IMPORTANT Tax Computation Schedule Long Form Individual

Understanding the IMPORTANT Tax Computation Schedule Long Form Individual

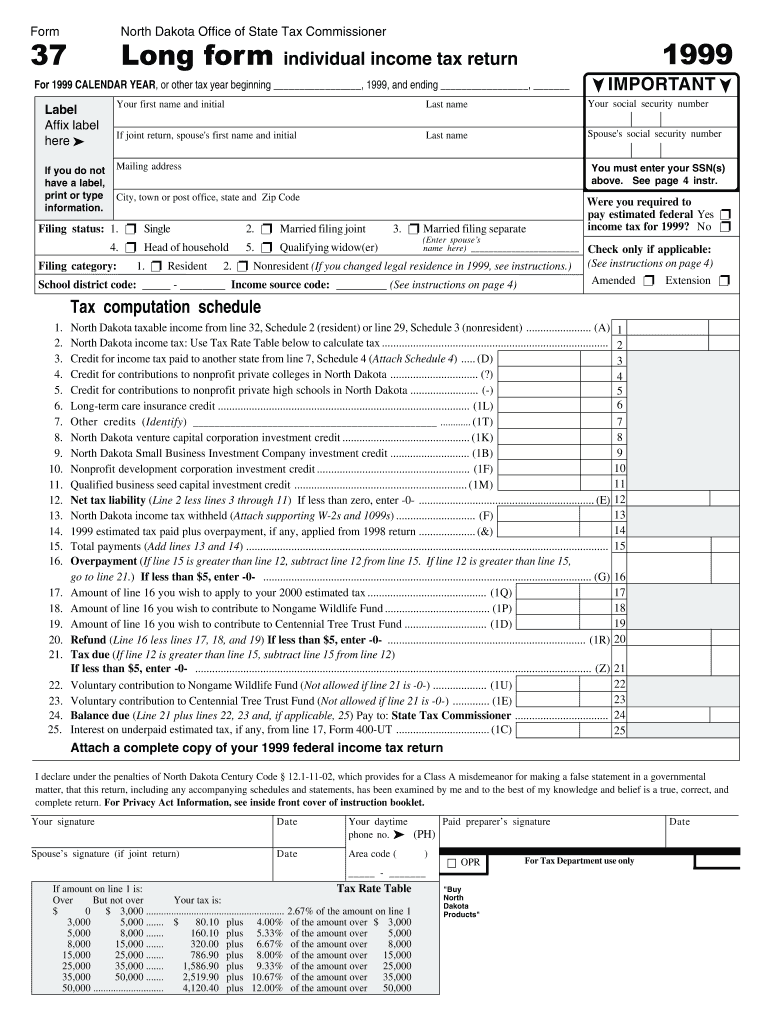

The IMPORTANT Tax Computation Schedule Long Form Individual is a critical document used by individuals to report their income, deductions, and tax liabilities to the Internal Revenue Service (IRS). This form is particularly relevant for those who have more complex tax situations, including multiple income sources or significant deductions. It helps taxpayers calculate their tax obligations accurately, ensuring compliance with federal tax laws.

How to Use the IMPORTANT Tax Computation Schedule Long Form Individual

Using the IMPORTANT Tax Computation Schedule Long Form Individual involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any records of deductions. Next, follow the instructions provided with the form to fill it out accurately. Ensure that all income is reported and deductions are claimed correctly. After completing the form, review it for accuracy before submitting it to the IRS.

Steps to Complete the IMPORTANT Tax Computation Schedule Long Form Individual

Completing the IMPORTANT Tax Computation Schedule Long Form Individual requires careful attention to detail. Here are the essential steps:

- Gather all relevant financial documents, including income statements and deduction records.

- Fill out personal information at the top of the form, including your name, address, and Social Security number.

- Report all sources of income in the designated sections, ensuring that totals are accurate.

- List any deductions you are eligible for, such as mortgage interest or medical expenses.

- Calculate your total tax liability based on the provided tax tables or formulas.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS by the appropriate deadline.

Required Documents for the IMPORTANT Tax Computation Schedule Long Form Individual

To complete the IMPORTANT Tax Computation Schedule Long Form Individual, certain documents are necessary. These typically include:

- W-2 forms from employers showing annual wages.

- 1099 forms for any freelance or contract income.

- Records of deductible expenses, such as receipts for medical expenses or charitable contributions.

- Statements for any investment income or capital gains.

IRS Guidelines for the IMPORTANT Tax Computation Schedule Long Form Individual

The IRS provides specific guidelines for completing and submitting the IMPORTANT Tax Computation Schedule Long Form Individual. It is essential to follow these guidelines to avoid penalties or delays. Key points include:

- Ensure all income is reported accurately.

- Use the correct tax year form to prevent processing issues.

- Submit the form by the IRS deadline to avoid late fees.

- Keep copies of all submitted documents for your records.

Penalties for Non-Compliance with the IMPORTANT Tax Computation Schedule Long Form Individual

Failure to comply with the requirements of the IMPORTANT Tax Computation Schedule Long Form Individual can result in significant penalties. These may include:

- Late filing penalties if the form is submitted after the deadline.

- Interest on any unpaid taxes due.

- Potential audits if discrepancies are found in reported income or deductions.

Quick guide on how to complete important tax computation schedule long form individual

Effortlessly prepare [SKS] on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and ease any document-related process today.

The simplest way to edit and eSign [SKS] without hassle

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and guarantee outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IMPORTANT Tax Computation Schedule Long Form Individual

Create this form in 5 minutes!

How to create an eSignature for the important tax computation schedule long form individual

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IMPORTANT Tax Computation Schedule Long Form Individual?

The IMPORTANT Tax Computation Schedule Long Form Individual is a comprehensive document used for reporting income and calculating tax obligations for individuals. It provides detailed guidelines on how to correctly compute taxes and ensures compliance with tax regulations.

-

How can airSlate SignNow assist with the IMPORTANT Tax Computation Schedule Long Form Individual?

airSlate SignNow simplifies the process of filling out the IMPORTANT Tax Computation Schedule Long Form Individual by allowing users to eSign and securely store their documents online. This streamlines the tax filing process and provides peace of mind with secure document handling.

-

Is there a fee for using airSlate SignNow for the IMPORTANT Tax Computation Schedule Long Form Individual?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. For those specifically dealing with the IMPORTANT Tax Computation Schedule Long Form Individual, choosing the right plan can provide you with valuable features and cost-effective solutions.

-

What features does airSlate SignNow offer for the IMPORTANT Tax Computation Schedule Long Form Individual?

airSlate SignNow provides features such as customizable templates, eSignature capabilities, and document tracking for the IMPORTANT Tax Computation Schedule Long Form Individual. These tools are designed to improve efficiency and accuracy in your tax filing process.

-

Can I integrate airSlate SignNow with other tax software to manage the IMPORTANT Tax Computation Schedule Long Form Individual?

Yes, airSlate SignNow can be integrated with various third-party tax software solutions to streamline your workflow. This integration enables efficient document management for the IMPORTANT Tax Computation Schedule Long Form Individual, making tax preparation smoother.

-

What are the benefits of using airSlate SignNow for tax documents like the IMPORTANT Tax Computation Schedule Long Form Individual?

Using airSlate SignNow for tax documents like the IMPORTANT Tax Computation Schedule Long Form Individual provides several benefits, including enhanced security, ease of use, and the ability to track document statuses. These benefits can signNowly reduce the stress associated with tax preparation.

-

How secure is airSlate SignNow for handling my IMPORTANT Tax Computation Schedule Long Form Individual?

Security is a top priority at airSlate SignNow. The platform utilizes advanced encryption technology to protect your IMPORTANT Tax Computation Schedule Long Form Individual and other sensitive documents, ensuring that your data remains confidential and secure.

Get more for IMPORTANT Tax Computation Schedule Long Form Individual

Find out other IMPORTANT Tax Computation Schedule Long Form Individual

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online