December S 211 SST Wisconsin Streamlined Sales and Use Tax Agreement Exemption Certificate and Instructions 2022-2026

Understanding the WI S 211 SST Form

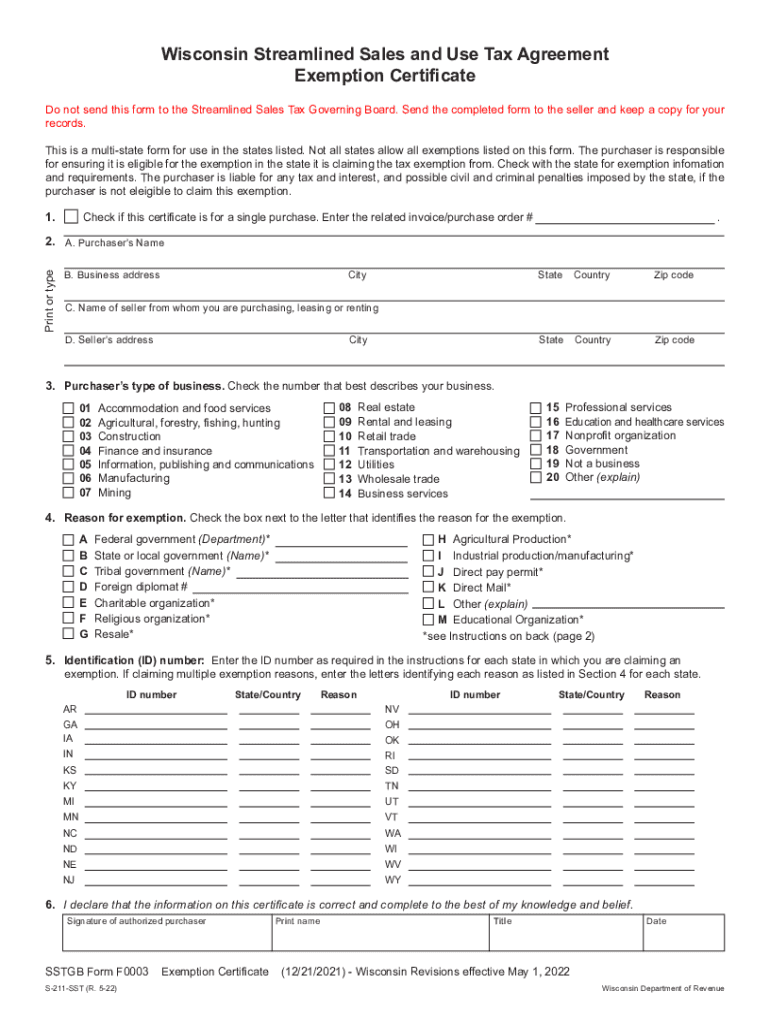

The WI S 211 SST form, also known as the Wisconsin Streamlined Sales and Use Tax Agreement Exemption Certificate, is a crucial document for businesses and individuals seeking to claim exemptions from sales and use tax in Wisconsin. This form is specifically designed to facilitate tax-exempt purchases for qualifying entities, such as government agencies, non-profit organizations, and certain types of businesses. Understanding the purpose and requirements of this form is essential for compliance with state tax regulations.

Steps to Complete the WI S 211 SST Form

Completing the WI S 211 SST form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the buyer's details, the seller's information, and the specific reason for the exemption. Next, fill out the form by providing the required details in each section. It is important to review the completed form for any errors or omissions before submission. Finally, submit the form to the seller, retaining a copy for your records to demonstrate compliance if needed.

Eligibility Criteria for Using the WI S 211 SST Form

To utilize the WI S 211 SST form, certain eligibility criteria must be met. Generally, the form is applicable to purchasers who are exempt from sales and use tax under Wisconsin law. This includes government entities, non-profit organizations, and specific types of businesses that meet the qualifications outlined in the Wisconsin sales tax regulations. It is important to ensure that the reason for exemption aligns with the state’s criteria to avoid any potential issues during audits.

Legal Use of the WI S 211 SST Form

The legal use of the WI S 211 SST form is governed by Wisconsin's tax laws. This form serves as a declaration of the buyer’s eligibility for tax exemption and must be completed accurately to be valid. Misuse of the form, such as claiming exemptions without proper justification, can result in penalties. It is essential for users to familiarize themselves with the legal implications of using this form to ensure compliance and avoid potential legal issues.

Obtaining the WI S 211 SST Form

The WI S 211 SST form can be obtained through the Wisconsin Department of Revenue's website or directly from authorized tax professionals. It is important to ensure that you are using the most current version of the form, as updates may occur. Users should also verify that they have all necessary information and documentation ready when requesting or downloading the form to streamline the process.

Key Elements of the WI S 211 SST Form

Key elements of the WI S 211 SST form include the purchaser’s name, address, and tax identification number, as well as the seller’s information. Additionally, the form requires a clear indication of the exemption reason, which must correspond with the applicable tax laws. Accurate completion of these elements is vital for the form’s acceptance and to ensure that the exemption is honored by the seller.

Examples of Using the WI S 211 SST Form

Examples of using the WI S 211 SST form include scenarios where non-profit organizations purchase supplies for charitable events or government agencies acquire equipment for public use. In these cases, the form allows these entities to make purchases without incurring sales tax, provided they meet the eligibility criteria. Understanding these examples can help clarify the practical applications of the form and reinforce compliance with tax regulations.

Quick guide on how to complete december s 211 sst wisconsin streamlined sales and use tax agreement exemption certificate and instructions

Complete December S 211 SST Wisconsin Streamlined Sales And Use Tax Agreement Exemption Certificate And Instructions effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal environmentally friendly substitute to traditional printed and signed documents, enabling you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any holdups. Manage December S 211 SST Wisconsin Streamlined Sales And Use Tax Agreement Exemption Certificate And Instructions on any platform using the airSlate SignNow mobile applications for Android or iOS and streamline any document-related tasks today.

How to modify and electronically sign December S 211 SST Wisconsin Streamlined Sales And Use Tax Agreement Exemption Certificate And Instructions with ease

- Obtain December S 211 SST Wisconsin Streamlined Sales And Use Tax Agreement Exemption Certificate And Instructions and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a standard ink signature.

- Review the details and then click on the Done button to preserve your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from your chosen device. Alter and electronically sign December S 211 SST Wisconsin Streamlined Sales And Use Tax Agreement Exemption Certificate And Instructions and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct december s 211 sst wisconsin streamlined sales and use tax agreement exemption certificate and instructions

Create this form in 5 minutes!

How to create an eSignature for the december s 211 sst wisconsin streamlined sales and use tax agreement exemption certificate and instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the wi s 211 sst form and how is it used?

The wi s 211 sst form is a specific document used in the state of Wisconsin for sales and use tax reporting. It is essential for businesses to ensure compliance with state tax regulations. By utilizing the wi s 211 sst form with airSlate SignNow, users can easily fill out, sign, and send this form electronically.

-

How does airSlate SignNow simplify the process of completing the wi s 211 sst form?

airSlate SignNow provides a user-friendly interface that allows users to complete the wi s 211 sst form online. With our platform, you can fill in the necessary details, e-sign the document, and share it securely in just a few clicks. This streamlines the process, eliminates paperwork, and enhances efficiency.

-

Can I integrate airSlate SignNow with other tools for managing the wi s 211 sst form?

Yes, airSlate SignNow offers various integrations with popular applications that help in managing the wi s 211 sst form. You can connect with platforms like Google Drive, Dropbox, and more to store and share your signed documents seamlessly. This makes the document management process more efficient.

-

Is there a cost associated with using the wi s 211 sst form on airSlate SignNow?

airSlate SignNow provides a cost-effective solution for businesses looking to use the wi s 211 sst form. Our pricing plans are designed to accommodate different business sizes and needs, ensuring that you only pay for what you use. You can start with a free trial to explore our features.

-

What benefits will I gain from using airSlate SignNow for the wi s 211 sst form?

Using airSlate SignNow for the wi s 211 sst form offers several benefits, including fast processing times, reduced errors, and greater compliance with state regulations. Additionally, the ease of electronic signatures ensures that you can get your documents signed quickly, boosting productivity in your business.

-

How secure is the data when using airSlate SignNow for the wi s 211 sst form?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like the wi s 211 sst form. We implement advanced encryption and secure cloud storage to protect your data. This ensures that your information remains confidential and safely managed throughout the signing process.

-

Can I access the wi s 211 sst form on mobile devices?

Absolutely! airSlate SignNow provides mobile compatibility, allowing you to access the wi s 211 sst form from your smartphone or tablet. This flexibility means you can complete, sign, and send documents while on the go, making it convenient for busy business professionals.

Get more for December S 211 SST Wisconsin Streamlined Sales And Use Tax Agreement Exemption Certificate And Instructions

- Academic record form distinguished young women distinguishedyw

- Notify party commercial invoices pdf no download needed form

- Authorization to release information uc santa cruz financial aid financialaid ucsc

- Rattlesnakes and men michael bishop correctedqxd form

- Security guard unarmed training verification arizona department of licensing azdps form

- Exhibit b job placement agreement form doc

- Haccp plan for soup form

- Drama camp registration form jacksonville state university jsu

Find out other December S 211 SST Wisconsin Streamlined Sales And Use Tax Agreement Exemption Certificate And Instructions

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip