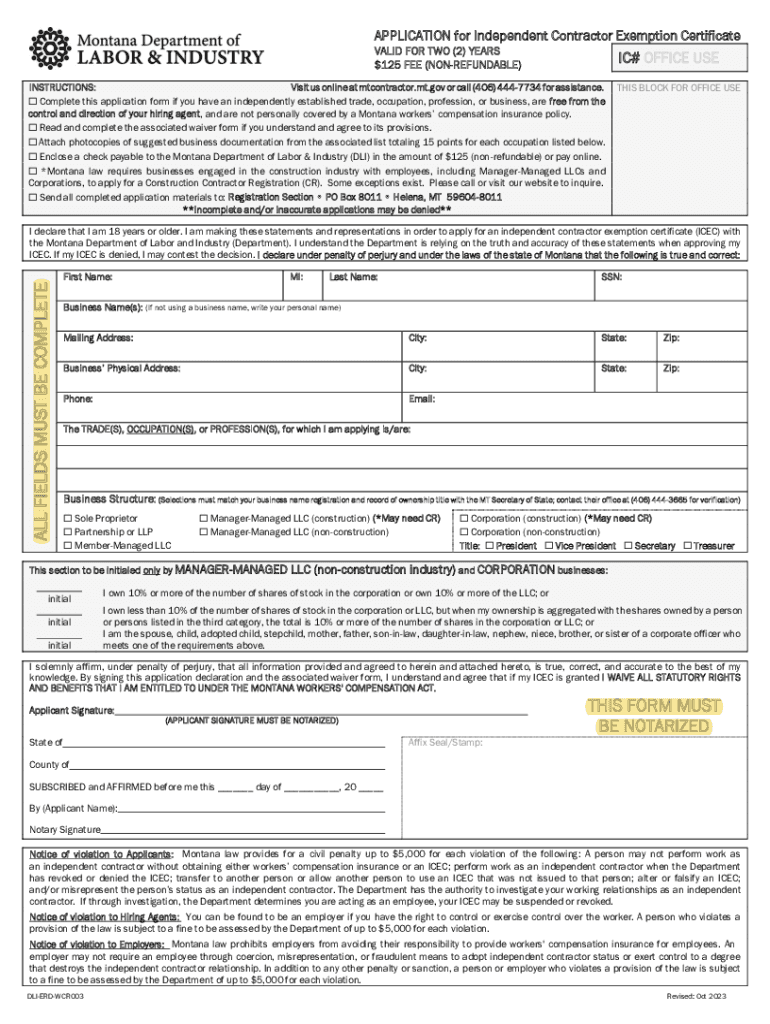

Fillable Online APPLICATION for Independent Contractor Form

What is the Fillable Online Application for Independent Contractor

The Fillable Online Application for Independent Contractor is a digital form designed to streamline the process of applying for independent contractor positions. This form collects essential information about the applicant, including personal details, work experience, and skills relevant to the contracting role. By using an online format, applicants can easily fill out and submit their information, reducing the need for paper forms and enhancing efficiency.

How to Use the Fillable Online Application for Independent Contractor

To use the Fillable Online Application for Independent Contractor, individuals should follow these steps:

- Access the form through the designated platform.

- Complete all required fields, ensuring accuracy in personal and professional information.

- Review the completed application for any errors or omissions.

- Submit the application electronically, following any provided submission guidelines.

Steps to Complete the Fillable Online Application for Independent Contractor

Completing the Fillable Online Application involves several key steps:

- Gather necessary documentation, such as identification and proof of qualifications.

- Fill in personal information, including name, address, and contact details.

- Detail work history, highlighting relevant experience and skills.

- Provide references if required, ensuring they are informed of the application.

- Submit the form and keep a copy for personal records.

Key Elements of the Fillable Online Application for Independent Contractor

Important components of the Fillable Online Application include:

- Personal Information: Name, address, phone number, and email.

- Work Experience: Previous positions held, responsibilities, and duration of employment.

- Skills: Specific skills relevant to the independent contractor role.

- References: Contact information for individuals who can vouch for the applicant's qualifications.

