Tax Registration Certificate 2007

What is the Tax Registration Certificate

The Tax Registration Certificate is an official document issued by the state of California that confirms a business's registration for tax purposes. This certificate is essential for businesses operating within the state, as it provides proof that the business is compliant with state tax laws. It typically includes important information such as the business name, address, and tax identification number. Obtaining this certificate is a crucial step for any business owner to ensure they meet local tax obligations.

How to Obtain the Tax Registration Certificate

To obtain a Tax Registration Certificate in California, a business owner must follow several steps. First, they need to register their business with the California Secretary of State, which can often be done online or via mail. After registering, the next step is to apply for a tax identification number through the California Department of Tax and Fee Administration (CDTFA). Once the application is processed, the business will receive the Tax Registration Certificate, which may be sent via email or postal mail, depending on the submission method.

Key Elements of the Tax Registration Certificate

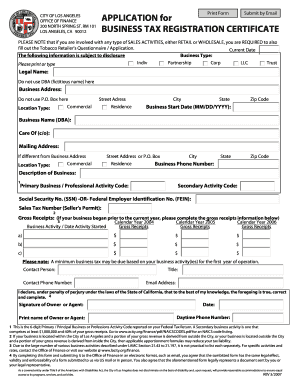

A Tax Registration Certificate typically includes several key elements that are important for both the business owner and tax authorities. These elements include:

- Business Name: The registered name of the business.

- Business Address: The physical location where the business operates.

- Tax Identification Number: A unique number assigned to the business for tax purposes.

- Date of Issue: The date when the certificate was issued.

- Expiration Date: The date by which the certificate must be renewed, if applicable.

Steps to Complete the Tax Registration Certificate

Completing the Tax Registration Certificate involves a series of steps that ensure all necessary information is accurately provided. The following steps are generally required:

- Gather necessary business information, including the business name, address, and ownership details.

- Visit the California Department of Tax and Fee Administration website to access the application form.

- Fill out the form, ensuring all sections are completed accurately.

- Submit the form online or print it out and mail it to the appropriate office.

- Wait for confirmation of processing and receipt of the Tax Registration Certificate.

Legal Use of the Tax Registration Certificate

The Tax Registration Certificate serves several legal purposes for businesses in California. It is required for various tax filings and compliance checks. Additionally, it may be needed when applying for business licenses, opening a business bank account, or entering into contracts. The certificate verifies that the business is recognized by the state and is in good standing regarding tax obligations.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for maintaining compliance with tax regulations. Businesses must be aware of the following important dates:

- Initial Registration Deadline: New businesses should register and obtain their Tax Registration Certificate before commencing operations.

- Annual Renewal: Depending on the business structure, some certificates may require annual renewal.

- Quarterly Tax Filing Dates: Businesses must file their taxes quarterly, and the Tax Registration Certificate may be needed during these filings.

Quick guide on how to complete tax registration certificate

Complete Tax Registration Certificate effortlessly on any device

Web-based document management has gained traction among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Tax Registration Certificate on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The most efficient way to modify and eSign Tax Registration Certificate with ease

- Locate Tax Registration Certificate and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), an invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Tax Registration Certificate and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax registration certificate

Create this form in 5 minutes!

How to create an eSignature for the tax registration certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is California business tax registration?

California business tax registration is the process of registering your business with the California Department of Tax and Fee Administration (CDTFA) to comply with state tax laws. This registration is essential for obtaining necessary permits and paying applicable taxes, ensuring your business operates legally within California.

-

Why is California business tax registration important for new businesses?

California business tax registration is crucial for new businesses as it formalizes your business entity and allows you to collect sales tax, if applicable. It also helps avoid legal issues and ensures you're up to date with state tax obligations, ultimately contributing to your business's success.

-

What documents are needed for California business tax registration?

To complete California business tax registration, you'll typically need your business name, address, and the type of business entity you're forming. You may also need to provide identification, such as a driver's license or Social Security number, along with any relevant permits or licenses for specific industries.

-

How much does it cost to register for California business tax?

The cost for California business tax registration varies depending on your business type and structure. Generally, initial registration fees can range from $50 to several hundred dollars, with potential ongoing fees tied to the taxes you collect. It's advisable to check the CDTFA website for specific fees related to your business.

-

Can I complete California business tax registration online?

Yes, you can complete California business tax registration online through the California Department of Tax and Fee Administration's website. This convenient service allows you to fill out your application and submit it digitally, streamlining the registration process and saving you time.

-

What are the benefits of using airSlate SignNow for California business tax registration?

Using airSlate SignNow while managing your California business tax registration can simplify document creation and eSignature processes. With its user-friendly platform, you can quickly prepare, send, and sign essential documents, ensuring a seamless registration process that meets all state requirements.

-

Does airSlate SignNow integrate with accounting software for tax purposes?

Yes, airSlate SignNow offers integrations with various accounting software that can assist with managing your California business tax registration and ongoing tax obligations. These integrations help streamline data entry, ensure consistency in records, and enhance overall efficiency in handling tax-related documents.

Get more for Tax Registration Certificate

- Sports equipment inventory template 67209794 form

- Scottsdale terrorism form

- Customs and excise clients form

- Turo incident card form

- Ime form

- Examiner report for instrument rating a skill test form

- Anerkennung einer weiterbildungsveranstaltung rlp de form

- Erkrung zum datenaustausch ber eine datenaustauschplattform fr zwecke der auenprfung datenaustauschplattform betriebsprfung

Find out other Tax Registration Certificate

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later