1207 NYS ST 100 Tax Ny Form

Understanding the 1207 NYS ST 100 Tax Ny

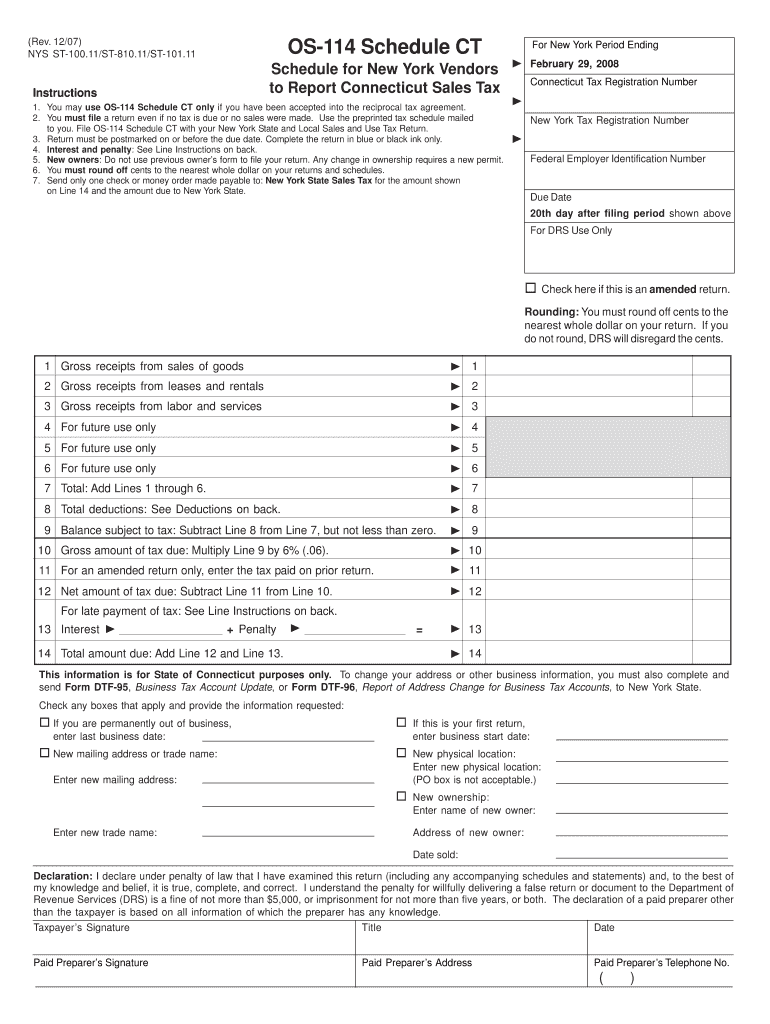

The 1207 NYS ST 100 Tax Ny is a specific tax form used in New York State for reporting various tax obligations. This form is essential for individuals and businesses to comply with state tax regulations. It is particularly relevant for those who need to report income, deductions, and credits accurately. Understanding the purpose of this form ensures that taxpayers fulfill their legal obligations and avoid potential penalties.

Steps to Complete the 1207 NYS ST 100 Tax Ny

Completing the 1207 NYS ST 100 Tax Ny involves several steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, including income statements and previous tax returns. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. Pay attention to specific instructions related to deductions and credits applicable to your situation. Finally, review the completed form for any errors before submission.

Required Documents for the 1207 NYS ST 100 Tax Ny

To successfully complete the 1207 NYS ST 100 Tax Ny, certain documents are required. These typically include:

- Income statements, such as W-2s or 1099s.

- Records of any deductions or credits claimed.

- Previous tax returns, if applicable.

- Identification information, including Social Security numbers.

Having these documents ready will streamline the process and help ensure all necessary information is reported correctly.

Filing Deadlines for the 1207 NYS ST 100 Tax Ny

It is crucial to be aware of the filing deadlines associated with the 1207 NYS ST 100 Tax Ny. Typically, the form must be submitted by the designated tax deadline, which is usually April fifteenth for individual taxpayers. However, specific deadlines may vary based on individual circumstances, such as extensions or special filing situations. Staying informed about these dates can help avoid late fees and penalties.

Legal Use of the 1207 NYS ST 100 Tax Ny

The legal use of the 1207 NYS ST 100 Tax Ny is essential for maintaining compliance with New York State tax laws. This form serves as an official document for reporting income and tax liabilities. Failing to use this form correctly can lead to legal repercussions, including fines or audits. It is important for taxpayers to understand their responsibilities and ensure that the form is completed and submitted in accordance with state regulations.

Who Issues the 1207 NYS ST 100 Tax Ny

The 1207 NYS ST 100 Tax Ny is issued by the New York State Department of Taxation and Finance. This agency is responsible for overseeing tax compliance and ensuring that taxpayers meet their obligations. Understanding the role of this department can provide clarity on where to seek assistance or clarification regarding the form and its requirements.

Quick guide on how to complete 1207 nys st 100 tax ny

Complete [SKS] seamlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools specially designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors necessitating the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 1207 NYS ST 100 Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the 1207 nys st 100 tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of 1207 NYS ST 100 Tax NY?

1207 NYS ST 100 Tax NY refers to a specific tax address and code used for compliance in New York State. This information is essential for businesses operating in New York for tax filing purposes. Understanding how this applies to your business can help ensure proper compliance and avoid penalties.

-

How does airSlate SignNow help with 1207 NYS ST 100 Tax NY documentation?

airSlate SignNow simplifies sending and signing documents that may be associated with 1207 NYS ST 100 Tax NY. Our platform ensures that all tax documents can be securely eSigned and stored for your records. This can streamline your tax preparation and submission process.

-

What are the pricing plans for airSlate SignNow regarding 1207 NYS ST 100 Tax NY needs?

Our pricing plans for airSlate SignNow are designed to accommodate businesses of all sizes, including those addressing 1207 NYS ST 100 Tax NY requirements. We offer flexible subscriptions that are both cost-effective and tailored to fit specific business needs. You can start with a free trial to see how it meets your requirements.

-

What features does airSlate SignNow offer for handling 1207 NYS ST 100 Tax NY documents?

airSlate SignNow provides features like customizable templates, automatic reminders, and secure cloud storage, which are particularly useful for managing 1207 NYS ST 100 Tax NY documents. Our platform also allows users to track the status of documents in real-time, ensuring deadlines are met efficiently.

-

Can airSlate SignNow integrate with other tools for managing 1207 NYS ST 100 Tax NY?

Yes, airSlate SignNow integrates seamlessly with a variety of business tools such as CRMs, accounting software, and more. This allows users to handle 1207 NYS ST 100 Tax NY associated documents within the systems they already use. Integration aids in streamlining workflows and enhancing productivity.

-

How secure is airSlate SignNow for documents related to 1207 NYS ST 100 Tax NY?

Security is a top priority at airSlate SignNow, especially for sensitive documents related to 1207 NYS ST 100 Tax NY. Our platform uses encryption protocols to protect your data at all stages of the document process. This means your eSigned documents are kept safe and confidential.

-

What benefits do businesses gain from using airSlate SignNow for 1207 NYS ST 100 Tax NY?

Using airSlate SignNow for 1207 NYS ST 100 Tax NY allows businesses to save time and reduce errors in document handling. The ease of eSigning accelerates the workflow and improves compliance with tax regulations. Furthermore, our platform ensures a clear audit trail for every document for enhanced accountability.

Get more for 1207 NYS ST 100 Tax Ny

Find out other 1207 NYS ST 100 Tax Ny

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors