Meals and Rentals Tax Form Department of Revenue

What is the Meals And Rentals Tax Form Department Of Revenue

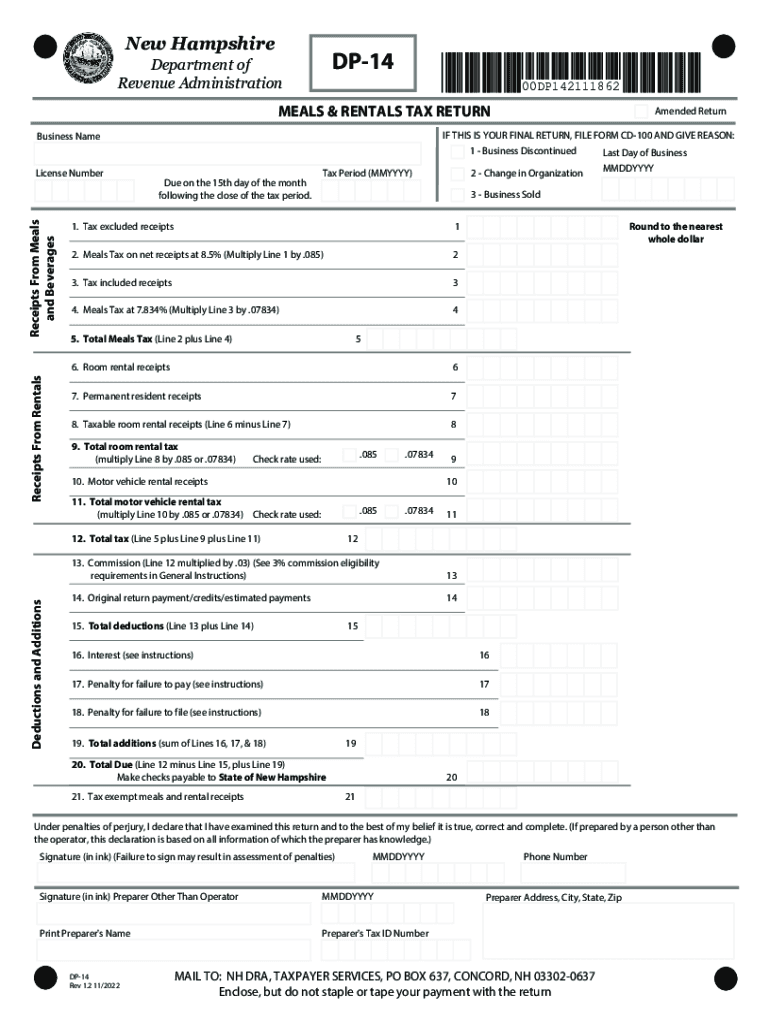

The Meals And Rentals Tax Form is a specific document required by the Department Of Revenue for businesses involved in providing meals and rental services. This form is essential for reporting and remitting taxes collected from customers. It is typically used by restaurants, hotels, and other businesses that offer meals and rental accommodations. The form ensures compliance with state tax regulations and helps maintain transparency in financial reporting.

How to use the Meals And Rentals Tax Form Department Of Revenue

Using the Meals And Rentals Tax Form involves several key steps. First, businesses must accurately collect the appropriate tax from customers at the point of sale. Next, they must fill out the form with details regarding the total sales, the amount of tax collected, and any exemptions that may apply. Once completed, the form should be submitted to the Department Of Revenue along with the tax payment. It's crucial to keep a copy of the submitted form for record-keeping and future reference.

Steps to complete the Meals And Rentals Tax Form Department Of Revenue

Completing the Meals And Rentals Tax Form requires careful attention to detail. Follow these steps:

- Gather all sales records related to meals and rentals for the reporting period.

- Calculate the total sales amount and the corresponding tax collected.

- Fill in the required fields on the form, including business information and tax amounts.

- Review the form for accuracy to avoid errors that could lead to penalties.

- Submit the completed form along with the tax payment by the due date.

Filing Deadlines / Important Dates

Filing deadlines for the Meals And Rentals Tax Form can vary by state, but generally, businesses should be aware of the following important dates:

- Monthly filers typically must submit their forms by the 20th of the following month.

- Quarterly filers usually have deadlines on the last day of the month following the quarter.

- Annual filers should check for specific dates set by their state’s Department Of Revenue.

Form Submission Methods

The Meals And Rentals Tax Form can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission through the Department Of Revenue’s website, which may offer a streamlined process.

- Mailing a paper copy of the form to the designated address provided by the state.

- In-person submission at local Department Of Revenue offices, which may be required for certain situations.

Penalties for Non-Compliance

Failure to comply with the requirements of the Meals And Rentals Tax Form can result in significant penalties. Common consequences include:

- Late filing penalties, which can accrue daily until the form is submitted.

- Interest on unpaid taxes, which may increase the total amount owed.

- Potential audits or further scrutiny from the Department Of Revenue if discrepancies are found.

Quick guide on how to complete meals and rentals tax form department of revenue

Effortlessly prepare Meals And Rentals Tax Form Department Of Revenue on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly and without any holdups. Manage Meals And Rentals Tax Form Department Of Revenue on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

Ways to edit and electronically sign Meals And Rentals Tax Form Department Of Revenue with ease

- Locate Meals And Rentals Tax Form Department Of Revenue and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that function.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious search for forms, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Meals And Rentals Tax Form Department Of Revenue and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the meals and rentals tax form department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Meals And Rentals Tax Form Department Of Revenue used for?

The Meals And Rentals Tax Form Department Of Revenue is utilized by businesses to report and remit tax on meals and rental transactions. It ensures compliance with local tax regulations and helps businesses avoid penalties. Proper use of this form is essential for maintaining good standing with the tax authority.

-

How can airSlate SignNow assist with the Meals And Rentals Tax Form Department Of Revenue?

airSlate SignNow streamlines the process of completing and submitting the Meals And Rentals Tax Form Department Of Revenue electronically. Our platform allows you to eSign and send the form quickly, reducing paperwork and saving time. This efficiency helps businesses remain compliant and focused on growth.

-

Is there a cost associated with using airSlate SignNow for the Meals And Rentals Tax Form Department Of Revenue?

Yes, airSlate SignNow offers various pricing plans to suit different business needs when handling the Meals And Rentals Tax Form Department Of Revenue. Our pricing is transparent, and we provide a cost-effective solution to meet your document management needs. Explore our plans to find the best fit for your organization.

-

Can I integrate airSlate SignNow with accounting software for the Meals And Rentals Tax Form Department Of Revenue?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, allowing you to manage the Meals And Rentals Tax Form Department Of Revenue alongside your financial records. This integration simplifies tracking and ensures accuracy in reporting, making tax season less stressful.

-

What features does airSlate SignNow offer for the Meals And Rentals Tax Form Department Of Revenue?

airSlate SignNow provides a host of features tailored for the Meals And Rentals Tax Form Department Of Revenue, including customizable templates, eSignature capabilities, and secure document storage. These features help streamline tax preparation and filing, ensuring compliance with ease and efficiency.

-

How secure is the process of submitting the Meals And Rentals Tax Form Department Of Revenue through airSlate SignNow?

Security is a top priority at airSlate SignNow. When you submit the Meals And Rentals Tax Form Department Of Revenue through our platform, your documents are encrypted and securely stored. Rest assured, your sensitive information is protected throughout the entire process.

-

What are the benefits of using airSlate SignNow for the Meals And Rentals Tax Form Department Of Revenue?

Using airSlate SignNow for the Meals And Rentals Tax Form Department Of Revenue offers numerous benefits, including increased efficiency, reduced errors, and faster processing times. By automating the signature and submission process, businesses can save valuable time and resources while ensuring compliance with tax regulations.

Get more for Meals And Rentals Tax Form Department Of Revenue

Find out other Meals And Rentals Tax Form Department Of Revenue

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document