Form 500es Fillable Form

What is the Form 500es Fillable Form

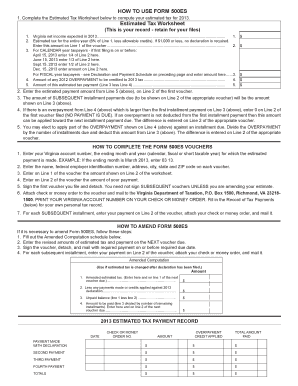

The Form 500es Fillable Form is a specific document used for tax purposes in the United States. It is designed to assist taxpayers in reporting their estimated tax payments to the appropriate state revenue department. This form is particularly useful for individuals and businesses that need to make quarterly estimated tax payments. By utilizing a fillable format, users can easily enter their information digitally, ensuring accuracy and efficiency in completing their tax obligations.

How to use the Form 500es Fillable Form

Using the Form 500es Fillable Form involves several straightforward steps. First, download the form from a reliable source or access it through a digital platform that supports electronic signatures. Next, enter the required information, including your personal details and estimated tax amounts. After filling out the form, review it carefully to ensure all entries are correct. Finally, submit the completed form electronically or print it for mailing, depending on your preference and the submission guidelines provided by your state’s tax authority.

Steps to complete the Form 500es Fillable Form

Completing the Form 500es Fillable Form can be broken down into clear steps:

- Access the form through a trusted platform.

- Fill in your name, address, and Social Security number or Employer Identification Number (EIN).

- Calculate your estimated tax liability based on your income projections.

- Enter the payment amounts for each quarter as required.

- Review the form for any errors or omissions.

- Submit the form electronically or print it for mailing.

Legal use of the Form 500es Fillable Form

The legal use of the Form 500es Fillable Form is governed by state tax laws. When completed and submitted correctly, this form serves as a formal declaration of your estimated tax payments. It is essential to ensure compliance with all relevant regulations to avoid penalties. Using a secure platform for electronic submission can enhance the legal standing of your document, as it provides a digital certificate and maintains compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 500es Fillable Form typically align with the quarterly estimated tax payment schedule set by the IRS or state tax authorities. Generally, these deadlines fall on the fifteenth day of April, June, September, and January. It is crucial to adhere to these dates to avoid late fees or interest on unpaid taxes. Marking your calendar with these important dates can help ensure timely submissions.

Form Submission Methods (Online / Mail / In-Person)

The Form 500es Fillable Form can be submitted through various methods, depending on state guidelines. Common submission options include:

- Online submission via the state tax authority's website, which often allows for immediate processing.

- Mailing a printed copy of the form to the designated address for your state.

- In-person submission at local tax offices, where assistance may also be available.

Choosing the right submission method can impact the processing time and convenience of your filing experience.

Quick guide on how to complete form 500es fillable form

Prepare Form 500es Fillable Form effortlessly on any device

Online document management has surged in popularity among organizations and individuals. It presents an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Form 500es Fillable Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-based operation today.

The simplest way to alter and eSign Form 500es Fillable Form seamlessly

- Acquire Form 500es Fillable Form and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign Form 500es Fillable Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 500es fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Form 500es Fillable Form?

The Form 500es Fillable Form is a digital form that allows users to complete and submit their documentation electronically. This form is designed for convenience and efficiency, making it easier for businesses to manage their documentation needs. With the Form 500es Fillable Form, users can save time and reduce the risk of errors.

-

How can I access the Form 500es Fillable Form?

To access the Form 500es Fillable Form, simply visit the airSlate SignNow platform where you can find a selection of fillable forms. Our easy-to-navigate interface enables users to locate and utilize the Form 500es Fillable Form effortlessly. Once accessed, you can fill it out directly online and send it for electronic signature.

-

Is there a cost associated with using the Form 500es Fillable Form?

airSlate SignNow offers competitive pricing plans that include access to the Form 500es Fillable Form. We provide various subscription options that cater to different business needs, ensuring that our solution remains cost-effective. You can choose a plan that best fits your budget while benefiting from our features.

-

What features are included with the Form 500es Fillable Form?

The Form 500es Fillable Form comes with features like easy editing, document tracking, and the ability to add electronic signatures. These features enhance the usability of the form, making it simple to manage documentation. Additionally, users can customize the Form 500es Fillable Form according to their specific requirements.

-

What are the benefits of using an electronic Form 500es Fillable Form?

Using the electronic Form 500es Fillable Form provides benefits such as faster processing times, reduced paperwork, and increased accuracy. Companies can streamline their operations and ensure that forms are completed and submitted more efficiently. Furthermore, electronic forms help in maintaining a clear digital record.

-

Can the Form 500es Fillable Form be integrated with other software?

Yes, the Form 500es Fillable Form can be easily integrated with various software solutions that enhance your workflow. airSlate SignNow supports numerous integrations with CRM systems, cloud storage, and productivity tools. This allows for a seamless experience when managing your documents across different platforms.

-

How secure is the Form 500es Fillable Form?

The security of the Form 500es Fillable Form is a top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to protect your data during and after submission. Users can have peace of mind knowing that their information is secure while using the Form 500es Fillable Form.

Get more for Form 500es Fillable Form

- Statement of claim for short term recovery ebview form

- Ups poa form

- Chdp program letter 01 11 california department of health care dhcs ca form

- Employee training record template form

- 5 paragraph essay outline form

- Daily vehicle checklist form

- Affidavit for name change after marriage form

- Wti program application template 1520 from form

Find out other Form 500es Fillable Form

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online