Tax Law Article 9, Section 186 C Tax Ny Form

Understanding Tax Law Article 9, Section 186 c Tax NY

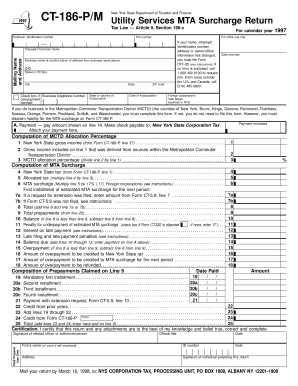

Tax Law Article 9, Section 186 c of New York pertains to the taxation of certain business entities, particularly focusing on the franchise tax for corporations and limited liability companies (LLCs). This section outlines the specific tax obligations and calculations for these entities, ensuring compliance with state tax regulations. It is essential for businesses operating in New York to understand the implications of this law, as it directly affects their financial responsibilities and overall tax strategy.

Steps to Complete the Tax Law Article 9, Section 186 c Tax NY

Completing the requirements under Tax Law Article 9, Section 186 c involves several steps:

- Determine the type of business entity you are operating, as different rules may apply to corporations and LLCs.

- Gather all necessary financial documents, including income statements and balance sheets, to accurately report your business income.

- Calculate the franchise tax based on the prescribed rates and methods outlined in the law.

- Complete the appropriate tax forms, ensuring all information is accurate and up-to-date.

- Submit the forms by the designated deadlines to avoid penalties.

Key Elements of the Tax Law Article 9, Section 186 c Tax NY

This section of the tax law includes several key elements that businesses must be aware of:

- Tax Rates: The law specifies various tax rates applicable to different business structures.

- Minimum Tax: There is a minimum franchise tax that may apply, regardless of income levels.

- Exemptions: Certain entities may qualify for exemptions or reduced rates based on specific criteria.

- Filing Requirements: The law outlines the necessary forms and documentation required for compliance.

Required Documents for Tax Law Article 9, Section 186 c Tax NY

To comply with Tax Law Article 9, Section 186 c, businesses must prepare and submit several key documents:

- Completed tax forms specific to the entity type.

- Financial statements, including profit and loss statements and balance sheets.

- Documentation supporting any claimed deductions or exemptions.

- Any additional forms required by the New York State Department of Taxation and Finance.

Legal Use of the Tax Law Article 9, Section 186 c Tax NY

The legal use of Tax Law Article 9, Section 186 c is crucial for ensuring that businesses comply with state tax obligations. Understanding the legal framework helps entities avoid potential disputes with tax authorities. It is advisable for businesses to consult with tax professionals to navigate the complexities of this law and ensure full compliance with all legal requirements.

Filing Deadlines for Tax Law Article 9, Section 186 c Tax NY

Filing deadlines are critical for businesses to avoid penalties. Generally, the deadlines for submitting the required tax forms under Tax Law Article 9, Section 186 c align with the fiscal year-end of the business. It is important to stay informed about specific dates, as they can vary based on the entity type and any changes in state regulations. Businesses should mark these deadlines on their calendars and prepare their documentation in advance to ensure timely submission.

Quick guide on how to complete tax law article 9 section 186 c tax ny

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents swiftly and without delays. Manage [SKS] on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related procedure today.

The simplest way to modify and electronically sign [SKS] with ease

- Acquire [SKS] and select Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] to guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Tax Law Article 9, Section 186 c Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the tax law article 9 section 186 c tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Tax Law Article 9, Section 186 c Tax Ny?

Tax Law Article 9, Section 186 c Tax Ny outlines the regulations regarding taxation for businesses operating within New York State. It addresses various taxation matters, ensuring businesses comply with state tax requirements. Understanding this law is crucial for businesses to avoid penalties and efficiently manage their taxes.

-

How can airSlate SignNow help with Tax Law Article 9, Section 186 c Tax Ny compliance?

airSlate SignNow streamlines document management, making it easier for businesses to handle compliance paperwork related to Tax Law Article 9, Section 186 c Tax Ny. Our eSigning solution allows users to securely sign and send documents that are necessary for compliance efficiently. This feature minimizes errors and helps ensure timely submissions to tax authorities.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to suit various business needs. Our plans include options for individual users as well as teams, making it affordable for businesses of all sizes. Check our website for specific pricing details and choose the plan that best meets your requirements regarding Tax Law Article 9, Section 186 c Tax Ny compliance.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features including eSigning, document templates, and secure cloud storage. These tools enable businesses to efficiently manage and track documents related to Tax Law Article 9, Section 186 c Tax Ny. With our user-friendly interface, you can streamline your workflow and enhance productivity in tax-related documents.

-

How secure is airSlate SignNow for sensitive tax documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security measures to protect your sensitive documents, including those related to Tax Law Article 9, Section 186 c Tax Ny. Your data is safeguarded against unauthorized access, ensuring your business complies with legal requirements.

-

Does airSlate SignNow integrate with other business applications?

Yes, airSlate SignNow offers integrations with various popular business applications, allowing for seamless workflow. Whether you use CRM, document management, or accounting software, our tool can enhance your efficiency and manage tasks related to Tax Law Article 9, Section 186 c Tax Ny compliance. Explore our integration options to find the best fit for your business.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation simplifies the process of sending, signing, and storing important tax-related documents, such as those required under Tax Law Article 9, Section 186 c Tax Ny. The platform increases efficiency and reduces the risk of errors. Plus, with our user-friendly features, your team will spend less time on paperwork and more time focusing on your business.

Get more for Tax Law Article 9, Section 186 c Tax Ny

Find out other Tax Law Article 9, Section 186 c Tax Ny

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors