Staple Forms Here CT 32 M Amended Return Employer Identification Number New York State Department of Taxation and Finance Bankin

Understanding the Staple Forms Here CT 32 M Amended Return

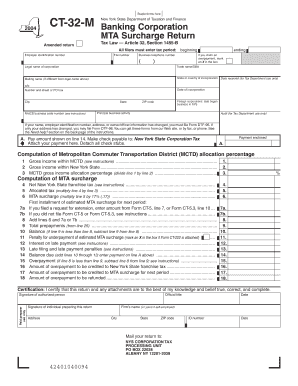

The Staple Forms Here CT 32 M Amended Return is a crucial document for businesses operating in New York. This form is specifically designed for filing amended returns related to the Banking Corporation MTA Surcharge under Article 32, Section 1455 B of the New York Tax Law. It is essential for all filers to accurately enter their Employer Identification Number (EIN) and the relevant tax period to ensure compliance with state regulations.

Steps to Complete the Staple Forms Here CT 32 M Amended Return

Completing the Staple Forms Here CT 32 M Amended Return involves several key steps:

- Gather necessary information, including your EIN and the tax period you are amending.

- Access the form from the New York State Department of Taxation and Finance website or through authorized providers.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions.

- Submit the completed form either online, by mail, or in person, depending on your preference.

Legal Use of the Staple Forms Here CT 32 M Amended Return

The legal use of the Staple Forms Here CT 32 M Amended Return is governed by New York State tax laws. It is important for businesses to understand that filing an amended return is a legal requirement when correcting previously submitted information. Failure to comply may result in penalties or additional scrutiny from tax authorities.

Filing Deadlines and Important Dates

Timely filing of the Staple Forms Here CT 32 M Amended Return is essential. The New York State Department of Taxation and Finance sets specific deadlines for filing amended returns. It is advisable to check the latest updates on deadlines to avoid any late fees or penalties associated with missed submissions.

Required Documents for Filing

When preparing to file the Staple Forms Here CT 32 M Amended Return, ensure you have the following documents ready:

- Your original tax return for the period you are amending.

- Any supporting documentation that justifies the changes being made.

- Records of payments made or any credits that apply to the amended return.

Form Submission Methods

The Staple Forms Here CT 32 M Amended Return can be submitted through various methods:

- Online submission via the New York State Department of Taxation and Finance portal.

- Mailing the completed form to the appropriate tax office address.

- In-person submission at designated tax offices, if applicable.

Quick guide on how to complete staple forms here ct 32 m amended return employer identification number new york state department of taxation and finance

Complete [SKS] effortlessly on any gadget

Online document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents rapidly without interruptions. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign [SKS] without any hassle

- Locate [SKS] and then click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the staple forms here ct 32 m amended return employer identification number new york state department of taxation and finance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Staple Forms Here CT 32 M Amended Return?

The Staple Forms Here CT 32 M Amended Return provides a means for businesses to amend their previously filed tax returns with the New York State Department of Taxation and Finance. This form is essential for ensuring compliance with Tax Law Article 32, Section 1455 B, which mandates that all filers accurately report changes in their tax obligations. Properly using this form helps businesses avoid penalties and ensures the correct tax period is filed.

-

How can I obtain my Employer Identification Number (EIN) for the Staple Forms Here CT 32 M Amended Return?

To obtain your Employer Identification Number (EIN) for completing the Staple Forms Here CT 32 M Amended Return, you can visit the IRS website and submit an online application. Your EIN is crucial for filing with the New York State Department of Taxation and Finance and should be easily accessible to ensure a smooth filing process. Remember that this number must be included on your amended return to avoid processing delays.

-

What are the key features of the airSlate SignNow platform for handling tax forms?

The airSlate SignNow platform offers several key features that make handling tax forms, including the Staple Forms Here CT 32 M Amended Return, seamless and efficient. These features include document eSigning, template management, and secure cloud storage, all designed to streamline your tax filing process. Our user-friendly interface ensures that you can easily manage all your forms while maintaining compliance with the latest tax regulations.

-

Is airSlate SignNow suitable for all businesses when filing Staple Forms Here CT 32 M Amended Return?

Yes, airSlate SignNow is designed to meet the needs of businesses of all sizes when filing the Staple Forms Here CT 32 M Amended Return. Our platform supports various document types and sizes, ensuring that any business can efficiently handle its tax obligations. Moreover, we provide comprehensive support to guide users through the filing process, making compliance easier.

-

What are the pricing options for using airSlate SignNow to eSign tax documents?

airSlate SignNow offers flexible pricing options that cater to different business needs and budgets when eSigning tax documents, such as the Staple Forms Here CT 32 M Amended Return. We provide various subscription plans, allowing you to choose the one that best fits your volume of document processing. Additionally, our cost-effective solutions emphasize value while helping you comply with New York State tax laws.

-

How does airSlate SignNow ensure the security of my tax information?

We prioritize the security of your tax information at airSlate SignNow. Our platform uses advanced encryption technologies and complies with industry standards to protect sensitive data, such as your Staple Forms Here CT 32 M Amended Return and Employer Identification Number. With our commitment to maintaining privacy, you can file your documents with confidence.

-

Can airSlate SignNow integrate with other accounting software for tax filing?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software solutions, making it easier to file your Staple Forms Here CT 32 M Amended Return. Integration simplifies the transfer of data between applications, minimizing the chances of errors and enhancing your workflow efficiency. Our versatile platform supports numerous integrations tailored to your business needs.

Get more for Staple Forms Here CT 32 M Amended Return Employer Identification Number New York State Department Of Taxation And Finance Bankin

Find out other Staple Forms Here CT 32 M Amended Return Employer Identification Number New York State Department Of Taxation And Finance Bankin

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple