Rev 714Form M2848 Power of Attorney and Declarat

What is the Rev 714 Form M-2848 Power of Attorney and Declaration?

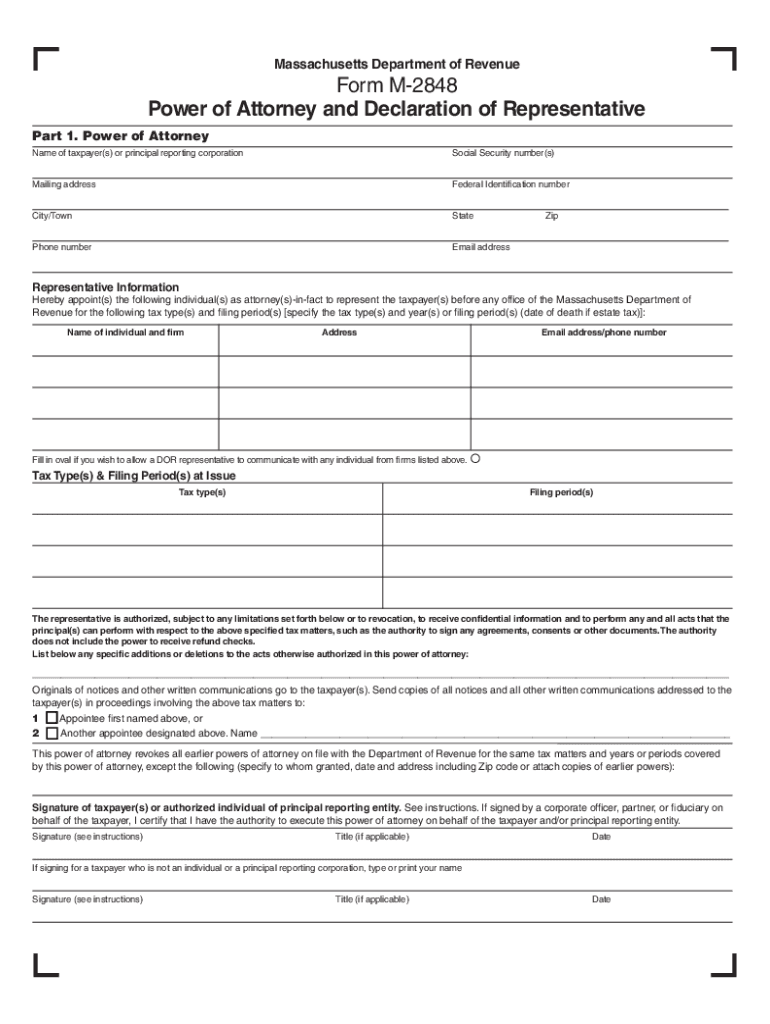

The Rev 714 Form M-2848 is a legal document used in Massachusetts, allowing individuals to appoint an authorized representative to act on their behalf in matters related to tax and other legal affairs. This form is essential for granting power of attorney, enabling the designated representative to communicate with the Massachusetts Department of Revenue (DOR) on behalf of the taxpayer. It is particularly useful for individuals who may not be able to manage their tax affairs due to various reasons, such as being out of state or needing assistance with complex tax issues.

Steps to Complete the Rev 714 Form M-2848

Completing the Rev 714 Form M-2848 involves several important steps:

- Obtain the form: Download the form from the Massachusetts DOR website or obtain a physical copy from a local office.

- Fill in taxpayer information: Provide the full name, address, and Social Security number or taxpayer identification number of the individual granting power of attorney.

- Designate the representative: Include the name, address, and phone number of the person being appointed as the representative.

- Specify the authority: Clearly outline the specific powers being granted to the representative, including any limitations.

- Sign and date: The form must be signed and dated by the taxpayer to validate the power of attorney.

Legal Use of the Rev 714 Form M-2848 Power of Attorney and Declaration

The Rev 714 Form M-2848 is legally binding and must be used in accordance with Massachusetts state laws. This form allows the appointed representative to handle various tax-related matters, such as filing returns, making payments, and addressing any inquiries from the DOR. It is crucial for taxpayers to ensure that the form is filled out accurately to avoid any potential legal issues or disputes regarding the authority granted to the representative.

How to Obtain the Rev 714 Form M-2848 Power of Attorney and Declaration

The Rev 714 Form M-2848 can be obtained through several methods:

- Online: Visit the Massachusetts Department of Revenue website to download the form in PDF format.

- In-person: Visit a local Massachusetts DOR office to request a physical copy of the form.

- By mail: Request a copy by contacting the DOR directly, providing your details for the mailing of the form.

Key Elements of the Rev 714 Form M-2848 Power of Attorney and Declaration

Understanding the key elements of the Rev 714 Form M-2848 is vital for effective use:

- Taxpayer Identification: Accurate identification of the taxpayer is essential for processing.

- Representative Information: Complete details of the appointed representative must be included.

- Scope of Authority: Clearly defined powers help prevent misunderstandings regarding what the representative can and cannot do.

- Signatures: The taxpayer's signature is required to validate the document.

Form Submission Methods for the Rev 714 Form M-2848

Once the Rev 714 Form M-2848 is completed, it can be submitted through various methods:

- Online: Some submissions may be accepted electronically through the Massachusetts DOR's online portal.

- Mail: Send the completed form to the appropriate address provided by the DOR for processing.

- In-person: Deliver the form directly to a local DOR office for immediate processing.

Quick guide on how to complete rev 714form m2848 power of attorney and declarat

Complete Rev 714Form M2848 Power Of Attorney And Declarat effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can obtain the appropriate form and safely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents quickly without delays. Manage Rev 714Form M2848 Power Of Attorney And Declarat on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to modify and eSign Rev 714Form M2848 Power Of Attorney And Declarat without difficulty

- Locate Rev 714Form M2848 Power Of Attorney And Declarat and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Verify all the details and then click the Done button to save your changes.

- Decide how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the issue of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Rev 714Form M2848 Power Of Attorney And Declarat to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rev 714form m2848 power of attorney and declarat

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form m 2848, and why is it important?

The form m 2848 is a document that allows you to authorize someone to represent you before the IRS. It's crucial for ensuring that tax matters are handled efficiently and accurately by your appointed representative. Understanding how to fill out this form is essential for compliance with IRS standards.

-

How can airSlate SignNow help me with my form m 2848?

airSlate SignNow streamlines the process of completing and eSigning your form m 2848. Our platform allows you to fill out the form digitally, ensuring that you don’t miss any important details. This not only saves time but also enhances accuracy and compliance.

-

Is there a cost associated with using airSlate SignNow for form m 2848?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs. Our plans provide you with access to eSigning features, document storage, and more, all while ensuring that using form m 2848 remainscost-effective for your organization. You can choose a plan that best fits your usage requirements.

-

What are the key features of airSlate SignNow relevant to form m 2848?

Key features of airSlate SignNow for form m 2848 include easy document editing, secure eSigning, and tracking capabilities. You can manage your form effortlessly from any device, gain insights into its signing status, and ensure its security throughout the process. This makes handling your tax documents much more efficient.

-

Can I integrate airSlate SignNow with other software for managing form m 2848?

Absolutely! airSlate SignNow supports integrations with various third-party applications, such as CRMs and document management systems. This seamless integration ensures that your form m 2848 is connected with your other business workflows, enhancing efficiency and collaboration.

-

What are the benefits of using airSlate SignNow for eSigning form m 2848?

Using airSlate SignNow provides numerous benefits for eSigning your form m 2848, including enhanced security and compliance. The platform uses advanced encryption to protect your sensitive information while making it easy to track the signing process. This accelerates your tax representation tasks and keeps everything organized.

-

Is airSlate SignNow suitable for small businesses handling form m 2848?

Yes, airSlate SignNow is specifically designed to be cost-effective for small businesses. Its user-friendly interface and affordable pricing plans make it ideal for any company that needs to manage documents like form m 2848 without breaking the bank. Small teams can easily collaborate on this essential tax form.

Get more for Rev 714Form M2848 Power Of Attorney And Declarat

- Sdaie lesson plan template form

- Enterprise income verification system brochure form

- Authorized repeat form peralta colleges web peralta

- Minor traffic form polk county

- Contact lens questionnaire form

- Certification of trust form mf24143 form mf24143 for authorizing ownership of a mutual fund account by a trust

- Leveattest danica pension form

- Time and materials contract template form

Find out other Rev 714Form M2848 Power Of Attorney And Declarat

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free