Form CT 186 Utilty Corporation Franchise Tax Return CT186 Tax Ny

Understanding Form CT-186: Utility Corporation Franchise Tax Return

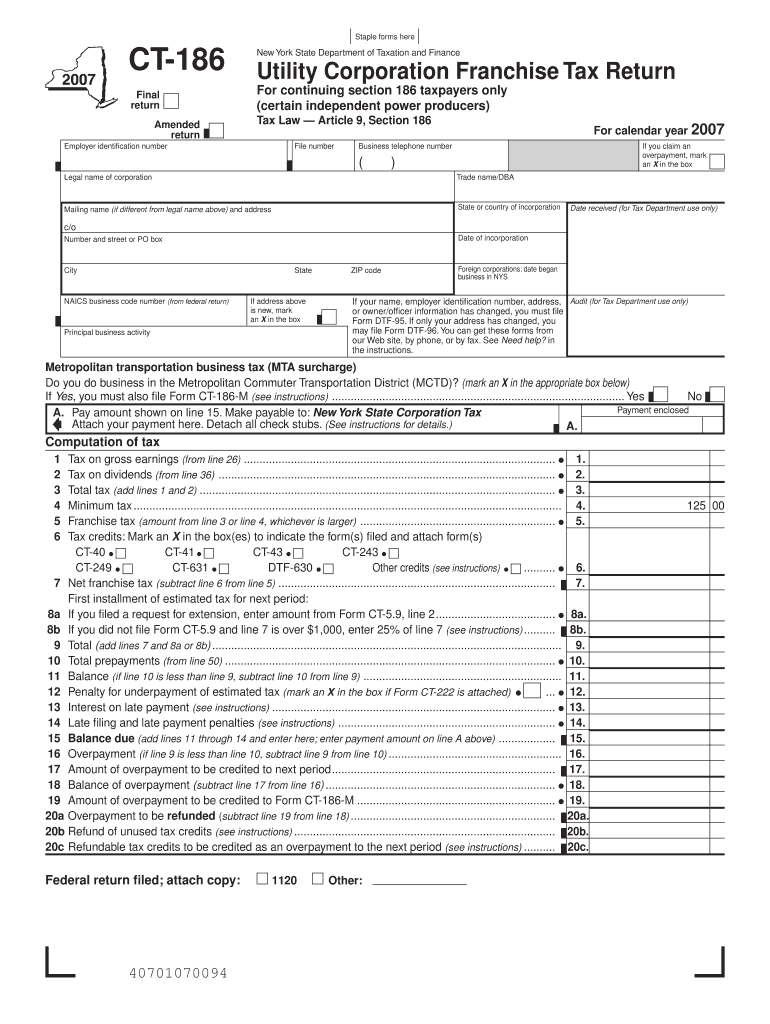

Form CT-186 is a crucial document for utility corporations operating in New York. This franchise tax return is specifically designed for corporations that provide utility services, ensuring they comply with state tax regulations. The form collects essential financial information about the corporation's operations, allowing the state to assess the appropriate franchise tax based on the corporation's income and assets. Understanding this form is vital for utility corporations to maintain compliance and avoid penalties.

Steps to Complete Form CT-186

Completing Form CT-186 involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Fill out the identification section, including the corporation's name, address, and employer identification number.

- Report total gross income and deductions as specified in the form.

- Calculate the franchise tax based on the provided tax rates and instructions.

- Review the completed form for accuracy before submission.

Obtaining Form CT-186

Form CT-186 can be obtained through the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing corporations to print and fill it out manually. Additionally, some tax preparation software may include the form, providing a digital option for completion. Ensuring you have the latest version of the form is essential for accurate filing.

Key Elements of Form CT-186

The key elements of Form CT-186 include:

- Identification Information: This section requires the corporation's name, address, and tax identification number.

- Income Reporting: Corporations must report their total gross income and any applicable deductions.

- Tax Calculation: The form includes a section for calculating the franchise tax based on the corporation's financial data.

- Signature Section: An authorized representative must sign the form to certify its accuracy.

