Are Property Tax Cuts Coming to SLO County Homeowners? Form

Understanding the California Property Tax Exemption

The California property tax exemption provides financial relief to homeowners by reducing the amount of property tax they owe. This exemption is particularly beneficial for individuals who qualify under specific criteria, such as age, disability, or low income. Homeowners can claim this exemption to lower their taxable property value, thus decreasing their overall tax bill. The program is administered by the California State Board of Equalization (BOE), which outlines the eligibility requirements and application process.

Eligibility Criteria for the Homeowners Property Tax Exemption

To qualify for the California homeowners property tax exemption, applicants must meet certain criteria:

- The property must be the applicant's principal residence.

- The homeowner must be at least 18 years old.

- The applicant must be a U.S. citizen or a legal resident.

- The total value of the property must not exceed a specified limit, which can vary based on county regulations.

Additional exemptions may apply for individuals who are seniors, disabled, or veterans. It is important to check with local authorities to understand any specific requirements that may pertain to your situation.

Steps to Complete the Claim for Homeowners Property Tax Exemption

Filing for the California property tax exemption involves several key steps:

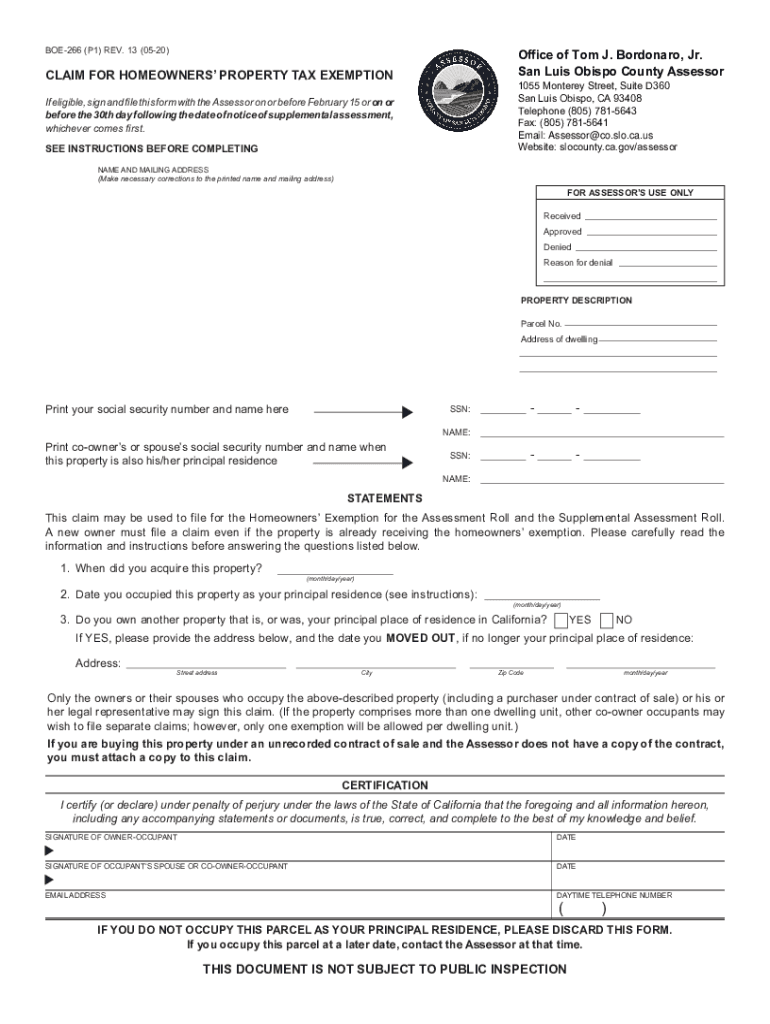

- Obtain the BOE 266 form, also known as the claim form for the homeowners property tax exemption.

- Fill out the form with accurate personal and property information.

- Submit the completed form to your county assessor's office. This can typically be done in person, by mail, or online, depending on the county.

- Keep a copy of the submitted form for your records.

It is crucial to submit the claim by the deadline set by your county to ensure that you receive the exemption for the current tax year.

Required Documents for the Application Process

When applying for the homeowners property tax exemption, certain documents may be required to support your claim:

- Proof of ownership, such as a deed or title to the property.

- Identification documents, like a driver's license or state ID.

- Any relevant financial documents that demonstrate eligibility, such as income statements or disability verification.

Having these documents ready will help streamline the application process and ensure that you meet all requirements.

Form Submission Methods for the BOE 266

The BOE 266 form can be submitted through various methods, allowing homeowners flexibility in how they apply for the exemption:

- Online submission through the county assessor's website, if available.

- Mailing the completed form to the appropriate county office.

- In-person submission at the county assessor's office during business hours.

Choosing the method that best suits your needs can help ensure your application is processed efficiently.

Important Filing Deadlines for the Exemption

Filing deadlines for the California property tax exemption can vary by county, but generally, homeowners should be aware of the following:

- Applications for the exemption must typically be submitted by a specific date each year, often around the end of March.

- Late applications may still be accepted, but they could result in a reduced exemption for that tax year.

Staying informed about these deadlines is essential for maximizing your property tax relief benefits.

Key Elements of the California Property Tax Exemption

Understanding the key elements of the California property tax exemption can help homeowners navigate the process more effectively:

- The exemption amount can reduce the assessed value of the property by a certain dollar amount, which directly impacts the tax owed.

- Homeowners may need to reapply for the exemption if they move or if there are changes in ownership.

- Some counties may offer additional local exemptions or benefits that can be combined with the state exemption.

Familiarizing yourself with these elements can enhance your understanding of the benefits available to you as a homeowner in California.

Quick guide on how to complete are property tax cuts coming to slo county homeowners

Finish Are Property Tax Cuts Coming To SLO County Homeowners? seamlessly on any device

Digital document management has become favored among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without hold-ups. Manage Are Property Tax Cuts Coming To SLO County Homeowners? on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Are Property Tax Cuts Coming To SLO County Homeowners? effortlessly

- Access Are Property Tax Cuts Coming To SLO County Homeowners? and click Get Form to begin.

- Make use of the tools at your disposal to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to secure your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require new document prints. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Are Property Tax Cuts Coming To SLO County Homeowners? and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the are property tax cuts coming to slo county homeowners

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the California property tax exemption?

The California property tax exemption is a benefit that allows eligible homeowners to reduce the amount of property tax they owe. It can signNowly lower tax bills for qualified individuals, including seniors, veterans, and those with disabilities. Understanding this exemption can help you save money and optimize your financial planning.

-

Who qualifies for the California property tax exemption?

To qualify for the California property tax exemption, you typically need to be a homeowner who meets specific criteria, such as age (65 or older), disability status, or being a veteran. Additionally, your property must be your primary residence to be eligible. It's important to check the current state regulations to ensure you meet all requirements.

-

How can airSlate SignNow help with the California property tax exemption application process?

airSlate SignNow simplifies the process of applying for the California property tax exemption by allowing you to electronically sign and send documents securely. Our platform streamlines communication with tax authorities and reduces paperwork, making it easier to manage your exemption application. This intuitive process ensures timely submission and faster approval.

-

Are there any fees associated with the California property tax exemption?

Generally, there are no fees directly associated with applying for the California property tax exemption itself. However, should you choose to use services like airSlate SignNow for managing your documentation, there may be subscription fees. Our affordable pricing models ensure that you have access to efficient tools for your property tax exemption needs.

-

What are the benefits of using airSlate SignNow for property tax related documents?

Using airSlate SignNow provides numerous benefits, including the ability to securely eSign your California property tax exemption applications and related documents. Our platform enhances efficiency through document tracking, reducing processing time, and ensuring that all forms are completed accurately. This leads to faster tax exemption approvals and peace of mind.

-

Does airSlate SignNow integrate with other tax software for managing property taxes?

Yes, airSlate SignNow offers integrations with various tax software solutions to facilitate seamless document management related to the California property tax exemption. These integrations can help you keep better track of your financial documentation and simplify the filing process. Utilizing our platform alongside your tax software enhances your overall productivity.

-

Can I use airSlate SignNow on mobile devices for my California property tax exemption needs?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing you to manage your California property tax exemption documents on-the-go. Whether you're completing forms or sending them for signatures, our mobile-friendly platform ensures that you have access to your important tax documents anytime, anywhere.

Get more for Are Property Tax Cuts Coming To SLO County Homeowners?

- The mohicans waiver release of liability assumption of risk and indemnity agreement form

- Dermfrac consent form

- Health risk assessment form 44579153

- Make sure you read all the instructions before you complete this declaration form

- Labor order form inform or request labor from iatse local 835 iatse835

- Motorcycle depost receipt form

- Motion to open judgment civil matters other than small claims and housing matters state of connecticut superior court www jud ct form

- Foot and ankle specialists of the mid atlantic new patient form large type format

Find out other Are Property Tax Cuts Coming To SLO County Homeowners?

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer