Louisiana Revised Statutes Tit 47,297 13 Tax Deduction 2025-2026

Understanding the Louisiana Revised Statutes Tit 47,297 13 Tax Deduction

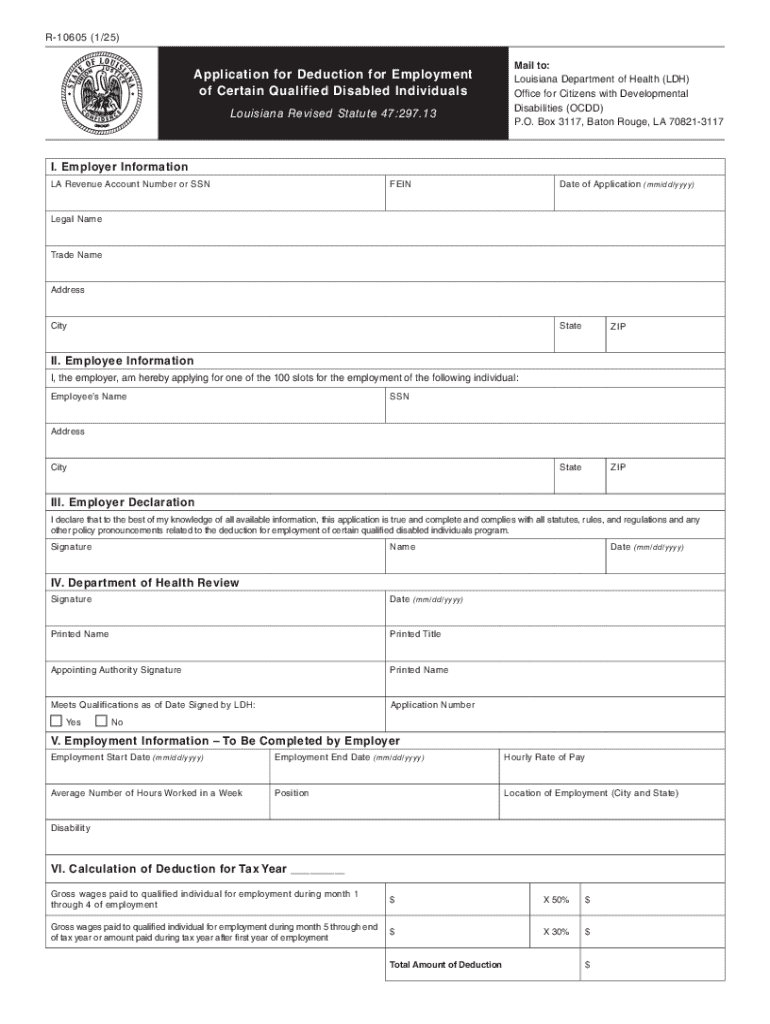

The Louisiana Revised Statutes Title 47, Section 297.13 provides specific guidelines for tax deductions available to taxpayers in Louisiana. This statute outlines the eligibility criteria, the types of expenses that can be deducted, and the overall purpose of the tax deduction. It is designed to encourage certain activities or expenditures that benefit the state and its residents.

Eligibility Criteria for the Tax Deduction

To qualify for the Louisiana Revised Statutes Tit 47,297 13 Tax Deduction, taxpayers must meet specific eligibility requirements. Generally, these criteria include:

- Residency in Louisiana for the tax year in question.

- Filing a Louisiana state income tax return.

- Meeting income thresholds as defined by the statute.

Taxpayers should review the detailed provisions of the statute to ensure compliance with all eligibility requirements.

Steps to Complete the Louisiana Revised Statutes Tit 47,297 13 Tax Deduction

Completing the tax deduction process involves several key steps:

- Gather relevant financial documents, including income statements and receipts for qualifying expenses.

- Determine eligibility based on the criteria outlined in the statute.

- Fill out the appropriate sections of the Louisiana state income tax return, ensuring the deduction is accurately claimed.

- Submit the completed tax return by the designated filing deadline.

Following these steps carefully can help ensure that taxpayers successfully claim the deduction.

Required Documents for the Tax Deduction

When claiming the Louisiana Revised Statutes Tit 47,297 13 Tax Deduction, taxpayers must provide certain documentation to support their claims. Required documents typically include:

- Proof of residency, such as a driver's license or utility bill.

- Income documentation, such as W-2 forms or 1099 statements.

- Receipts or records of expenses that qualify for the deduction.

Having these documents ready can facilitate a smoother filing process.

Legal Use of the Louisiana Revised Statutes Tit 47,297 13 Tax Deduction

The legal framework surrounding the Louisiana Revised Statutes Tit 47,297 13 Tax Deduction is designed to ensure that the deduction is used appropriately. Taxpayers must adhere to the guidelines set forth in the statute to avoid potential penalties or legal issues. Misuse of the deduction can lead to audits or other enforcement actions by the state tax authority.

Examples of Using the Louisiana Revised Statutes Tit 47,297 13 Tax Deduction

Understanding how the tax deduction applies in real-world scenarios can help taxpayers navigate their filing. For instance:

- A self-employed individual may deduct certain business expenses that fall under the criteria of the statute.

- A homeowner making energy-efficient upgrades may qualify for deductions related to those improvements.

These examples illustrate the practical application of the tax deduction and highlight the importance of thorough documentation.

Create this form in 5 minutes or less

Find and fill out the correct louisiana revised statutes tit 47297 13 tax deduction

Create this form in 5 minutes!

How to create an eSignature for the louisiana revised statutes tit 47297 13 tax deduction

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Louisiana Revised Statutes Tit 47,297 13 Tax Deduction?

The Louisiana Revised Statutes Tit 47,297 13 Tax Deduction allows eligible taxpayers to deduct certain expenses related to business operations. This deduction can signNowly reduce taxable income, making it an essential consideration for businesses in Louisiana. Understanding this statute can help you maximize your tax benefits.

-

How can airSlate SignNow help with the Louisiana Revised Statutes Tit 47,297 13 Tax Deduction?

airSlate SignNow provides a streamlined solution for managing documents related to the Louisiana Revised Statutes Tit 47,297 13 Tax Deduction. By using our eSignature platform, businesses can efficiently sign and store necessary documents, ensuring compliance and easy access during tax season. This can simplify the process of claiming your deductions.

-

What features does airSlate SignNow offer for tax documentation?

airSlate SignNow offers features such as customizable templates, secure eSignatures, and document tracking, which are crucial for managing tax-related documents. These features ensure that all paperwork related to the Louisiana Revised Statutes Tit 47,297 13 Tax Deduction is handled efficiently and securely. This can save time and reduce errors in your tax filings.

-

Is airSlate SignNow cost-effective for small businesses looking to utilize the Louisiana Revised Statutes Tit 47,297 13 Tax Deduction?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. With flexible pricing plans, it allows businesses to manage their documentation needs without breaking the bank. This affordability is particularly beneficial for those looking to maximize their benefits under the Louisiana Revised Statutes Tit 47,297 13 Tax Deduction.

-

Can airSlate SignNow integrate with other accounting software for tax purposes?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your financial documents. This integration is particularly useful for businesses looking to streamline their processes related to the Louisiana Revised Statutes Tit 47,297 13 Tax Deduction, ensuring all necessary documents are in one place.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers numerous benefits, including enhanced security, ease of use, and improved efficiency. These advantages are crucial when dealing with the Louisiana Revised Statutes Tit 47,297 13 Tax Deduction, as they help ensure that your documents are secure and easily accessible when needed. This can lead to a smoother tax filing experience.

-

How does airSlate SignNow ensure the security of documents related to tax deductions?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your documents. This is especially important for sensitive tax documents associated with the Louisiana Revised Statutes Tit 47,297 13 Tax Deduction. You can trust that your information is safe and compliant with industry standards.

Get more for Louisiana Revised Statutes Tit 47,297 13 Tax Deduction

- Revocation of power of attorney for care of child or children texas form

- Newly divorced individuals package texas form

- Tx durable form

- Contractors forms package texas

- Power of attorney for sale of motor vehicle texas form

- Declaration mental treatment form

- Revocation power attorney 497327839 form

- Wedding planning or consultant package texas form

Find out other Louisiana Revised Statutes Tit 47,297 13 Tax Deduction

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document