Schedule Sb Form

What is the Schedule SB Form

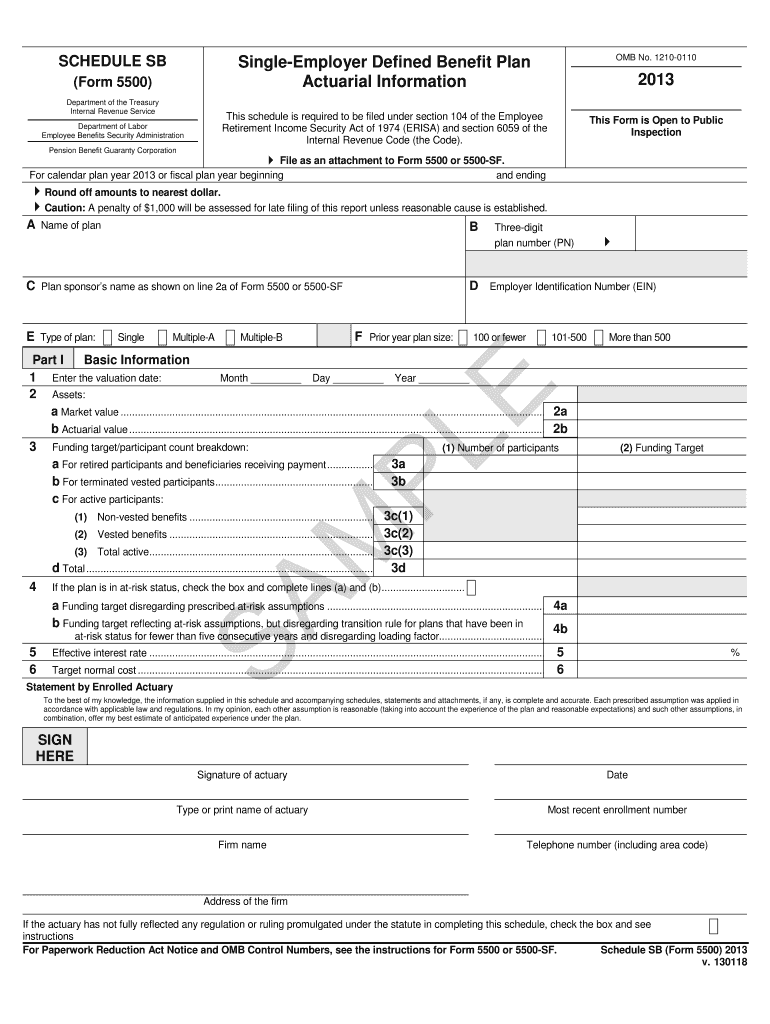

The Schedule SB form is a tax document used by certain businesses to report specific information regarding their pension plans. It is primarily utilized by employers with single-employer defined benefit plans. This form provides the Internal Revenue Service (IRS) with essential details about the funding status of these plans, ensuring compliance with federal regulations. The information collected helps determine whether the plans meet the necessary funding requirements under the Employee Retirement Income Security Act (ERISA).

How to Use the Schedule SB Form

Using the Schedule SB form involves several key steps. First, gather all necessary information regarding your pension plan, including funding levels and actuarial assumptions. Next, complete the form by accurately reporting the plan's assets, liabilities, and any changes from the previous year. Ensure that all calculations are correct, as inaccuracies can lead to penalties. After completing the form, it should be attached to your Form 5500 when filing with the IRS. This ensures that the IRS receives a comprehensive overview of your pension plan's status.

Steps to Complete the Schedule SB Form

Completing the Schedule SB form requires careful attention to detail. Follow these steps for proper completion:

- Review the instructions provided by the IRS for the Schedule SB form.

- Gather financial statements and actuarial reports related to your pension plan.

- Fill out the form, ensuring all required sections are completed accurately.

- Double-check your calculations for funding levels and actuarial assumptions.

- Attach the completed Schedule SB to your Form 5500 before submission.

Legal Use of the Schedule SB Form

The legal use of the Schedule SB form is crucial for maintaining compliance with federal regulations. Employers must file this form annually to report on the funding status of their pension plans. Failure to file can result in penalties, including fines and potential legal action. It is essential to ensure that the information provided is accurate and complete, as discrepancies can lead to audits or additional scrutiny from the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule SB form align with the deadlines for Form 5500. Generally, the form must be filed on the last day of the seventh month following the plan year end. If the plan year ends on December 31, the filing deadline is July 31 of the following year. Extensions may be available, but it is important to adhere to original deadlines to avoid penalties.

Required Documents

To complete the Schedule SB form, several documents are necessary:

- Actuarial valuation reports for the pension plan.

- Financial statements detailing the plan's assets and liabilities.

- Prior year’s Schedule SB form, if applicable, for reference.

- Any additional documentation required by the IRS instructions for the form.

Quick guide on how to complete schedule sb form

Complete Schedule Sb Form effortlessly on any device

Online document management has become popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Schedule Sb Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to alter and eSign Schedule Sb Form without hassle

- Find Schedule Sb Form and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow takes care of your needs in document management in just a few clicks from any device you prefer. Modify and eSign Schedule Sb Form and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule sb form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to schedule an SB form using airSlate SignNow?

Scheduling an SB form with airSlate SignNow is straightforward. Simply log in to your account, select the document you wish to schedule, and navigate to the scheduling settings. You can set a date and time for when the SB form should be sent out, ensuring timely delivery to your recipients.

-

Are there any costs associated with using the schedule SB form feature?

The schedule SB form feature is included in various pricing plans. airSlate SignNow offers several tiers, allowing businesses to choose the option that best suits their needs. Be sure to review our pricing page for detailed information on costs and included features.

-

Can I schedule multiple SB forms at once?

Yes, airSlate SignNow allows you to schedule multiple SB forms simultaneously. This feature is particularly useful for businesses that need to send out multiple documents on specific dates. You can manage and track all scheduled SB forms from your dashboard for easy oversight.

-

What benefits do I gain by scheduling SB forms with airSlate SignNow?

Using airSlate SignNow to schedule SB forms provides signNow advantages, like ensuring timely delivery and saving time on manual sending. You can automate the sending process, which enhances workflow efficiency and reduces the chance of errors. This feature also allows better organization of document management.

-

How secure is the process of scheduling an SB form with airSlate SignNow?

airSlate SignNow prioritizes security in all its operations, including the scheduling of SB forms. Our platform employs industry-standard encryption and complies with data protection regulations, ensuring that your documents remain safe during the entire scheduling and signing process.

-

Can I integrate airSlate SignNow with other tools for better scheduling of SB forms?

Absolutely! airSlate SignNow offers integrations with various third-party applications, enhancing the scheduling process for your SB forms. Whether it's CRM software, project management tools, or email platforms, you can streamline your workflow effectively using our integrations.

-

Is it possible to edit a scheduled SB form before it is sent?

Yes, airSlate SignNow allows you to edit scheduled SB forms at any time before they are sent. You can make necessary changes to the document, add additional recipients, or adjust the send date to ensure that all information is accurate and aligns with your needs.

Get more for Schedule Sb Form

Find out other Schedule Sb Form

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document