CT 186 P Amended Return Employer Identification Number Legal Name of Corporation Staple Forms Here New York State Department of

Understanding the CT 186 P Amended Return

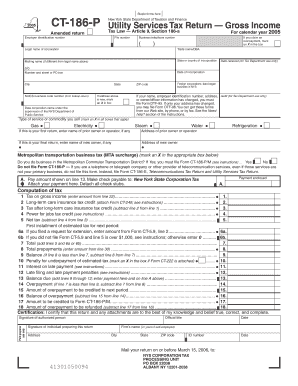

The CT 186 P Amended Return is a crucial tax document for corporations operating in New York. It is specifically designed for businesses that need to amend their previously filed returns under Article 9, Section 186 of the New York State Tax Law. This form allows corporations to correct any errors in their gross income services tax filings, ensuring compliance with state tax regulations. The legal name of the corporation and the Employer Identification Number (EIN) must be accurately provided on the form to facilitate proper processing.

Steps to Complete the CT 186 P Amended Return

Completing the CT 186 P Amended Return involves several key steps:

- Gather necessary information, including the original return, your EIN, and the legal name of your corporation.

- Review the original return for any discrepancies or errors that need correction.

- Fill out the CT 186 P form, ensuring all sections are completed accurately.

- Attach any required supporting documents that substantiate the changes being made.

- Sign and date the form before submission.

Key Elements of the CT 186 P Amended Return

Important components of the CT 186 P Amended Return include:

- Employer Identification Number (EIN): This unique number identifies your corporation for tax purposes.

- Legal Name of Corporation: Ensure this matches the name registered with the state.

- Gross Income Details: Provide accurate figures reflecting the amended gross income.

- Filing Period: Clearly indicate the tax year for which the amendment is being filed.

Required Documents for Submission

When submitting the CT 186 P Amended Return, you may need to include the following documents:

- The original CT 186 return that is being amended.

- Any supporting documentation that explains the changes made.

- Payment for any additional tax owed, if applicable.

Filing Methods for the CT 186 P Amended Return

The CT 186 P Amended Return can be submitted through various methods:

- Online: Use the New York State Department of Taxation and Finance online services for electronic filing.

- Mail: Send the completed form and any attachments to the address specified by the New York State Department of Taxation and Finance.

- In-Person: Visit a local tax office to submit the form directly.

Penalties for Non-Compliance

Failure to file the CT 186 P Amended Return accurately and on time can result in penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on any unpaid taxes, calculated from the due date until payment is made.

- Potential audits or further scrutiny from the tax authorities.

Quick guide on how to complete ct 186 p amended return employer identification number legal name of corporation staple forms here new york state department of

Prepare [SKS] effortlessly on any device

Managing documents online has gained popularity among companies and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the features necessary to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related task today.

How to alter and electronically sign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant parts of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, laborious form searching, or mistakes that necessitate printing new copies. airSlate SignNow satisfies your document management needs in just a few clicks from your chosen device. Modify and electronically sign [SKS] while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 186 p amended return employer identification number legal name of corporation staple forms here new york state department of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CT 186 P Amended Return and why do I need it?

The CT 186 P Amended Return is a vital form used for reporting gross income for services tax in New York. Businesses must submit this return to the New York State Department of Taxation and Finance when there are amendments to previously filed returns. Ensuring you have the correct Employer Identification Number and Legal Name of Corporation is crucial for compliance.

-

How do I file the CT 186 P Amended Return using airSlate SignNow?

You can easily file the CT 186 P Amended Return using airSlate SignNow by uploading your documents and utilizing our eSigning features. The platform allows you to quickly assemble and staple forms here, ensuring you include the correct data such as the Employer Identification Number and Legal Name of Corporation. This streamlines your interaction with the New York State Department of Taxation and Finance.

-

What are the key features of airSlate SignNow that assist in filing the CT 186 P Amended Return?

airSlate SignNow offers features such as template creation, automated reminders, and secure eSigning capabilities that simplify the process of preparing the CT 186 P Amended Return. You can easily input the Employer Identification Number and Legal Name of Corporation, ensuring you are ready to file with the New York State Department of Taxation and Finance. Additionally, our cloud storage helps you organize your documents efficiently.

-

Is airSlate SignNow cost-effective for businesses needing to file CT 186 P Amended Returns?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing to file the CT 186 P Amended Return. Our pricing plans are designed to scale with your business needs while offering unlimited eSigning and document management features. This can signNowly reduce operational costs associated with filing and ensure compliance with New York State tax regulations.

-

Can I integrate airSlate SignNow with other software tools for filing my CT 186 P Amended Return?

Absolutely! airSlate SignNow seamlessly integrates with various tools and accounting software, making it easier to file your CT 186 P Amended Return. By connecting platforms where you manage your Employer Identification Number and Legal Name of Corporation, you can automatically pull necessary data into your returns, enhancing accuracy and efficiency.

-

What if I have questions about completing the CT 186 P Amended Return on airSlate SignNow?

If you have questions about completing the CT 186 P Amended Return on airSlate SignNow, our customer support team is here to help. You can signNow out via chat or email for assistance tailored to your needs. We'll guide you on submitting the correct Employer Identification Number and Legal Name of Corporation to meet New York State's requirements.

-

Can airSlate SignNow help ensure compliance with New York State tax laws when filing CT 186 P Amended Records?

Yes, airSlate SignNow is designed to help businesses remain compliant with New York State tax laws, including the filing of CT 186 P Amended Returns. Our platform ensures that you can easily manage your documents and comply with all necessary regulations related to the Gross Income Services Tax Tax Law. You can verify your Employer Identification Number and Legal Name of Corporation to avoid any compliance issues.

Get more for CT 186 P Amended Return Employer Identification Number Legal Name Of Corporation Staple Forms Here New York State Department Of

- March employment trends and recovery in the columbus ga al metropolitan statistical area introduction the american recovery and form

- Detail for cip code 36 0118 cip user site ed gov form

- Legal due diligence commercial review contract template form

- Legal loan contract template form

- Legal for service contract template form

- Legal payment contract template form

- Legal separation contract template form

- Legal service contract template form

Find out other CT 186 P Amended Return Employer Identification Number Legal Name Of Corporation Staple Forms Here New York State Department Of

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors