Form CT 33 AATT Tax Ny

What is the Form CT 33 AATT Tax Ny

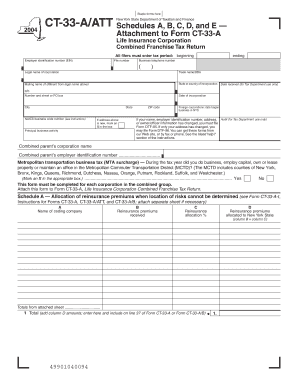

The Form CT 33 AATT Tax Ny is a tax form used in New York State for specific tax reporting purposes. It is primarily utilized by businesses to report their tax liabilities and ensure compliance with state tax regulations. This form is essential for maintaining accurate tax records and fulfilling state obligations. Understanding its purpose is crucial for any business operating within New York.

How to use the Form CT 33 AATT Tax Ny

Using the Form CT 33 AATT Tax Ny involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form with precise information regarding your business’s financial activities. It is important to review the completed form for accuracy before submission. This form can be filed electronically or by mail, depending on your preference and the requirements set by the New York State Department of Taxation and Finance.

Steps to complete the Form CT 33 AATT Tax Ny

Completing the Form CT 33 AATT Tax Ny requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant financial documents.

- Fill out the form with your business information, including name, address, and tax identification number.

- Report income and expenses accurately in the designated sections.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Form CT 33 AATT Tax Ny

The Form CT 33 AATT Tax Ny is legally mandated for businesses operating in New York. It serves as an official record of tax obligations and compliance with state tax laws. Proper use of this form helps businesses avoid penalties and ensures that they meet their legal responsibilities. It is advisable to consult with a tax professional to understand the legal implications of the information reported on this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 33 AATT Tax Ny vary depending on your business structure and tax year. Generally, businesses must submit this form by the end of the fiscal year. It is essential to stay informed about specific deadlines to avoid late fees and penalties. Check with the New York State Department of Taxation and Finance for the most current deadlines and any updates that may affect your filing schedule.

Required Documents

To complete the Form CT 33 AATT Tax Ny, certain documents are required. These typically include:

- Income statements for the reporting period.

- Expense records, including receipts and invoices.

- Previous tax returns, if applicable.

- Any additional documentation requested by the New York State Department of Taxation and Finance.

Having these documents ready will facilitate a smoother filing process and help ensure accuracy.

Quick guide on how to complete form ct 33 aatt tax ny

Prepare [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents rapidly and without delays. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight key sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 33 aatt tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT 33 AATT Tax Ny and who needs it?

Form CT 33 AATT Tax Ny is a tax document required for certain businesses operating in New York. It is essential for reporting and calculating the appropriate tax liabilities for organizations. If you are a business owner operating in New York, understanding this form is crucial for compliance.

-

How can airSlate SignNow help with completing Form CT 33 AATT Tax Ny?

airSlate SignNow streamlines the process of completing Form CT 33 AATT Tax Ny by allowing users to fill out and eSign documents electronically. This efficient solution minimizes errors and saves time, making tax documentation more manageable for businesses. Our platform is user-friendly, ensuring you can focus on your business rather than paperwork.

-

Is there a fee for using airSlate SignNow to manage Form CT 33 AATT Tax Ny?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs. These plans provide access to all features required for efficiently managing and submitting Form CT 33 AATT Tax Ny. You can choose a plan based on your organization's size and requirements.

-

What features does airSlate SignNow provide for Form CT 33 AATT Tax Ny?

airSlate SignNow includes features such as document templates, eSigning capabilities, and secure cloud storage specifically for managing Form CT 33 AATT Tax Ny. These tools improve accuracy and ensure that your tax documents are always accessible and organized. Additionally, real-time collaboration features enhance teamwork during the documentation process.

-

Can I integrate airSlate SignNow with other applications while handling Form CT 33 AATT Tax Ny?

Absolutely! airSlate SignNow offers seamless integrations with various applications like Google Drive, Dropbox, and other business tools. This flexibility allows for a more streamlined workflow when managing Form CT 33 AATT Tax Ny, enabling easy access to all necessary documents in one place.

-

What are the benefits of using airSlate SignNow for tax documents like Form CT 33 AATT Tax Ny?

Using airSlate SignNow for tax documents like Form CT 33 AATT Tax Ny provides numerous benefits, including reduced paperwork, enhanced security, and faster processing times. The platform's easy-to-navigate interface helps businesses stay compliant while saving time and resources on tax documentation. You can also track document status in real time, ensuring timely submissions.

-

How secure is airSlate SignNow when handling sensitive forms like Form CT 33 AATT Tax Ny?

airSlate SignNow prioritizes security, employing encryption and secure storage to protect sensitive documents like Form CT 33 AATT Tax Ny. Our platform complies with industry standards for data protection, ensuring that your information remains confidential and secure at all times. You can trust us to keep your business data safe.

Get more for Form CT 33 AATT Tax Ny

Find out other Form CT 33 AATT Tax Ny

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document