Form CT 184 M Tax Ny

What is the Form CT 184 M Tax Ny

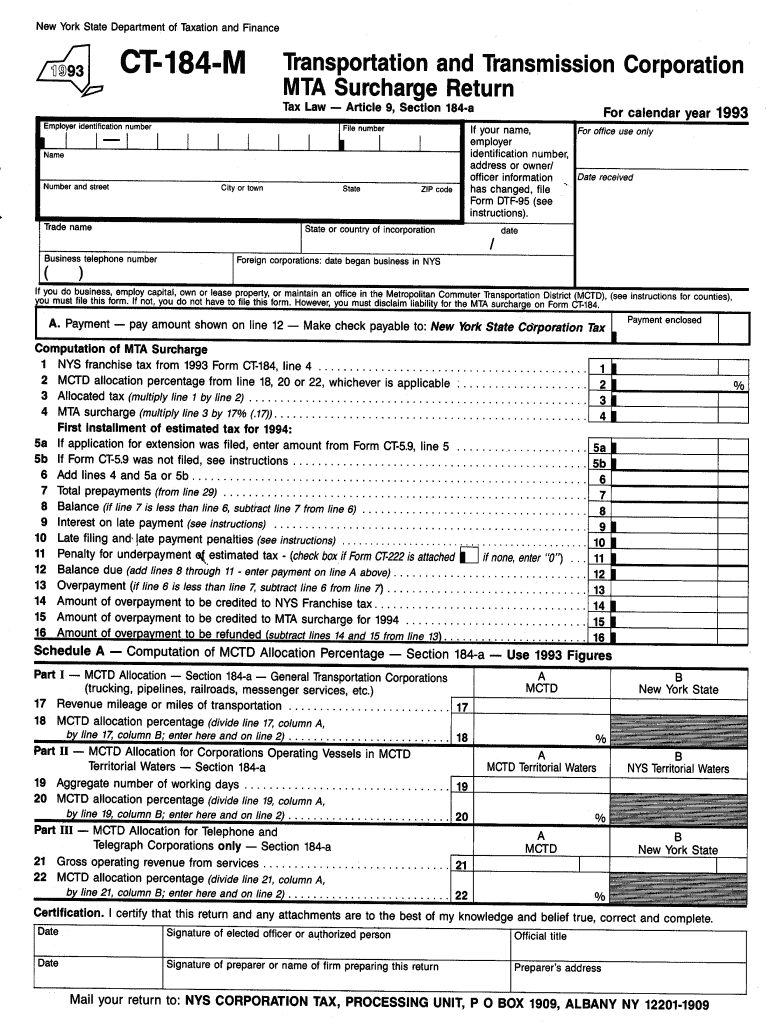

The Form CT 184 M Tax Ny is a tax form used in the state of New York for specific tax-related purposes. This form is primarily utilized by businesses to report and pay certain taxes, including those related to income and franchise tax. Understanding the purpose of this form is essential for compliance with state tax regulations. It is crucial for businesses to accurately complete this form to avoid penalties and ensure proper tax reporting.

How to use the Form CT 184 M Tax Ny

To effectively use the Form CT 184 M Tax Ny, businesses should first gather all necessary financial information and documentation. This includes income statements, expense reports, and any other relevant financial data. Once the required information is collected, the form can be filled out by entering the appropriate figures in the designated fields. After completing the form, it should be reviewed for accuracy before submission to the appropriate tax authority.

Steps to complete the Form CT 184 M Tax Ny

Completing the Form CT 184 M Tax Ny involves several key steps:

- Gather all necessary financial documents, including income and expense records.

- Fill out the form carefully, ensuring that all required fields are completed accurately.

- Double-check the entries for any errors or omissions.

- Sign and date the form as required.

- Submit the completed form by the designated deadline.

Legal use of the Form CT 184 M Tax Ny

The legal use of the Form CT 184 M Tax Ny is vital for businesses operating in New York. This form must be used in accordance with state tax laws to ensure compliance. Failure to use the form correctly can result in penalties, fines, or other legal repercussions. It is advisable for businesses to consult with a tax professional if they have questions regarding the legal implications of using this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 184 M Tax Ny are crucial for compliance. Typically, businesses must submit this form by a specific date each year, which aligns with the state's tax calendar. It is important to stay informed about these deadlines to avoid late fees or penalties. Keeping a calendar of important tax dates can help ensure timely submission.

Required Documents

When completing the Form CT 184 M Tax Ny, several documents are required to support the information reported. These may include:

- Income statements from the previous year.

- Expense reports detailing business costs.

- Any relevant tax documents from prior years.

- Proof of payments made towards estimated taxes.

Form Submission Methods (Online / Mail / In-Person)

The Form CT 184 M Tax Ny can be submitted through various methods, providing flexibility for businesses. Options typically include:

- Online submission via the state tax website, which may offer a faster processing time.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices, which allows for immediate confirmation of receipt.

Quick guide on how to complete form ct 184 m tax ny

Effortlessly complete Form CT 184 M Tax Ny on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Form CT 184 M Tax Ny on any platform with airSlate SignNow Android or iOS applications and enhance any document-based operation today.

The simplest method to edit and eSign Form CT 184 M Tax Ny effortlessly

- Locate Form CT 184 M Tax Ny and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any chosen device. Modify and eSign Form CT 184 M Tax Ny and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 184 m tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT 184 M Tax NY?

Form CT 184 M Tax NY is a state tax form used by businesses in New York to report certain tax obligations. This form is critical for ensuring compliance with state tax laws and should be completed accurately to avoid penalties.

-

How can airSlate SignNow help with Form CT 184 M Tax NY?

airSlate SignNow streamlines the process of filling out and eSigning Form CT 184 M Tax NY. By using our easy-to-use platform, you can quickly complete and send this form, ensuring a smooth filing process with the New York tax authorities.

-

Is airSlate SignNow affordable for small businesses needing Form CT 184 M Tax NY?

Yes, airSlate SignNow offers cost-effective solutions ideal for small businesses that need to manage Form CT 184 M Tax NY. Our pricing plans are designed to fit various budgets, allowing businesses to access essential document management features without breaking the bank.

-

What features does airSlate SignNow include for handling Form CT 184 M Tax NY?

airSlate SignNow provides a range of features, including templates for Form CT 184 M Tax NY, eSignature capabilities, and easy document sharing. You can also track the status of your documents in real-time, ensuring you never miss an important filing deadline.

-

Can I integrate airSlate SignNow with other software for Form CT 184 M Tax NY?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and business management software, allowing you to efficiently manage Form CT 184 M Tax NY. This integration helps in synchronizing your data and streamlining your overall tax preparation process.

-

What are the benefits of using airSlate SignNow for Form CT 184 M Tax NY?

Using airSlate SignNow for Form CT 184 M Tax NY offers numerous benefits, such as increased efficiency, reduced turnaround time, and enhanced compliance. Our platform helps ensure your forms are filled out correctly and submitted on time, minimizing the risk of errors.

-

Is there customer support available for questions about Form CT 184 M Tax NY?

Yes, airSlate SignNow provides comprehensive customer support to assist users with questions regarding Form CT 184 M Tax NY. Our dedicated support team is available to guide you through the process, ensuring you have all the resources you need for successful document management.

Get more for Form CT 184 M Tax Ny

- Minn stat 523 23 short form poa minnesota state bar association mnbar

- Gapcsr form

- Certificado de cbtis form

- Has successfully completed civil rights training squaremeals form

- Syep timesheet 86852909 form

- Its a long way to neptune amazon s3 form

- Rabies antibody test biochemistry amp toxicology certificate riasbt or form

- Fill in the missing statements and reasons in the proof form

Find out other Form CT 184 M Tax Ny

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer