Form 5564 Notice of Deficiency Waiver

What is the Form 5564 Notice of Deficiency Waiver

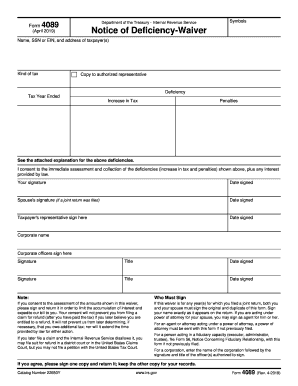

The Form 5564 Notice of Deficiency Waiver is a document used by taxpayers to waive their right to contest a notice of deficiency issued by the Internal Revenue Service (IRS). This form allows taxpayers to accept the IRS's proposed adjustments to their tax return without formally disputing them. By signing this waiver, individuals acknowledge the adjustments and agree to the tax amount owed, which can expedite the resolution process. Understanding this form is crucial for those who wish to resolve tax issues efficiently and avoid prolonged disputes with the IRS.

How to use the Form 5564 Notice of Deficiency Waiver

To use the Form 5564 Notice of Deficiency Waiver, taxpayers must first receive a notice of deficiency from the IRS. This notice outlines the proposed changes to their tax return. Once the taxpayer reviews the notice and decides to accept the changes, they can complete the waiver form. The form requires basic information, including the taxpayer's name, address, and details of the notice received. After filling out the form, the taxpayer must sign and date it, then return it to the IRS as instructed in the notice. This process helps ensure that the taxpayer's acceptance of the deficiency is officially documented.

Steps to complete the Form 5564 Notice of Deficiency Waiver

Completing the Form 5564 Notice of Deficiency Waiver involves several key steps:

- Review the notice of deficiency carefully to understand the proposed changes.

- Obtain the Form 5564 from the IRS or through official IRS resources.

- Fill in the required information, including your personal details and the specifics of the notice.

- Sign and date the form to indicate your acceptance of the changes.

- Submit the completed form to the IRS as directed in the notice.

Following these steps ensures that the waiver is processed correctly, helping to resolve any outstanding tax issues efficiently.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Form 5564 Notice of Deficiency Waiver. Taxpayers should ensure they understand the implications of signing the waiver. By accepting the deficiency, taxpayers forfeit their right to appeal the IRS's findings. It is advisable to consult IRS publications or a tax professional to fully comprehend the consequences of signing the waiver. Additionally, the IRS outlines the timeframe for submitting the form, which is typically within a specific period after receiving the notice of deficiency.

Eligibility Criteria

Eligibility to use the Form 5564 Notice of Deficiency Waiver generally applies to any taxpayer who has received a notice of deficiency from the IRS. This includes individuals, businesses, and entities that have filed tax returns. However, it is essential to review the specific details of the notice to ensure that the proposed adjustments are understood and accepted. Taxpayers who disagree with the adjustments may not be eligible to use this form and should consider other options for disputing the IRS's findings.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5564 Notice of Deficiency Waiver are critical to ensure compliance with IRS regulations. Typically, taxpayers must submit the waiver within a specified timeframe after receiving the notice of deficiency, often within 90 days. Missing this deadline can result in the taxpayer losing their right to contest the IRS's proposed changes. It is important for taxpayers to keep track of these deadlines to avoid unnecessary complications and ensure timely resolution of their tax matters.

Quick guide on how to complete form 5564 notice of deficiency waiver

Prepare Form 5564 Notice Of Deficiency Waiver effortlessly on any device

Online document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form 5564 Notice Of Deficiency Waiver on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 5564 Notice Of Deficiency Waiver with ease

- Obtain Form 5564 Notice Of Deficiency Waiver and then select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal standing as a handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form 5564 Notice Of Deficiency Waiver and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5564 notice of deficiency waiver

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a notice of deficiency waiver?

A notice of deficiency waiver is a document that allows taxpayers to waive their right to receive a notice of deficiency from the IRS before they file an appeal or take further action. This waiver can streamline communication and help resolve tax disputes more efficiently. Using airSlate SignNow, you can easily create and eSign your notice of deficiency waiver.

-

How can airSlate SignNow help with creating a notice of deficiency waiver?

airSlate SignNow offers a user-friendly platform that simplifies the process of drafting and signing a notice of deficiency waiver. With its intuitive interface, you can create custom templates and utilize advanced eSignature capabilities to ensure your document is legally binding. This functionality speeds up the process and enhances accuracy in your tax discussions.

-

Is there a cost associated with using airSlate SignNow for a notice of deficiency waiver?

Yes, there is a cost associated with using airSlate SignNow, but it offers various pricing plans to cater to different business needs. Each plan includes features that support document management, eSigning, and secure storage, making it cost-effective for businesses. You can start with a free trial to explore how it can assist with your notice of deficiency waiver.

-

Can I integrate airSlate SignNow with other tools for managing my notice of deficiency waiver?

Absolutely! airSlate SignNow provides seamless integration with popular tools like Google Drive, Dropbox, and CRMs, enhancing your workflow when preparing a notice of deficiency waiver. These integrations allow you to manage all related documents in one place, ensuring a smoother process for you and your clients.

-

What are the benefits of using airSlate SignNow for a notice of deficiency waiver?

Using airSlate SignNow for a notice of deficiency waiver ensures that you can handle your documents efficiently and securely. The platform offers legally binding eSignatures, cloud storage for easy access, and compliance with regulations. These benefits minimize errors and facilitate quicker resolutions in tax matters.

-

Is airSlate SignNow user-friendly for creating a notice of deficiency waiver?

Yes, airSlate SignNow is designed with user experience in mind, making it highly user-friendly for creating a notice of deficiency waiver. With drag-and-drop features and ready-to-use templates, anyone can navigate the platform easily, regardless of their technical expertise. This accessibility makes the process quicker and more streamlined.

-

How secure is airSlate SignNow when handling a notice of deficiency waiver?

AirSlate SignNow prioritizes security, employing bank-level encryption to protect your documents, including notice of deficiency waivers. Data privacy and compliance are central to the platform’s operations, giving users peace of mind when storing and signing sensitive tax documents. This ensures that your information is always safe and secure.

Get more for Form 5564 Notice Of Deficiency Waiver

- Candidate filing challenge can 1 form

- The waltz by dorothy parker form

- Bloomington grove apartments application form

- Schedule sb form

- Aka letter of recommendation form

- Mvr 605a 444543493 form

- Yahoo emergency disclosure request form 5 21 14 docx

- Initial functional assessment questionnaire spanish gillettechildrens form

Find out other Form 5564 Notice Of Deficiency Waiver

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy