due by April 15. It is important to check for any specific state extensions or changes to deadlines that may apply.

Required Documents

To complete the OK Resident Fiduciary Income Tax Forms, fiduciaries must prepare several documents, including:

- Income statements from all sources related to the estate or trust.

- Records of expenses incurred during the tax year.

- Documentation supporting any deductions claimed.

- Previous tax returns for the estate or trust, if applicable.

Legal use of the OK Resident Fiduciary Income Tax Forms And Instructions

The OK Resident Fiduciary Income Tax Forms are legally mandated for fiduciaries managing estates or trusts in Oklahoma. Proper completion and submission of these forms ensure compliance with state tax laws. Failure to file these forms can result in penalties and interest on unpaid taxes. Fiduciaries should consult legal or tax professionals if they have questions about their responsibilities or the legal implications of the forms.

Quick guide on how to complete ok resident fiduciary income tax forms and instructions

Accomplish OK Resident Fiduciary Income Tax Forms And Instructions seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage OK Resident Fiduciary Income Tax Forms And Instructions on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to edit and eSign OK Resident Fiduciary Income Tax Forms And Instructions effortlessly

- Find OK Resident Fiduciary Income Tax Forms And Instructions and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign OK Resident Fiduciary Income Tax Forms And Instructions and ensure excellent communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ok resident fiduciary income tax forms and instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are OK Resident Fiduciary Income Tax Forms And Instructions?

OK Resident Fiduciary Income Tax Forms And Instructions are official documents mandated by the state of Oklahoma for reporting income generated by trusts and estates. These forms guide fiduciaries in accurately filing taxes owed on behalf of the entities they manage, ensuring compliance with state tax laws.

-

How can airSlate SignNow assist with filling out OK Resident Fiduciary Income Tax Forms And Instructions?

airSlate SignNow provides a user-friendly interface that simplifies the process of filling out OK Resident Fiduciary Income Tax Forms And Instructions. Our platform allows you to easily input data, digitally sign, and share completed forms, ensuring your tax documents are ready for submission quickly and securely.

-

Are there any costs associated with using airSlate SignNow for OK Resident Fiduciary Income Tax Forms And Instructions?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While there is a subscription fee, the cost is generally offset by the efficiency gained through streamlined document management and eSigning capabilities, specifically for OK Resident Fiduciary Income Tax Forms And Instructions.

-

What features does airSlate SignNow offer for preparing tax documents like OK Resident Fiduciary Income Tax Forms And Instructions?

airSlate SignNow includes several features beneficial for preparing OK Resident Fiduciary Income Tax Forms And Instructions, such as customizable templates, cloud storage, and electronic signatures. These features enhance efficiency and accuracy, ensuring you can manage your documents effortlessly.

-

Is it possible to integrate airSlate SignNow with other software for tax preparation?

Yes, airSlate SignNow seamlessly integrates with various tax preparation software and applications. This integration allows you to manage OK Resident Fiduciary Income Tax Forms And Instructions alongside other financial tools, streamlining your overall workflow and improving productivity.

-

What are the benefits of using airSlate SignNow for OK Resident Fiduciary Income Tax Forms And Instructions?

Using airSlate SignNow for OK Resident Fiduciary Income Tax Forms And Instructions offers several benefits, including reduced paper usage, faster turnaround times, and enhanced document security. These advantages lead to a more efficient tax preparation process and ensure your sensitive information is well-protected.

-

Can airSlate SignNow help me track the status of my OK Resident Fiduciary Income Tax Forms And Instructions?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your OK Resident Fiduciary Income Tax Forms And Instructions. You'll receive notifications when documents are viewed, signed, or completed, giving you complete visibility throughout the process.

Get more for OK Resident Fiduciary Income Tax Forms And Instructions

- Family affidavit form

- This graph shows a ball rolling from a to g form

- Crime incident report form boston university police ucsd

- Naming chemical compounds worksheets form

- App 01 00 nevada business registration 7 12 04 form

- Horizon medical equipment form

- Sports physical clearance form take command jfk dpsk12

- Family information sheet 204020057

Find out other OK Resident Fiduciary Income Tax Forms And Instructions

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document