Legal Use of the Fillable Online Application for Independent Contractor

The Fillable Online Application for Independent Contractor must be completed in accordance with applicable laws and regulations. This includes providing truthful information and understanding the terms of engagement as an independent contractor. Misrepresentation can lead to legal consequences and affect future employment opportunities.

Eligibility Criteria

To qualify for using the Fillable Online Application for Independent Contractor, applicants typically need to meet certain criteria, such as:

- Being of legal working age in the United States.

- Possessing relevant skills or qualifications for the contracting work.

- Having a valid identification document.

Quick guide on how to complete fillable online application for independent contractor

Easily Prepare Fillable Online APPLICATION For Independent Contractor on Any Device

The management of online documents has gained popularity among organizations and individuals. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to swiftly create, modify, and electronically sign your documents without any delays. Manage Fillable Online APPLICATION For Independent Contractor across any platform with the airSlate SignNow applications for Android or iOS, and enhance any document-related workflow today.

How to Edit and Electronically Sign Fillable Online APPLICATION For Independent Contractor Effortlessly

- Obtain Fillable Online APPLICATION For Independent Contractor and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method to send your form via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and electronically sign Fillable Online APPLICATION For Independent Contractor to ensure exceptional communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable online application for independent contractor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Fillable Online APPLICATION For Independent Contractor?

A Fillable Online APPLICATION For Independent Contractor is a digital form that allows users to input their information and submit their application remotely. It streamlines the hiring process for independent contractors, making it easier for both applicants and employers. By using this fillable application, businesses can efficiently collect necessary information without the need for paper forms.

-

How can airSlate SignNow help with creating a Fillable Online APPLICATION For Independent Contractor?

airSlate SignNow provides an intuitive platform that allows you to create and customize a Fillable Online APPLICATION For Independent Contractor with ease. You can add fields, set validation rules, and ensure a smooth user experience. This process not only saves time but also enhances the accuracy of the collected data.

-

Is there a cost associated with using airSlate SignNow for creating a Fillable Online APPLICATION For Independent Contractor?

Yes, airSlate SignNow offers a range of pricing plans that cater to different business needs, including options for using a Fillable Online APPLICATION For Independent Contractor. The pricing is competitive, and the value gained from its features far outweighs the cost, especially for businesses looking to streamline their document processes.

-

What features are included in the Fillable Online APPLICATION For Independent Contractor?

The Fillable Online APPLICATION For Independent Contractor includes features such as customizable templates, automatic email notifications, and secure cloud storage. Additionally, it offers eSignature capabilities, ensuring that your application is not only filled out but also signed digitally. This functionality facilitates quicker hiring decisions.

-

How does the Fillable Online APPLICATION For Independent Contractor enhance the hiring process?

Using a Fillable Online APPLICATION For Independent Contractor signNowly speeds up the hiring process. Candidates can submit their applications from anywhere at any time, making it convenient. This results in a more diverse candidate pool and allows employers to quickly review resumes and process applications without unnecessary delays.

-

Are there any integrations available with airSlate SignNow for the Fillable Online APPLICATION For Independent Contractor?

Yes, airSlate SignNow integrates seamlessly with various tools and platforms, enhancing the functionality of the Fillable Online APPLICATION For Independent Contractor. You can connect with popular CRM systems, project management tools, and cloud storage solutions. This integration facilitates a smooth workflow, enabling businesses to manage documents efficiently.

-

Can I track the status of a Fillable Online APPLICATION For Independent Contractor using airSlate SignNow?

Absolutely! airSlate SignNow provides tracking capabilities for every Fillable Online APPLICATION For Independent Contractor submitted. You will receive real-time updates and notifications when applications are opened, completed, or signed. This helps maintain clear communication and keeps the hiring process organized.

Get more for Fillable Online APPLICATION For Independent Contractor

- Cda lesson plan example form

- City and guilds level 2 hairdressing textbook online form

- Ssp form pdf printable

- Form di 7600 form

- Authorization agreement for state medicaid payments ohiohcp form

- Adelanto school district enrollment form

- Vl1a form

- North carolina general warranty deed bryant amp associates home form

Find out other Fillable Online APPLICATION For Independent Contractor

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple