CT 32 M Employer Identification Number New York State Department of Taxation and Finance Banking Corporation MTA Surcharge Retur Form

Understanding the CT 32 M Form

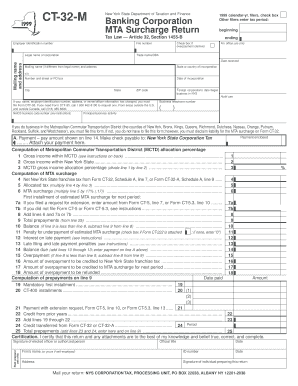

The CT 32 M form is an essential document for businesses operating in New York, specifically those subject to the Metropolitan Transportation Authority (MTA) surcharge. This form is used to report the Employer Identification Number (EIN) and calculate any applicable surcharges under New York State Tax Law, particularly Article 32, Section 1455 B. Businesses must accurately complete this form to ensure compliance with state tax regulations and avoid potential penalties.

Steps to Complete the CT 32 M Form

Completing the CT 32 M form involves several key steps. First, gather all necessary information, including your Employer Identification Number and any relevant financial data. Next, fill out the required sections of the form, ensuring that you check the box if claiming an overpayment. It's important to double-check all entries for accuracy before submission. Finally, submit the form by the designated deadline to avoid any late fees or penalties.

Legal Use of the CT 32 M Form

The CT 32 M form serves a legal purpose in the context of tax reporting for businesses in New York. It ensures that companies comply with state tax laws regarding the MTA surcharge. Proper use of this form is crucial for maintaining good standing with the New York State Department of Taxation and Finance. Failure to use the form correctly may result in legal repercussions, including fines or audits.

Required Documents for Filing

To successfully file the CT 32 M form, certain documents are required. These typically include your business's financial statements, records of any previous surcharges paid, and documentation supporting any claims for overpayment. Having these documents ready will facilitate a smoother filing process and help ensure that your submission is complete and accurate.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the CT 32 M form. Businesses must submit this form by the specified due date to avoid penalties. Typically, the deadlines align with the state’s tax filing schedule, so keeping track of these dates is essential for compliance. Mark your calendar to ensure timely submission and prevent any late fees.

Examples of Using the CT 32 M Form

Practical examples of using the CT 32 M form can help clarify its application. For instance, a corporation that has been assessed an MTA surcharge may use the form to report its EIN and calculate the amount owed. Another example includes a business that has overpaid its surcharge, utilizing the form to claim a refund. These scenarios illustrate the form's importance in various business contexts.

Quick guide on how to complete ct 32 m employer identification number new york state department of taxation and finance banking corporation mta surcharge

Complete [SKS] effortlessly on any device

Web-based document management has become favored among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow provides you with all the resources necessary to create, adjust, and eSign your documents swiftly without holdups. Handle [SKS] on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically available through airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Verify all the information and then select the Done button to save your modifications.

- Select your preferred method to send your form, either by email, text message (SMS), link invitation, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs within a few clicks from any device you select. Edit and eSign [SKS] and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 32 m employer identification number new york state department of taxation and finance banking corporation mta surcharge

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CT 32 M Employer Identification Number?

The CT 32 M Employer Identification Number is a unique identifier assigned to businesses in New York State for tax purposes by the New York State Department of Taxation and Finance. It is crucial for filing the MTA Surcharge Return, as required under Article 32, Section 1455 B of the Tax Law, ensuring compliance with state tax obligations.

-

How do I file the MTA Surcharge Return?

To file the MTA Surcharge Return, you need the CT 32 M Employer Identification Number and to complete the appropriate forms provided by the New York State Department of Taxation and Finance. The filing process can be facilitated through platforms like airSlate SignNow, allowing you to eSign and send documents digitally, making it more efficient and secure.

-

What is the purpose of the File Number Check Box?

The File Number Check Box on the MTA Surcharge Return indicates any overpayment claimed under Article 32, Section 1455 B of the New York State Tax Law. Marking this box helps ensure that you properly account for any overpayments made, potentially affecting your tax obligations and refunds.

-

Are there any fees associated with using airSlate SignNow for my tax filings?

airSlate SignNow offers a cost-effective solution for sending and eSigning documents, including tax filings such as the MTA Surcharge Return. Pricing plans vary based on features and usage, allowing businesses to choose a plan that best fits their needs while ensuring compliance with the New York State Department of Taxation and Finance.

-

Can I integrate airSlate SignNow with my accounting software?

Yes, airSlate SignNow offers integration capabilities with various accounting and financial software. This allows businesses to streamline their processes, making it easier to manage documents related to the CT 32 M Employer Identification Number and other tax filings efficiently.

-

What are the benefits of using airSlate SignNow for tax document management?

airSlate SignNow provides numerous benefits for tax document management, including easy electronic signatures, secure document storage, and streamlined workflows. By using this platform for managing your CT 32 M and other tax-related documents, you can reduce processing time and enhance compliance with New York State Department of Taxation and Finance requirements.

-

How does airSlate SignNow ensure the security of my documents?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption methods and complies with industry standards to protect your documents, including those related to your CT 32 M Employer Identification Number, ensuring that your sensitive tax information is safe and secure.

Get more for CT 32 M Employer Identification Number New York State Department Of Taxation And Finance Banking Corporation MTA Surcharge Retur

Find out other CT 32 M Employer Identification Number New York State Department Of Taxation And Finance Banking Corporation MTA Surcharge Retur

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document