Farm Form

What is the farm lease form?

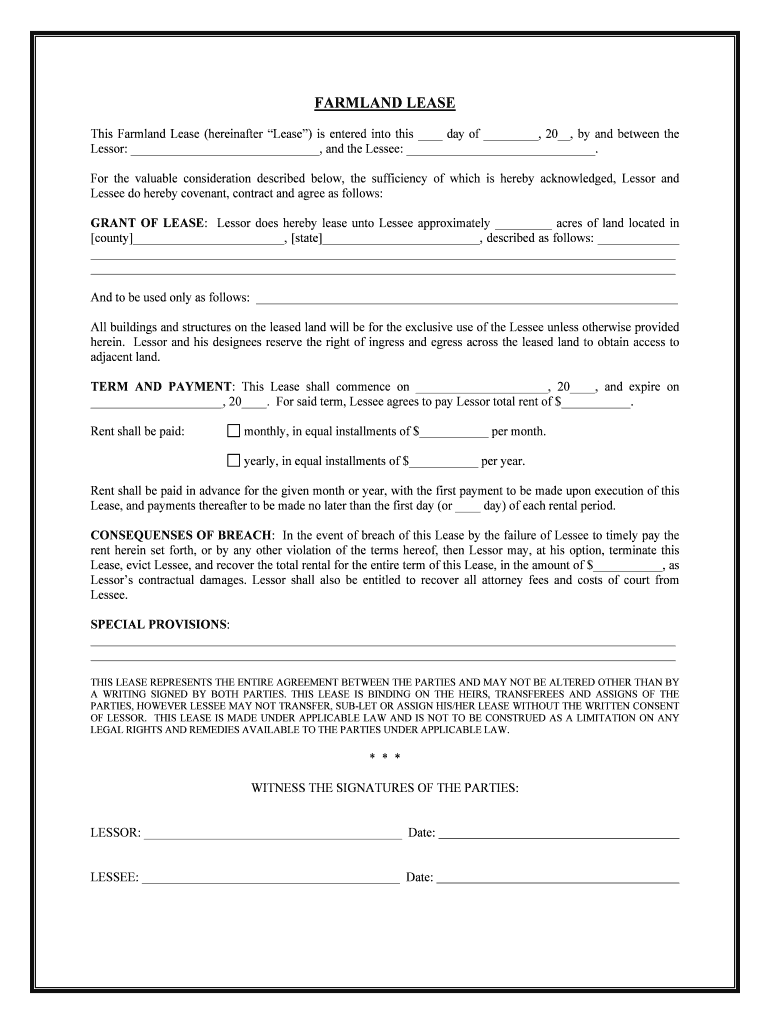

The farm lease form is a legal document that outlines the terms and conditions under which a landowner (lessor) allows a farmer (lessee) to use agricultural land for a specified period. This form serves as a binding agreement that details crucial aspects such as rental payments, land use, maintenance responsibilities, and the duration of the lease. It is essential for both parties to understand the obligations and rights defined within the document to ensure a smooth farming operation.

Key elements of the farm lease form

Several key elements must be included in a farm lease form to ensure clarity and legal compliance. These elements typically include:

- Identification of parties: Names and addresses of the lessor and lessee.

- Description of the property: Detailed information about the land being leased, including boundaries and any structures.

- Lease term: The start and end dates of the lease agreement.

- Rental payment terms: Amount of rent, payment schedule, and method of payment.

- Use of land: Specific agricultural activities permitted on the leased land.

- Maintenance and repairs: Responsibilities for upkeep and repairs of the property.

- Termination conditions: Circumstances under which the lease can be terminated early.

Steps to complete the farm lease form

Completing a farm lease form involves several important steps to ensure that all necessary information is accurately captured. These steps include:

- Gather information: Collect details about the property, parties involved, and specific terms of the lease.

- Fill out the form: Input the gathered information into the farm lease form, ensuring accuracy and completeness.

- Review the document: Both parties should review the form to confirm that all terms are correctly stated.

- Sign the form: Both the lessor and lessee should sign the document, indicating their agreement to the terms.

- Distribute copies: Provide copies of the signed lease to both parties for their records.

Legal use of the farm lease form

The farm lease form is a legally binding document that must adhere to state laws governing lease agreements. It is important for both parties to ensure that the form complies with local regulations to avoid potential disputes. Legal use includes understanding the rights and responsibilities outlined in the lease, as well as any applicable laws regarding agricultural leases in their state.

Examples of using the farm lease form

Farm lease forms can be utilized in various scenarios, including:

- Crop farming: Leasing land for the cultivation of crops such as corn, soybeans, or vegetables.

- Livestock grazing: Allowing livestock to graze on leased pastureland.

- Organic farming: Leasing land specifically for organic agricultural practices.

Each example highlights the versatility of the farm lease form in accommodating different farming needs and practices.

State-specific rules for the farm lease form

State-specific rules can significantly impact the terms of a farm lease. Each state may have unique regulations regarding lease agreements, including maximum allowable lease durations, specific disclosures required, and conditions for termination. It is essential for both lessors and lessees to familiarize themselves with their state's laws to ensure compliance and protect their interests.

Quick guide on how to complete farm form

Effortlessly Prepare Farm Form on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with the essential tools to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Farm Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Steps to Modify and eSign Farm Form with Ease

- Locate Farm Form and click Get Form to begin.

- Use the tools provided to complete your form.

- Select pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting documents. airSlate SignNow manages your document needs with just a few clicks from any device you prefer. Modify and eSign Farm Form and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the farm form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a farm lease form?

A farm lease form is a legal document used to establish the terms and conditions under which agricultural land is rented or leased. This form typically outlines the duration of the lease, payment details, and responsibilities of both the lessor and lessee, ensuring clarity and protection for both parties.

-

How can I create a farm lease form using airSlate SignNow?

Creating a farm lease form with airSlate SignNow is straightforward. You can start by selecting a template tailored for agricultural leases, customize it to fit your specific needs, and add any necessary details before sending it for eSignature, making the process efficient and legally binding.

-

What features does airSlate SignNow offer for farm lease forms?

airSlate SignNow offers a range of features for farm lease forms, including customizable templates, secure cloud storage, and real-time tracking of document status. You can also integrate it with other applications for enhanced workflow efficiency, making document management seamless.

-

Is there a cost associated with using airSlate SignNow for farm lease forms?

Yes, airSlate SignNow offers various pricing plans to cater to different needs, including those who frequently create farm lease forms. You can choose a plan based on the number of forms sent and the features you require, ensuring you get the best value for your investment.

-

Can I store my farm lease forms securely with airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your farm lease forms. This means you can easily access your documents anytime while ensuring they are protected with state-of-the-art security measures.

-

What benefits does using airSlate SignNow for farm lease forms provide?

Using airSlate SignNow for your farm lease forms streamlines the signing process, saves time, and reduces paperwork. Additionally, it enhances collaboration between parties and ensures that all documents are legally valid and easily auditable.

-

Does airSlate SignNow integrate with other software for managing farm lease forms?

Yes, airSlate SignNow integrates seamlessly with various software tools, enabling you to manage your farm lease forms more effectively. Whether you're using CRM systems, accounting software, or property management tools, these integrations enhance productivity.

Get more for Farm Form

- Irs audit letter 2604c sample pdf taxaudit com form

- Oklahoma request for separate taxation of undivided interest form

- Fullmakt bank form

- Complimed topup membership application form prosperity health

- Intellectual property rights contract template form

- Intellectual property rights software development contract template form

- Interest contract template form

- Interest exemption contract template form

Find out other Farm Form

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate