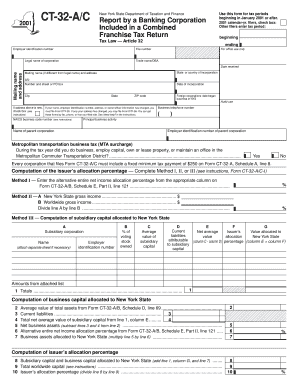

Filers, Check Box Other Filers Enter Tax Period Beginning Ending for Office Use Only Legal Name of Corporation Trade NameDBA Mai Form

Understanding the Form Details

The form titled "Filers, Check Box Other Filers Enter Tax Period Beginning Ending For Office Use Only Legal Name Of Corporation Trade NameDBA Mailing Name And Address Mailing Name if Different From Legal Name And Address Co Number Tax Ny" is essential for businesses operating in New York. It is primarily used for tax reporting purposes, allowing corporations to provide necessary information about their legal identity and tax periods. This form ensures compliance with state tax regulations and helps maintain accurate records for tax authorities.

Key Elements of the Form

Several critical components must be accurately filled out on this form:

- Legal Name of Corporation: This is the official name registered with the state.

- Trade Name (DBA): If the business operates under a different name, it should be included here.

- Mailing Name and Address: This is where all correspondence will be sent. If it differs from the legal name, provide the alternate mailing name.

- Tax Period: Indicate the beginning and ending dates for the tax period being reported.

- Co Number: This is the corporation's identification number assigned by the state.

Steps to Complete the Form

Completing this form involves a few straightforward steps:

- Gather necessary information, including your corporation's legal name, DBA, and mailing address.

- Determine the appropriate tax period for which you are filing.

- Fill in each section of the form carefully, ensuring all details are accurate.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified submission methods, whether online or by mail.

Legal Use of the Form

This form serves a legal purpose in tax compliance. It is required for corporations to report their tax obligations accurately to the state of New York. Failing to complete and submit this form can result in penalties or issues with tax authorities, making it crucial for businesses to adhere to legal standards.

State-Specific Rules

In New York, specific rules govern the completion and submission of this form. Businesses must ensure they are aware of any updates to tax laws that may affect how they complete the form. Understanding these rules helps avoid potential legal issues and ensures compliance with state regulations.

Filing Deadlines and Important Dates

Timely submission of the form is essential. Corporations should be aware of the filing deadlines set by the New York State Department of Taxation and Finance. Missing these deadlines can lead to penalties or interest on unpaid taxes, emphasizing the importance of staying informed about critical dates.

Quick guide on how to complete filers check box other filers enter tax period beginning ending for office use only legal name of corporation trade namedba

Accomplish [SKS] effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and without holdups. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The simplest method to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically available through airSlate SignNow.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional signature made with ink.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or shareable link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious document searches, or errors requiring new document prints. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Revise and eSign [SKS] while ensuring exceptional communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the filers check box other filers enter tax period beginning ending for office use only legal name of corporation trade namedba

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for Filers?

airSlate SignNow provides a streamlined eSigning process that enables Filers to submit essential documents electronically. With features like customizable templates, document sharing, and robust security measures, users can manage their legal documents efficiently, ensuring compliance with all requirements for Filers.

-

How does airSlate SignNow simplify document management for Tax Filers?

With airSlate SignNow, Tax Filers can easily organize and access their documents, enhancing productivity and reducing errors. The platform allows Filers to Check Box Other Filers Enter Tax Period Beginning Ending For Office Use Only Legal Name Of Corporation Trade NameDBA Mailing Name And Address, ensuring all necessary information is captured seamlessly.

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including options for individual Filers and teams. Each plan is designed to provide maximum value, including access to all essential features needed by Filers to successfully manage documents and forms.

-

Can airSlate SignNow integrate with other tools?

Yes, airSlate SignNow integrates seamlessly with various applications, making it easier for Filers to manage their workflows. By connecting with tools like CRM systems and file storage services, Filers can enhance their efficiency and streamline their operations.

-

Is airSlate SignNow secure for legal documents?

Absolutely! airSlate SignNow prioritizes security with features like encryption and secure access controls, ensuring that all sensitive information from Filers is protected. This level of security is crucial, especially when handling documentation such as Legal Name Of Corporation Trade NameDBA.

-

How do I get started with airSlate SignNow?

Getting started is simple! Prospective Filers can sign up for an account and begin using airSlate SignNow to eSign and send documents. The user-friendly interface makes it easy to navigate and customize forms, including those needed for the Tax Period Beginning Ending.

-

What support options are available for Filers using airSlate SignNow?

airSlate SignNow offers comprehensive support for Filers, including tutorials, a knowledge base, and customer service assistance. Whether you have questions about entering Tax Period Beginning Ending or navigating the platform, help is just a click away.

Get more for Filers, Check Box Other Filers Enter Tax Period Beginning Ending For Office Use Only Legal Name Of Corporation Trade NameDBA Mai

Find out other Filers, Check Box Other Filers Enter Tax Period Beginning Ending For Office Use Only Legal Name Of Corporation Trade NameDBA Mai

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer