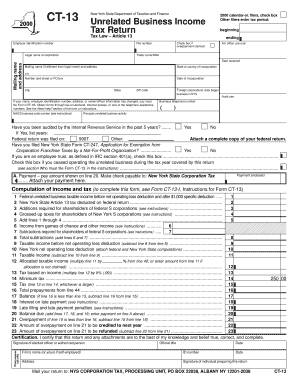

CT 13 Employer Identification Number New York State Department of Taxation and Finance Unrelated Business Income Tax Return Tax Form

Understanding the CT 13 Form

The CT 13 form is a crucial document for businesses in New York that engage in unrelated business activities. It is officially known as the Employer Identification Number New York State Department Of Taxation And Finance Unrelated Business Income Tax Return. This form is used to report income from activities that are not substantially related to the organization's exempt purpose. Understanding the significance of this form is essential for compliance with state tax laws.

Steps to Complete the CT 13 Form

Completing the CT 13 form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your Employer Identification Number (EIN) and financial records related to unrelated business income.

- Fill out the form accurately, ensuring all sections are completed, including the check box for overpayment claims if applicable.

- Provide your trade name or DBA (Doing Business As) if different from your legal business name.

- Indicate the calendar year for which you are filing the return.

Required Documents for Filing

When filing the CT 13 form, certain documents are necessary to support your submission. These include:

- Financial statements that detail unrelated business income.

- Any prior year tax returns that may be relevant.

- Documentation for any claimed overpayments.

Legal Use of the CT 13 Form

The CT 13 form serves a legal purpose in the context of New York State tax law. It ensures that organizations comply with tax obligations related to unrelated business income. Filing this form correctly helps avoid penalties and ensures that any overpayments are properly claimed and refunded.

Filing Deadlines for the CT 13 Form

Timely filing of the CT 13 form is essential to avoid penalties. The due date for submission typically aligns with the federal tax return deadlines, but it is important to verify the specific dates each year. Keeping track of these deadlines can help ensure compliance and maintain good standing with the New York State Department of Taxation and Finance.

Examples of When to Use the CT 13 Form

Organizations may need to use the CT 13 form in various scenarios, such as:

- A nonprofit organization generating income from a business activity unrelated to its mission, like selling merchandise.

- A charity hosting an event that includes unrelated business activities, such as a raffle or a paid concert.

Obtaining the CT 13 Form

To obtain the CT 13 form, businesses can visit the New York State Department of Taxation and Finance website or contact their office directly. The form is available for download, and it is also possible to request a paper copy if needed. Ensuring you have the correct version of the form is vital for accurate filing.

Quick guide on how to complete ct 13 employer identification number new york state department of taxation and finance unrelated business income tax return tax

Complete [SKS] seamlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors requiring new printouts. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to CT 13 Employer Identification Number New York State Department Of Taxation And Finance Unrelated Business Income Tax Return Tax

Create this form in 5 minutes!

How to create an eSignature for the ct 13 employer identification number new york state department of taxation and finance unrelated business income tax return tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CT 13 Employer Identification Number and how is it used?

The CT 13 Employer Identification Number is essential for filing the Unrelated Business Income Tax Return under Tax Law Article 13. It identifies your entity to the New York State Department of Taxation and Finance, enabling proper tracking of tax obligations. This number is crucial for ensuring compliance and managing any related tax filings.

-

How can I file the CT 13 Unrelated Business Income Tax Return?

Filing the CT 13 Unrelated Business Income Tax Return involves submitting the required documentation to the New York State Department of Taxation and Finance. You will need your Employer Identification Number and relevant financial information. Using airSlate SignNow can streamline this process, making it easy to fill out and digitally sign necessary forms.

-

What should I do if I have claimed an overpayment on my CT 13 form?

If you have claimed an overpayment on your CT 13 form, check the box provided on the form to indicate this. Ensure you attach any supporting documentation detailing the overpayment. This will help the New York State Department of Taxation and Finance accurately process your return and potential refund.

-

What are the benefits of using airSlate SignNow for filing my CT 13 Tax forms?

Using airSlate SignNow for filing your CT 13 Tax forms offers several benefits, including a user-friendly interface and the ability to eSign documents securely. This reduces paperwork and helps ensure your forms are submitted accurately and on time to the New York State Department of Taxation and Finance. Additionally, you can track the status of your submissions easily.

-

Are there any fees associated with filing the CT 13 Unrelated Business Income Tax Return?

Yes, there may be fees associated with filing the CT 13 Unrelated Business Income Tax Return, depending on your specific situation and tax obligations. It’s important to review the latest guidelines from the New York State Department of Taxation and Finance. airSlate SignNow offers cost-effective solutions to streamline your filing process while adhering to these requirements.

-

Does airSlate SignNow integrate with accounting software for tax preparation?

Yes, airSlate SignNow integrates seamlessly with various accounting software platforms that facilitate tax preparation, including those designed to manage CT 13 Employer Identification Number filings. This ensures that your tax documents are collated efficiently and are accessible for filing your Unrelated Business Income Tax Return.

-

What type of support does airSlate SignNow provide for tax-related queries?

airSlate SignNow offers comprehensive customer support for tax-related queries, including assistance with understanding your CT 13 Employer Identification Number and filing processes. Their team is knowledgeable about tax law requirements, including those for the New York State Department of Taxation and Finance, ensuring you receive accurate guidance.

Get more for CT 13 Employer Identification Number New York State Department Of Taxation And Finance Unrelated Business Income Tax Return Tax

Find out other CT 13 Employer Identification Number New York State Department Of Taxation And Finance Unrelated Business Income Tax Return Tax

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free