Filing Deadlines for Form CT-186

Filing deadlines for Form CT-186 are typically aligned with the corporation's fiscal year. Corporations must file the form by the 15th day of the third month following the end of their fiscal year. It is important to stay informed about any changes in deadlines or extensions that may apply, as timely submission is crucial to avoid penalties.

Legal Use of Form CT-186

Form CT-186 serves a legal purpose in ensuring that utility corporations fulfill their tax obligations in New York. Proper completion and submission of the form are necessary for compliance with state tax laws. Failing to file the form or providing inaccurate information can lead to legal repercussions, including fines and penalties.

Quick guide on how to complete form ct 186 utilty corporation franchise tax return ct186 tax ny

Effortlessly Prepare [SKS] on Any Device

The management of documents online has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools necessary to swiftly create, modify, and eSign your documents without hindrance. Manage [SKS] on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Adjust and eSign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the resources we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review all details and then click on the Done button to save your changes.

- Choose your preferred method of delivering your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign [SKS] and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 186 utilty corporation franchise tax return ct186 tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT 186 Utility Corporation Franchise Tax Return CT186 Tax NY?

Form CT 186 Utility Corporation Franchise Tax Return CT186 Tax NY is a tax return specifically designed for utility corporations operating in New York. It helps businesses accurately report their franchise taxes and comply with state regulations, ensuring that they avoid any penalties or legal issues related to tax filings.

-

How can airSlate SignNow help with filing Form CT 186 Utility Corporation Franchise Tax Return CT186 Tax NY?

airSlate SignNow simplifies the process of preparing and submitting Form CT 186 Utility Corporation Franchise Tax Return CT186 Tax NY. With our user-friendly platform, businesses can easily eSign and send their completed documents, streamlining the filing process and ensuring compliance with state laws.

-

What are the main features of using airSlate SignNow for Form CT 186 Utility Corporation Franchise Tax Return CT186 Tax NY?

airSlate SignNow offers features such as customizable templates, secure eSigning, and real-time tracking for Form CT 186 Utility Corporation Franchise Tax Return CT186 Tax NY. These tools enhance productivity and help ensure that all necessary documents are completed accurately and on time.

-

Is airSlate SignNow a cost-effective solution for businesses filing Form CT 186 Utility Corporation Franchise Tax Return CT186 Tax NY?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing to file Form CT 186 Utility Corporation Franchise Tax Return CT186 Tax NY. Our pricing plans are designed to accommodate different business sizes and needs, allowing you to manage your tax documents without breaking the bank.

-

Can I integrate airSlate SignNow with other applications while filing Form CT 186 Utility Corporation Franchise Tax Return CT186 Tax NY?

Absolutely! airSlate SignNow supports seamless integrations with various applications that can assist in filing Form CT 186 Utility Corporation Franchise Tax Return CT186 Tax NY. This ensures a smooth flow of information between platforms, making your tax filing process more efficient.

-

What benefits does airSlate SignNow offer when preparing Form CT 186 Utility Corporation Franchise Tax Return CT186 Tax NY?

By using airSlate SignNow, businesses gain benefits such as enhanced security, faster processing times, and improved accuracy when preparing Form CT 186 Utility Corporation Franchise Tax Return CT186 Tax NY. Our platform also reduces paperwork, allowing you to focus on other important business tasks.

-

Is there customer support available for issues related to Form CT 186 Utility Corporation Franchise Tax Return CT186 Tax NY in airSlate SignNow?

Yes, airSlate SignNow offers robust customer support for users navigating issues related to Form CT 186 Utility Corporation Franchise Tax Return CT186 Tax NY. Our dedicated team is available to provide assistance, ensuring you have a smooth experience while using our services.

Get more for Form CT 186 Utilty Corporation Franchise Tax Return CT186 Tax Ny

- Ky health choices kentucky unbridled spirit form

- Lds permission slip form

- Narcotic count sheet shift change form

- Worksheet 34 gross pay with overtime answer key form

- Dental records release form

- How to eat an elephant pdf form

- Colorado residential lease agreement dora form

- Biodata form for domestic helper 401272245

Find out other Form CT 186 Utilty Corporation Franchise Tax Return CT186 Tax Ny

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online